Market for OTC CAPP barge coal dwindles as utility demand declines

The Central Appalachian barge coal market has been shrinking for years, and recently a significant amount of CAPP tonnage has been taken out of production on bankruptcies and mine closures. Jim Levesque examines how the switch to cheaper coals pressured the market and why S&P Global Platts proposed to discontinue the daily OTC CAPP barge price.

Making a decision to discontinue a price assessment, especially a benchmark, does not come easily, but after surveying industry participants and extensive market research, Platts determined the move was prudent.

The CAPP barge market has been shrinking for years. US Energy Information Administration data shows that from 2015 to 2016, utility deliveries of NYMEX-quality barge coal fell 32.7 percent year over year to 2.6 million short tons from 3.9 million short tons. Many factors accounted for the decline, including retirements of older coal-fired power plants along the Appalachian waterways and a loss of market share to Illinois Basin and Northern Appalachian barge coals.

The installation of emission control technologies has helped encourage utilities to switch to cheaper, high-sulfur coals, while some power plants have retained a limited amount of CAPP barge consumption as a blending product.

Producer bankruptcies, mine closures took significant CAPP barge coal tonnage out of production

The bankruptcies of Patriot Coal and Alpha Natural Resources and ensuing closures of dozens of CAPP mines as the coal market sank in 2015 took a significant amount barge coal tonnage out of production for good. CAPP miners now are also shifting production into the much more liquid rail market.

As utility demand declined, the markets responded. In May 2015, the CME announced it was discontinuing its physically-settled CAPP barge futures contract at the end of 2016 because of a lack of liquidity. OTC CAPP barge trading volumes have plummeted since, as brokers and traders have pulled out of the shrinking market. Only five barge trades were made on CME in all of 2016. And while there still is a financially-settled CAPP barge contract on ICE, there has been no open interest there since at least March 2015.

Last OTC CAPP barge deal was October 11, 2016

Today, CAPP Barge deals are made directly between the few remaining utility consumers and producers; and there hasn’t been an OTC CAPP barge deal since October 11, 2016.

Platts will cease daily CAPP barge OTC price on September 26, 2017, but will continue assessing physical market on weekly basis

Platts will cease its daily CAPP barge OTC price as of September 26 but will continue to assess CAPP barge prices in the traditional physical market on a weekly basis.

Source: Platts

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

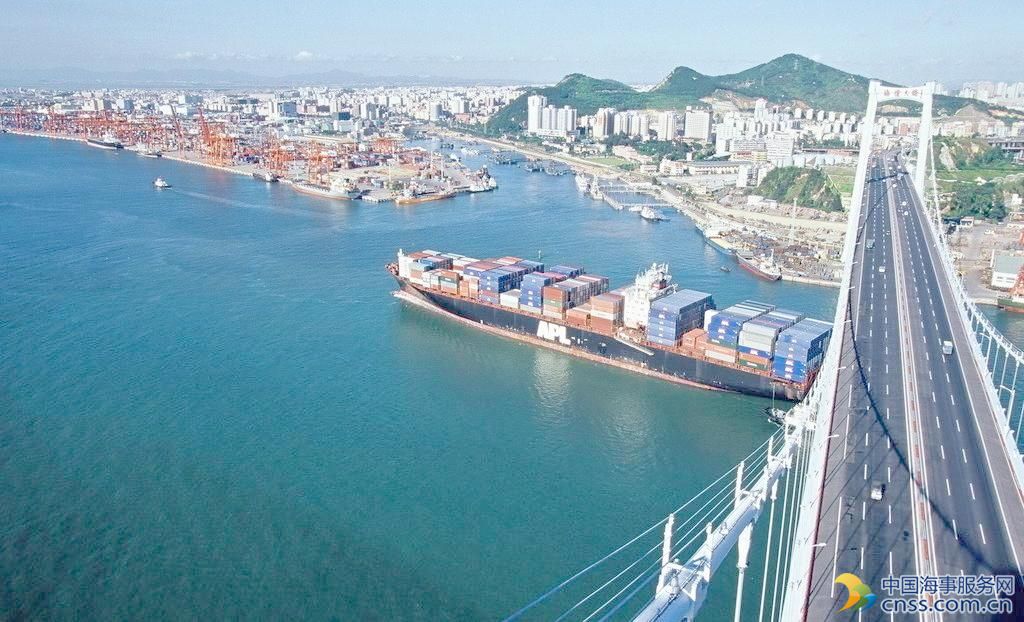

- China continues seaport consolidation as Dalian offer goes unconditional