European Owners’ Deliveries Holding Their Own

Following the record deliveries of 2010-12, the volume of newbuilding tonnage entering the global fleet has since been decreasing. Whilst output has continued to slow in 2014 so far, European owners are reported to have taken delivery of 9% more tonnage on an annualised basis, closing the gap between their share and Asia/Pacific owners’ share of global deliveries.

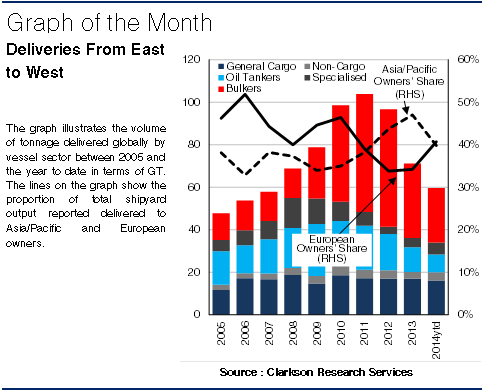

Declining Deliveries

Following the surge in contracting activity in 2005-08, the volume of tonnage delivered globally reached record levels with an average of 100m GT delivered p.a. in the years 2010-12. This was around  62% more tonnage than output on average p.a. 2005-09. The volume of tonnage output by shipyards peaked at 104m GT in 2011 and has declined since, falling 26% year-on-year in 2013 to 71m GT. In the first eleven months of 2014, a reported 60m GT of newbuildings have entered the fleet and, on an annualised basis, deliveries in GT are down 9% y-o-y.

62% more tonnage than output on average p.a. 2005-09. The volume of tonnage output by shipyards peaked at 104m GT in 2011 and has declined since, falling 26% year-on-year in 2013 to 71m GT. In the first eleven months of 2014, a reported 60m GT of newbuildings have entered the fleet and, on an annualised basis, deliveries in GT are down 9% y-o-y.

Worldwide Delivery

Whilst global deliveries have continued to slow in 2014 so far, deliveries to European owners are firm y-o-y at a reported 24.3m GT. Deliveries to Greek owners are up 2% y-o-y in 2014 so far at 9.5m GT, 16% of total output. Meanwhile, reported deliveries to Norwegian and Danish owners are up by 62% and 58% y-o-y to 3.7m GT and 2.0m GT respectively. European owners account for a slightly higher proportion of tonnage delivered (41%) in the ytd than their Asia/Pacific counterparts (40%) for the first time since 2011. In recent years, Asia/Pacific owners have taken a larger share of deliveries than European owners and this has contributed to a rapid expansion of their fleet. However, Chinese and Japanese owners, who account for 59% of the 23.7m GT reported delivered to Asia/Pacific owners in the ytd, have seen deliveries fall by 16% and 15% y-o-y to 7.3m GT and 6.8m GT respectively in the ytd. This has led to a 23% y-o-y drop in ytd deliveries to Asia/Pacific owners.

Special Deliveries

Delivery levels in the major cargo sectors are generally down y-o-y in the ytd, while delivery volumes in the more specialised ship sectors are up. This has contributed to the rise in deliveries to European owners, who have taken delivery of a more diverse product mix than Asian owners. The ‘general cargo’ sector, which includes containerships, accounts for the largest share of tonnage reported delivered to European owners (35%) and they took 60% of the 5.9m GT delivered in the 12,000+ TEU boxship sector. In the ‘specialised’ sector, which includes gas units and specialised tankers, deliveries are up by 14% y-o-y in the ytd and European owners account for around 64% of the 5.8m GT output, including 72% of the 3.2m GT of LNG carrier deliveries. Meanwhile, bulkers account for around half of the tonnage output to Asia/Pacific owners in 2014 so far (11.5m GT) and bulker deliveries are down by 20% y-o-y.

So, delivery volumes are down in 2014 so far but deliveries to European owners are up. With a more diverse product mix, European owners have taken the largest share of global deliveries in 2014 so far as Asia/Pacific owned deliveries have fallen y-o-y, particularly in the bulker sector. For now at least, European owners are more than holding their own.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional