12.8-12.12 International Dry Bulk Market Weekly Comment

Weekly Dry Bulk Observation

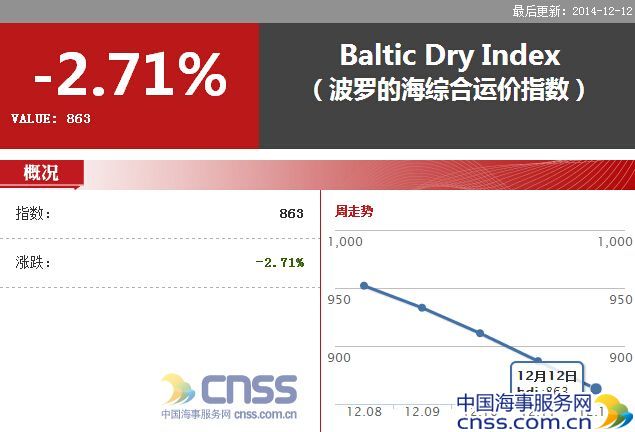

The international dry bulk market ended last week with the Baltic Dry Index (BDI) at 863 points, a drop of 12.12% from a week ago. The freight rate of capsize vessels saw the biggest decline with sharp slump of 40 percent above for two weeks. In addition, BPI, BSI and BHSI respectively decreased 8%, 2.16% and 1.2% to 1001 points,950 points and 493 points.For the shipping demand continues to be weak, the international dry bulk market situation is still worrying.

Capesize market

In capesize market, due to continuous decline in iron ore inventory with Chinese coastal inventory last week reaching 104.89 million tons with a fall of 1.3%, the iron ore price continued the downtrend, and the iron ore market has still experienced excess shipping capacity but with less shipment. Therefore, the trade activity in capesize market was quite anemic. Australia-China route, Brazil-China route and South Africa-China route all have seen woefully inadequate time charter transactions and have experienced big plunge in daily charter. The rate of two Tubaro/West Australia routes declined 3.49% and 9.92% week-on-week respectively to $15.2/ton and $5.45/ton.In time charter market, the average of daily charter for four time charter voyages was $6139 with a drop of 35.44% week-on-week.BCI ended with 763 points at the end of last week, down 40.48% from the previous week, its lowest level since 2014.

Panamax market

In Panamax market, the freight rate kept dropping and the week-on-week decline was bigger but still much better than that of Capesize. Although the shipment in US West Coast and from Indonesia to India were relative sufficient, the weak demand of winter coal storage and excess of shipping capacity in Panama market caused the freight rate of Panama vessels to remain the downward trend. On last Thursday, the daily charter of Panamax vessel in the round-route from South China to East Australia was $7511, with a decline of 11.7%. In time charter market, the average of daily charter of Panamax vessel for four time charter voyages was $7976 with a week-on-week decline of 8.079%. Finally, the BPI closed at 1001 points at the end of last week, down 8.00% from the previous week.

Supramax market

The Supramax market experienced a tight range of shock. The shipment of grain in Southeast Asia region and US Gulf-Asia were quite insufficient, and the freight rate of Supramax vessels was stagnant.On Thursday, the daily charter of Supramax vessel in the round-route from South China to Indonesia was $6353, with a week-on-week decline of 0.8$. The rate of coal shipment from Taboneo to Guangzhou was $7.545/ton, a drop of 1.0% from last Thursday.The rate of nickel minerals shipment from Surigao to Rizhao was $8.583/ton, the same as the last Thursday. Finally, the BPI closed at 950 points at the end of last week, down 2.16% from the previous week.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional