Two Steps In The Oil Tanker Orderbook

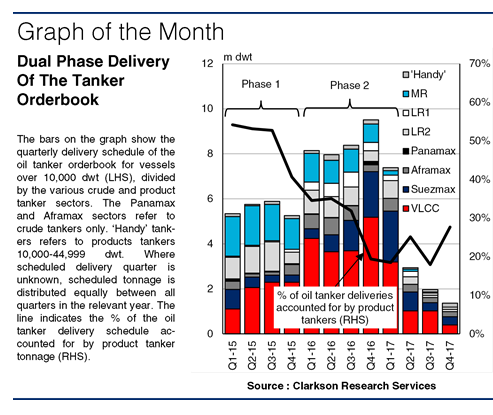

Although looking at the total volume of oil tankers on order may shine a light on potential fleet development, it does not tell the whole story. At the start of March, 72.0m dwt of oil tanker tonnage was on order, 15% of the fleet. Whilst this appears relatively manageable, the breakdown of the delivery schedule paints an interesting two-part picture of what may be in store for the different sectors of tanker fleet.

Overview Of An Orderbook

Crude tonnage accounts for 65% of the oil tanker orderbook scheduled for delivery before 2018, totalling 45.7m dwt, or 206 vessels. Of these, 97 are VLCCs of a combined 30.2m dwt, and a further 10.3m dwt is accounted for by Suezmax tonnage. In terms of products tankers, there are 441 on order for delivery by end 2017, accounting for 24.2m dwt. Of this, 11.0m dwt is MR tanker tonnage and 8.3m dwt is accounted for by LR2 vessels, reflecting the surge in ordering in 2013. Although the actual delivery pattern is of course significantly affected by non-delivery trends, how these vessels are scheduled to enter the fleet shows a distinct pattern.

a combined 30.2m dwt, and a further 10.3m dwt is accounted for by Suezmax tonnage. In terms of products tankers, there are 441 on order for delivery by end 2017, accounting for 24.2m dwt. Of this, 11.0m dwt is MR tanker tonnage and 8.3m dwt is accounted for by LR2 vessels, reflecting the surge in ordering in 2013. Although the actual delivery pattern is of course significantly affected by non-delivery trends, how these vessels are scheduled to enter the fleet shows a distinct pattern.

Push The Products

In ‘phase one’ of delivery, in the rest of 2015, product tanker tonnage looks set to steal the spotlight, even in spite of their smaller average size compared to the crude tankers on order. In the remainder of the first three quarters of 2015, over 50% of the tonnage scheduled to be delivered is in the product tanker sector. This is driven by significant amounts of MR and LR2 deliveries, with 1.3m dwt of LR2 and 1.6m dwt of MR deliveries scheduled for Q3 2015 alone, although LR1 deliveries are likely to be very limited throughout the whole of 2015. Meanwhile, deliveries in the crude sector are expected to remain relatively muted throughout 2015, with VLCC deliveries scheduled to stand at just over 2.0m dwt in each of the final three quarters of 2015. Similarly, Suezmax deliveries are scheduled at less than 0.6m dwt per quarter in the remainder of 2015.

Concentrate On Crude

A significant change in delivery pattern is scheduled for 2016, with crude tonnage looking likely to dominate during ‘phase 2’. Accordingly, the volume of delivered oil tanker tonnage accounted for by the products sector is scheduled to slip to 19% in Q4 2016. The first and fourth quarters of 2016 are scheduled to be dominated by VLCC deliveries, of 4.2m dwt and 5.2m dwt respectively. Meanwhile, Suezmax deliveries are scheduled to rise above the 1m dwt mark from Q3 2016 to Q1 2017, peaking at 2.3m dwt. On the products side, MR deliveries are still scheduled to be firm, averaging over 1.0m dwt per quarter in 2016. Meanwhile, LR1 deliveries are expected to rise from limited levels in 2015 as vessels ordered during the recent uptick in contracting are delivered. However, the orderbook for 2017 currently looks light, although contracting is likely to boost the total.

Clearly, products deliveries look likely to take much of the limelight in 2015. Meanwhile, crude deliveries look set to take centre stage in 2016, in spite of a continued steady flow of products deliveries. Whilst the pattern for 2017 is as yet unclear, the orderbook schedule can indicate what the near future holds for the different phases of tanker fleet growth.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional