Deliveries: Sharing The Story

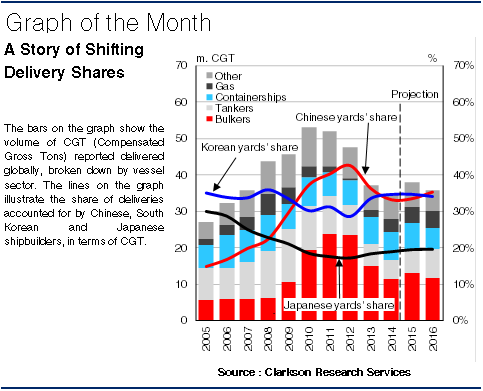

Korean yards accounted for the largest share of global deliveries in CGT terms in 2014 with a 35% share of the 35.0m CGT reported delivered. This was the first time that Korean yards output more CGT than their Chinese counterparts since 2009. Whilst global output fell 6% y-o-y in 2014 in terms of CGT, Korean activity dropped 3%, supported by firmer deliveries in several of the more specialised sectors.

Who’s At The Top?

Korean yards regained the ‘top’ spot in terms of global CGT delivered in 2014, delivering a reported 12.1m CGT. Between 2002 and 2009, Korean yards  accounted for 37% of CGT reported delivered with Chinese yards outputting 19% of tonnage in terms of CGT. However, they subsequently lost their top spot to Chinese yards in 2010. Last year, strong deliveries in the LNG carrier and 8,000+ TEU (VLCS) boxship sectors supported Korea’s shipyard output. Korean yards accounted for 70% of the 5.7m CGT delivered in the VLCS sector and almost 90% of the 2.8m CGT delivered in the LNG sector. This firm delivery activity saw Korean yards retake the lead in terms of CGT delivered.

accounted for 37% of CGT reported delivered with Chinese yards outputting 19% of tonnage in terms of CGT. However, they subsequently lost their top spot to Chinese yards in 2010. Last year, strong deliveries in the LNG carrier and 8,000+ TEU (VLCS) boxship sectors supported Korea’s shipyard output. Korean yards accounted for 70% of the 5.7m CGT delivered in the VLCS sector and almost 90% of the 2.8m CGT delivered in the LNG sector. This firm delivery activity saw Korean yards retake the lead in terms of CGT delivered.

Bulked Down In China

Following a significant ramp up in Chinese delivery volumes over the delivery boom, predominantly in the bulker sector, yards in China accounted for the largest share of deliveries between 2010 and 2013. Their share of global deliveries, in terms of CGT, peaked in 2012 and they accounted for 43% of global deliveries that year. However, with lower output levels in recent years, Chinese yards’ share of deliveries has dropped, falling back to 33% in 2014. This was driven by a 27% drop y-o-y in Chinese bulker deliveries, in terms of CGT, in 2014.

Outside The Top Two

Elsewhere, Japanese yards’ share of global deliveries remained steady in 2014 (19% of CGT) with 6.6m CGT reported delivered. Yards in the Philippines delivered their second largest volume of tonnage on record in 2014 in terms of CGT (1.0m CGT). Meanwhile, 2014 also saw a European shipbuilding nation in the ‘top 5’ delivery list for the first time since 2010, with German yards delivering a reported 0.5m CGT (the cruise ship sector accounted for over 65% of this).

A Forward Look

Deliveries are projected to increase 9% this year to 38.0m CGT after four years of decline. Strong boxship and LNG deliveries from Korean yards in 2015 look set to support their delivery share this year and a total of 13.1m CGT is projected for delivery by Korean builders. Meanwhile, Chinese yards are projected to deliver a similar 12.8m CGT in 2015. Looking to 2016, a total of 36.3m CGT is expected for delivery and Chinese and Korean yards’ delivery shares are projected to stay closely aligned again at around 35%.

Strong deliveries in a number of more specialised vessel sectors helped Korean yards overtake their Chinese counterparts as the top delivery nation in terms of CGT last year. Looking forward, delivery activity is projected to rise for the first time since 2009 this year and, in terms of CGT, Korea and China’s delivery shares look set to remain closely aligned.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional