(May 30-Jun.3) Tianjin Shipping Index

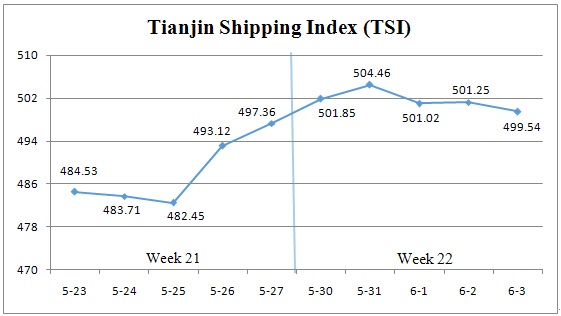

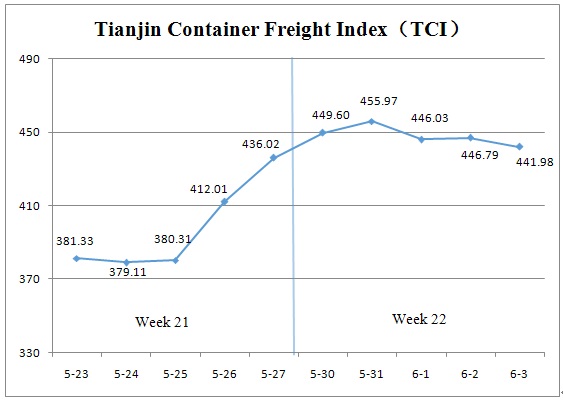

I. Tianjin Shipping Index (TSI)

Week 22 (May 30-Jun.3), Tianjin Container Freight Index (TCI) increased at first and then decreased. Tianjin Bulk Freight Index (TBI) slightly increased. Tianjin Domestic Container Freight Index (TDI) decreased at the beginning of the week and kept stable afterwards. Tianjin Shipping Index (TSI) increased at the beginning of the week, then decreased at the end of the week and was closed at 499.54 points with an increase of 0.44% from May 27 (the last release day of Week 21). The TCI trend is shown in the chart below:

The chart above shows the trends of TSI from May 23 to Jun.3. The value of TSI in Week 22 is shown in the table below:

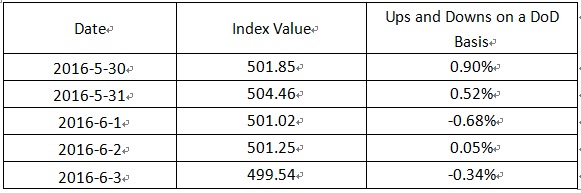

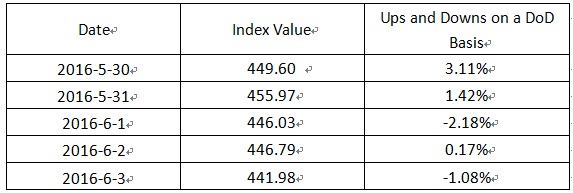

II. Tianjin Container Freight Index (TCI)

Week 22, 2016 (May 30-Jun.3), the TCI trend is shown in the chart below:

In Week 22, TCI increased at first and then decreased

From May 30 to May 31 (Mon. to Tue.), the freight rates in European route, Mediterranean route, North American route and South American East Coast route increased. TCI increased 4.58% on two consecutive release days. From Jun 1 to Jun 3 (Wed. to Fri.), the freight rates in North American route and South American East Coast route continued to increase, while the freight rates in European route, Mediterranean route, South American West Coast route, Central South American route and Persian Gulf route decreased. TCI decreased 3.07% on three consecutive release days.

TCI eventually was closed at 441.98 points on Jun.3 with an increase of 5.96 points (1.37%) from May 27 (the last release day of Week 21).

The TCI index value and ups and downs on a day-on-day basis are shown as follows:

European/ Mediterranean route

The market continued to implement the plan of increasing freight rate at the beginning of the week, and the upward trend of the freight rate continued. At the middle and the end of the week, after increasing the freight rate twice, the current freight rate hit the highest point from March. However, the weak shipment volume was the key factor restricting the increasing freight rate. Some shipping companies decreased the freight rate in order to maintain the market share. The decrease of the freight rates in European route and Mediterranean West route was in a narrow range, the freight index in European route and Mediterranean West route increased 0.57% and 0.72% respectively on a week-on-week basis. In contrast, the freight rate in Mediterranean East route decreased markedly because of the high pressure of seeking cargoes. The freight index decreased 2.60% on a week-on-week basis.

North American route

The plan of increasing freight rate finally implemented this week, the freight rate increased overall. However, the increase of the freight rate did not meet expectation due to the current overcapacity. The freight index in North American West Coast route and North American East Coast route increased 3.54% and 5.93% respectively this week.

South American route

The freight rate were mixed this week. The demand of shipment in South American West Coast route and Central South American route did not improved too much. The market decreased the freight rate slightly in order to improve the loading rate. The freight index decreased 0.71% and 3.62% respectively this week. The freight rate in South American East Coast route increased all the way because the market continued to increase GRI generally. The freight index increased 24.50% this week.

Persian Gulf route

During the Ramadan, the overall cargo volume was weak. The low density cargo continued to be insufficient. The freight rate continued to decrease. The freight index decreased 1.78% this week.

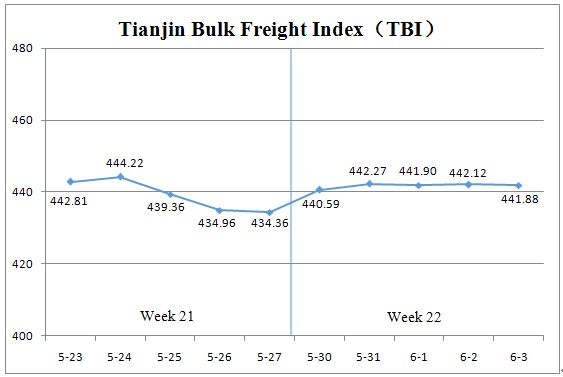

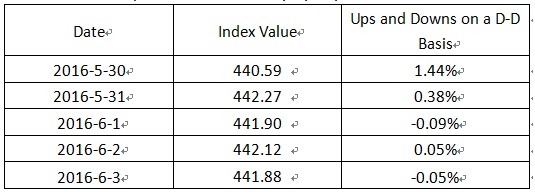

III. Tianjin Bulk Freight Index (TBI)

Week 22, 2016 (May 30-Jun.3), Tianjin Bulk Freight Index (TBI) is shown as follows:

In week 22, the TBI continued increasing slightly at first and stabilized gradually at the end of this week.

From May 30 to 31 (Mon. to Tue.), the freight rates for coal and mineral ore increased slightly, but the rate for grain stabilized gradually. The TBI, which demonstrated an increase tendency, ended with an increase of 1.82%. And then, the freight rate for coal dropped down slightly, the freight rate for grain increased , and the freight rate for mineral ore fluctuated in narrow ranges. The TBI from Jun.1 to 3 (Wed. to Fri.) stabilized gradually, and each single day the fluctuation rate is less than 0.1%.

Eventually, the TBI ended at 441.88 points, an increase of 7.52points (1.73%) from May 27(the last release day of Week 21).

TBI index value saw several ups and downs on a day-by-day basis are shown as follows:

The TBCI, which demonstrated an increase at first and a decrease afterward, ended at 279.96 points with the increase of 0.71 points (0.25% ) from May 27(the last release day of Week 21). Due to the slightly volume for coal transportation from Australasia to China, and the Panamax vessels continued falling back, the rate of the DBCT-Tianjin route decreased nearly 3%. In contrast, the freight rate of the Capesize rallied early this week and markedly late this week. An increase of 3.50%, the freight of Hay Point to Tianjin decreased after the increasing tendency.

The TBGI increased in a narrow range this week and ended at 404.13 points, an increase of 1.75 points (0.43%) from May 27 (the last release day of Week 21). The freight rate of the grain stayed steady generally. Due to the tepid quantity of grain in the Atlantic market, the freight rate of South Coast American to Tianjin decreased 0.06%, and US Gulf to Tianjin increased nearly 0.25%. In contrast, the freight rate of West Coast America to Tianjin increased dramatically nearly 2.8%.

The TBMI, which demonstrated an increase tendency, ended at 641.55 points with the increase of 20.11 points (3.24% ) from May 27(the last release day of Week 21). For iron ore, the international bunker price kept a high level and the Capesize ship chartering centralize which made the freight rate increased. Among them, the freight rates of Australia to North China and Tubarao (Brazil) to Tianjin increased over 5% and 3.3% respectively. However, the steel prices were falling back and steel mills demand for iron ore still weak, Capesize ship of rising momentum or difficult to continue. As for nickel ore, the Handysize market was limited chartered, Surigao to Tianjin rate decreased nearly 1.7%, and Celebes to Tianjin remained almost the same as last week.

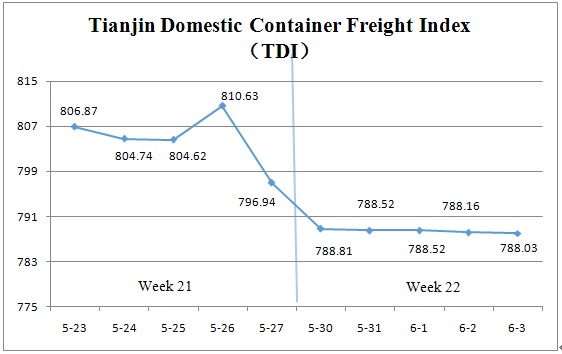

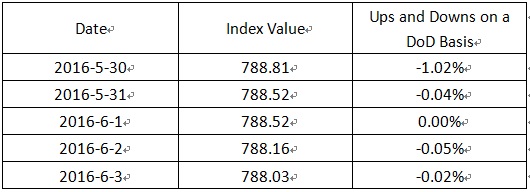

IV. Tianjin Domestic Container Freight Index (TDI)

Week 22, 2016 (May 30-Jun.3), Tianjin Domestic Container Freight Index (TDI) was released and the trend is shown in the chart below.

In Week 22, the TDI declined at the beginning of this week, and kept stable afterwards.

From May 30 to 31 (Mon.-Tue.), both the Outward Index and Inward Index declined, and the TDI continued to be the downward trend. The TDI decreased 1.06% for two consecutive release days. On Jun.1 (Wed.), the TDI stood stable. From Jun.2 to 3(Thu.-Fri.), Inward Index went down slightly, leading to a 0.06% decrease on the TDI for two consecutive release days.

Finally, the TDI was closed at 788.03 points, with a decrease of 8.91 points (1.12%) from May 27 (the last release day of Week 21).

The TDI index value and ups and downs on a day-on-day basis are shown as follows:

Tianjin Domestic Container Outward Freight Index (TDOI) declined this week, and was closed at 909.88 points on Jun.3 (Fri.) with a decrease of 15.13 points (1.64%) from May 27 (the last release day of Week 21). The market shipment volume of Tianjin-Guangzhou route remained in the doldrums. New transport capacity made the conflict between supplement and demand prominent and broke the situation of stable freight rate. The freight rate decreased then. The freight index of this route decreased 1.11% on a week-on-week basis. The freight rate in Shanghai-Tianjin route declined. The freight index decreased 0.73% on a week-on-week basis. The loading condition in Quanzhou-Tianjin route was not good. The freight rate decreased markedly, and the freight index declined 4.41% on a week-on-week basis.

Tianjin Domestic Container Inward Freight Index (TDII) decreased with a fluctuation this week and was closed at 666.17 points on Jun.3 (Fri.) with a decrease of 2.70 points (0.40%) from May 27 (the last release day of Week 21). The demand of shipment volume in northbound routes was not boosted. The freight index in Guangzhou-Tianjin route declined this week and was closed at 635.92 points with a decrease of 0.43%. The freight index in Shanghai-Tianjin route saw a slight downward trend at the beginning of the week, then kept stable. Eventually, the freight index in this route decreased 0.72% on a week-on-week basis.The freight index in Quanzhou-Tianjin route kept stable this week.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional