Demand for Dry Bulk Tonnage Still Strong

Despite a correction in the dry bulk market, ship owners are still quite keen on modern dry bulk tonnage. In its latest weekly report, shipbroker Banchero Costa said that “starting from dry bulk two Capesize chaged hands, the Aristofanis I, 177,000 dwt built 2005 by Mitsui was sold again after 2 months by the “new” owner for $16,65mln generating a profit of around $2mln; the Lowlands Brilliance 169,000 dwt, built 2002 by Samho was sold to Korean interests for $10mln. The Post-Panamax Dimitra 93,000 dwt, built 2010 by Yangfan was reported sold for $11,8mln. Two Supramax, the King Island 57,000 dwt, built 2015 by Tsuneishi Zosen and the Torenia 56,000 dwt, built 2007 by Mitsui were sold for $20.5mln to Pacific Basin in cash and shares and for $11.3mln to Greek buyers respectively. Pacific Basin purchased also two sisters Handysize the Saldanha Bay and the Seal Island 35,000 dwt, built 2015 by Shikoku in an operation involving again cash and shares. The VLCC Toyo 310,000 dwt, built 2005 by Imabari was reported sold to Altomare for $28.5mln. An undisclosed Danish buyer concluded an en bloc deal for 7 product tanker sisterships at a price of $93.5mln; the vessels are Bunga Allium, Bunga Angelica, Bunga Angsana, Bunga Aster, Bunga Azalea, Bunga Akasia and Bunga Alamanda all 38,000 dwt built 2009/2010 by STX. Another en bloc deal was reported for two MR1 sisters Maersk Edgar and Maersk Erin 37,000 dwt, built 2004 by Jinling for a a price of $9,35mln each”.

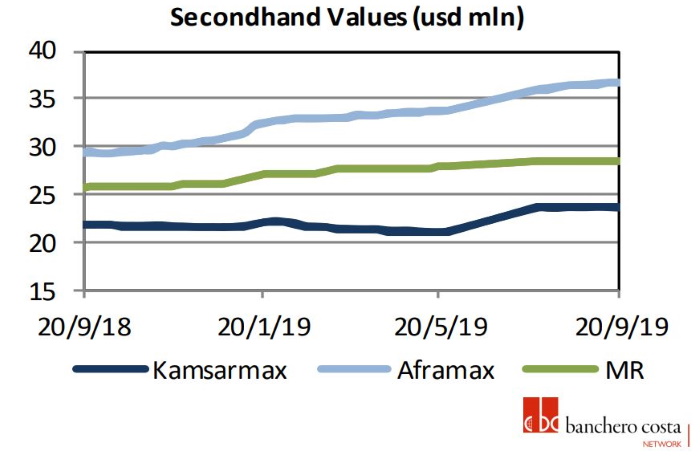

In a separate note, Allied Shipbroking said that “on the dry bulk side, a strong flow of transactions took place the last couple of days or so. Of course, this can been seen as a mere reflection of the much better earning levels currently being experienced. At this point, we see sound focus for the smaller size segments (Handysize and Supramax), which show higher stability against the recent corrections noted in the freight market the past couple of weeks. All-in-all, as we are approach the last quarter of the year, we can expect buying interest to remain relatively strong. On the tanker side, activity exploded this week, showing the strong buying appetite that has emerged in the market. Yet again the main driving size segment was the MR, which has nourished the SnP market repeatedly over the past year or so. Given that we are also seeing robust buying appetite for other size ranges, we can expect a strong secondhand market for the remainder of the year”.

Meanwhile, in the newbuilding market, it was yet another fairly quiet week. Banchero Costa said that “on the dry bulk we registered a few orders for Kamsarmax: Yangzijiang Shipping ordered 1 x 81,800 dwt for delivery August 2020 at their own yard, Japanese Sanoyas took an interesting order for an unnamed account for 1 x 81,500 dwt for delivery February 2021, the vessel will be fitted with 30.5t cranes. Oshima was awarded for 2 + 1 x 84,200 dwt at price in the region of $32.5mln, account Ta-Ho Maritime; the deal is backed by long term charter with Bunge and financed by ICBC Leasing. For Tankers the relevant order to report is for 8 ships firm ordered by Shandong Shipping at New Times for the construction of MRs 50,000 dwt, deliveries starting end 2020 and price around $27mln, the order is backed by long term charter with Shell and again financed by ICBC Leasing”.

Similarly, Allied Shipbroking noted that “it seems as though a high rise in activity has been long overdue in the newbuilding market, given that we are fast approaching the final quarter of the year. After an impressive recovery in freight rates in the dry bulk sector during the summer period, we finally witness a glimpse of robust sentiment being portrayed in terms of new ordering as well. At this point, the Kasmarax size segment has taken the lead, with Supramaxes and smaller segments following close behind. Moreover, given the current trends from the side of earnings, we can expect things to remain vivid during the final part of the year. In terms of new ordering for the tanker sector, it has also been a very interesting week. Beyond the very active MR segment, with a plethora new orders being placed as of late, we can also see bigger size segments more active now. With all being said, we must be patient to see whether the current momentum will be sustained further during the coming weeks”, the shipbroker concluded.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional