Fleet Development: The High Tide Of Container Demolition

Following a record year for boxship demolition in 2013, scrapping levels in 2014 reached the next highest annual total. Since the financial crisis, high volumes of container capacity have been sold for demolition as an oversupply of tonnage has depressed vessel earnings. Elevated scrapping has become an important consideration for fleet growth and could continue in 2015.

Post-Crisis Demolition

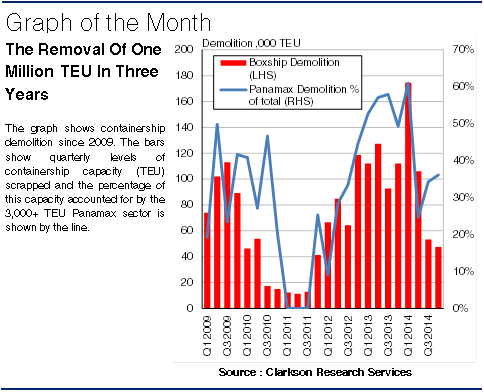

The 2009 box trade contraction generated a sudden oversupply in the container market, plunging charter earnings and secondhand prices to historically low  levels. This encouraged many owners to sell their vessels for scrap, and in 2009, demolition sales reached 0.33m TEU. This level eclipsed the demolition activity of the early to mid 2000s which only once rose to as high as 0.10m TEU. Although scrapping fell to low levels in 2010 and 2011 (see the Graph of the Month), as vessel earnings staged a temporary recovery, the ‘overhang’ in capacity had not yet been removed. When charter earnings fell again in 2012, scrapping rose to total 0.38m TEU and, in 2013, it reached a record high of 0.40m TEU. That year 197 boxships, including 67 3,000+ TEU Panamaxes of a combined 0.24m TEU, were sold for recycling.

levels. This encouraged many owners to sell their vessels for scrap, and in 2009, demolition sales reached 0.33m TEU. This level eclipsed the demolition activity of the early to mid 2000s which only once rose to as high as 0.10m TEU. Although scrapping fell to low levels in 2010 and 2011 (see the Graph of the Month), as vessel earnings staged a temporary recovery, the ‘overhang’ in capacity had not yet been removed. When charter earnings fell again in 2012, scrapping rose to total 0.38m TEU and, in 2013, it reached a record high of 0.40m TEU. That year 197 boxships, including 67 3,000+ TEU Panamaxes of a combined 0.24m TEU, were sold for recycling.

The Peak In Q1 2014

Demolition totalled 0.38m TEU in 2014, with 0.17m TEU sold for scrap during the first quarter, 61% of which was Panamax tonnage. Two shipowners sold 15 Panamax vessels of a total 59,904 TEU between them in January and February alone. Whilst charter rates were very poor across the vessel sectors in 1H 2014, the circumstances for the Panamax vessels were particular. The upcoming expansion of the Panama Canal will render the Panamax design obsolete as larger vessels are expected to transit the new locks. Operators servicing the Transpacific trade are likely to prefer chartering larger and more fuel-efficient boxships leaving the Panamaxes to find alternative employment. However, in 2014 a number of Panamaxes were successfully re-deployed as operators took advantage of their relatively low charter rates. As a result, Panamax earnings improved and the scrapping of these vessels eased off; Panamaxes accounted for 30% of the capacity scrapped during Q2-Q4 2014.

A Wave Of Scrapping

The volume of tonnage removed from the fleet in the period 2012-14 topped the 1m TEU mark, equivalent to 8% of start 2012 fleet capacity. Indeed the 2012-14 surge in scrapping accounted for half of total boxship demolition since 1996. This has been largely responsible for the contraction of the sub-3,000 TEU and Panamax fleets since 2012/13 and it is hoped that this tightening of supply will eventually improve charter market earnings, which remained subdued in 2014.

More To Come?

The continuation of elevated levels of scrapping will clearly be subject to demand from the demolition market, making scrapping levels difficult to predict. However, although improved Panamax charter rates slowed containership demolition in 2H 2014, earnings remain historically low. In this environment scrapping levels may well remain robust in 2015.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional