Tianjin Shipping Index (May 2-May 4)

I. Tianjin Shipping Index (TSI)

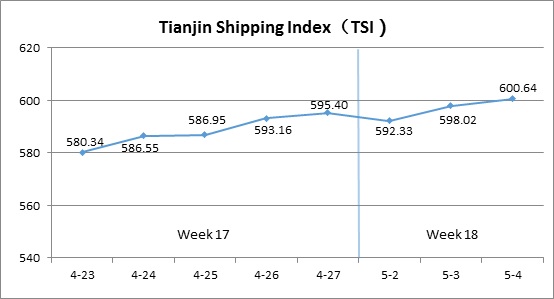

In Week 18 2018 (May 2-May 4), Tianjin Shipping Index released three times because of Labor Day holiday shift. Tianjin Container Freight Index (TCI) increased markedly. Tianjin Bulk Freight Index (TBI) decreased and then increased. Tianjin Domestic Container Freight Index (TDI) kept decreasing. Tianjin Shipping Index (TSI) decreased and then increased. The TSI closed at 600.64 points with an increase of 0.88% from Apr.27 (the last release day of Week 17). The TSI trend is as follows:

The chart above shows the trends of TSI from Apr.23 to May 4. The value of TSI in Week 18, 2018 is as follows:

II. Tianjin Container Freight Index (TCI)

In Week 18 2018 (May 2 to May 4), because of Labor Day holiday shift, the TCI released three times. The trend of TCI is as follows:

In week 18, the TCI increased markedly.

On May 2(Wed.), the freight rates in European Route, Mediterranean Route, North American Route and South American East Coast Route increased overall. The freight rates in South American West Coast Route, Central South American Route and Persian Gulf Route decreased. The TCI increased markedly by 3.84% on a day on day basis. From May 3 to May 4 (Thu. to Fri.), the freight rates in European Route, Mediterranean Route and Persian Gulf Route increased. The freight rates in North American Route and South American Route kept stable. The TCI kept an increase trend with a narrower range. The increase was 1.93% on two consecutive release days.

The TCI closed at 405.66 points with an increase of 22.40 points (5.84 %) from Apr.28 (the last release day of Week 17).

The TCI index value saw several up and down on a day-on-day basis are as follows:

European/Mediterranean route Cargo Volume increased steadily. Some shipping alliances increased the freight rates markedly last week, therefore, other ship owners carried out the freight-rate-rising plan this week. The freight rates increased rapidly. The freight indices in European Route, Mediterranean East Route and Mediterranean West Route increased 11.84%, 14.39% and 13.12% this week.

North American route The solution of China-US trade friction is not clear yet. The factories and traders are afraid that goods delivery might be influenced, thus the shipment pace became faster. Cargo volume presented an increase trend. Besides, the ports in the U.S. were congested, the freight rates hit a high point and kept stable on a high level. The freight indices in North American West Coast Route and North American East Coast Route increased 10.24% and 4.97% this week.

South American route The market demand did not improve obviously. The freight rates stabilized and decreased this week. The freight indices in South American West Coast Route and Central South American Route decreased 1.18% and 0.86% on a week on week basis. In comparison, thanks to the transportation capacity reduction by some ship owners, the freight rates in South American East Coast Route kept a slight increase trend by 2.45% on a week on week basis.

Persian-Gulf route With the coming of Ramadan, cargo owners slowed delivery speed to prevent importers’ customs clearance during holiday. Cargo volume decreased. The freight rates decreased with shocks. The freight indices decreased 1.23% on a week on week basis.

III. Tianjin Bulk Freight Index (TBI)

Week 18, 2018 (May.2 – May.4), Tianjin Bulk Freight Index (TBI) was released three times due to the May Day holiday arrangement and the trend is shown as follows:

In week 18, the TBI first decreased and then increased.

After the May Day holiday, the freight rates of coal and grain shocked narrowly and the freight rate of mineral ore decreased, which led to a day-on-day TBI decrease of 1.17% on May.2 (Wed.). Then, the freight rate of coal increased slightly, the freight rate of grain decreased with shocks and the freight rate of mineral ore increased continuously. TBI increased continuously from May.3 to May.4 (Thu. to Fri.) and the total increase was 2.52%.

TBI ended at 809.03 points with an increase of 10.57 points (1.32%) from Apr.27 (the last release day of week 17).

TBI index value saw several ups and downs on a day-on-day basis, which is shown as follows:

TBCI kept increasing slightly this week. TBCI ended at 615.68 points with an increase of 16.60 points (2.77%) from Apr.27 (the last release day of week 17). For the Panamax market, cargos of coal increased and the freight rate of the DBCT to Tianjin route increased about 3.5%. For the Capesize market, the market became better and the freight rate of Hay Point to Qingdao route increased over 2%.

TBGI decreased with shocks this week. It ended at 688.64 points with a decrease of 2.63 points (0.38%) from Apr.27 (the last release day of week 17). The shipment of grain in South America slowed down and the available carriers were in oversupply. Under the influence of the oversupply of carriers, the freight rate of South America to Tianjin route decreased over 0.6%. The freight rate of US Gulf to Tianjin route decreased about 0.2% and the freight rate of West America to Tianjin route decreased over 0.09%.

TBMI decreased first but increased significantly later. It ended at 1122.77 points with an increase of 17.75 points (1.61%) from Apr.27 (the last release day of week 17). For the iron ore market, affected by Chinese and Australian holidays, the deal in the market slowed down and the freight rate decreased in the first release day this week compared with that before the holiday. As the end of the week approached, the deal in the market became active and ship-owners had more confidence to hold the price, then the freight rate increased continuously. The freight rate of West Australia to North China increased over 2% and the freight rate of Brazil to Tianjin route increased over 1%. As for nickel ore, the Handysize market became active, which led the freight rate of Surigao to Tianjin route to increase about 0.3%.

IV. Tianjin Domestic Container Freight Index (TDI)

Only three days (May.02-May.04) of Tianjin Domestic Container Freight Index (TDI) updates due to the Labor Day holiday in Week 18. The trend is shown in the chart below.

The TDI in Week 18 declined dramatically.

On May.02 (Wed.), the Inward Index kept steady, but the Outward Index of the frieght of Tianjin-Guangzhou route suffered a sharp decrease, causing the TDI to plummet (1.92%). On May.03 (Thur.), the Outward Index recovered stability, while the Inward Index of the freight of Shanghai-Tianjin route fluctuated a bit, leading to the TDI decreasing slightly. On May.04 (Fri.), both the Inward Index and the Outward Index dropped again, so the TDI continued trending downwards, finally closing at 752.76 points and decreasing 18.18 points (2.36%), compared with that on Apr.28 (the last release day of Week 17).

The value of TDI ups and downs on a day-on-day basis is shown as follows:

Tianjin Domestic Container Outward Freight Index (TDOI) decreased rapidly this week, eventually closing at 910.11 points on May.04 (Fri.), declining 35.19 points (3.72%) compared with that on Apr.28 (the last release day of Week 17). Cargo shipping was influenced by the market distribution, that is to say, some cargos were transported by land or by iron, instead of by sea and the shipping market was dissatisfying this week. The freight of Tianjin-Shanghai route and Tianjin-Guangzhou route continued declining and finally their freight rate indices decreased 6.33% and 4.18% respectively. The freight rate index of Tianjin-Quanzhou route was comparatively better, remaining stable this week.

The decrease of Tianjin Domestic Container Inward Freight Index (TDII) narrowed this week. the TDII closed at 595.41 points on May.04(Fri.), with a decrease of 1.16 points (0.19%), compared with that on Apr.28 (the last release day of Week 17). The freight, in this week, kept sliding due to the expanded market capacity. In details, the frieht rate indices of Shanghai-Tianjin route and Guangzhou-Tianjin route separately decreased 0.13% and 0.26%. That of Quanzhou-Tianjin route, by contrast, returned to stability this week.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional