Tianjin Shipping Index(Jan.15-Jan.19)

I. Tianjin Shipping Index (TSI)

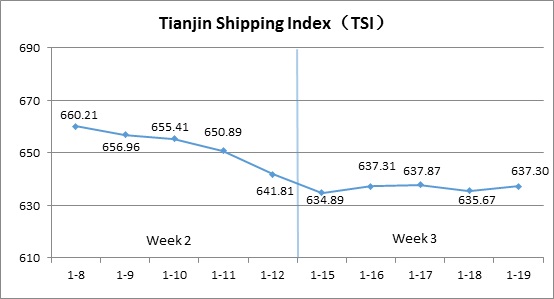

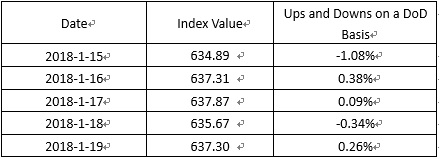

In Week 3 (Jan.15-Jan.19), Tianjin Container Freight Index (TCI) kept increasing. Tianjin Bulk Freight Index (TBI) kept the decrease trend of last week. Tianjin Domestic Container Freight Index (TDI) decreased early this week and then stabilized. Tianjin Shipping Index (TSI) shocked with narrow range. The TSI closed at 637.30 points with a decrease of 0.70% from Jan.12 (the last release day of Week 2). The TSI trend is as follows,

The chart above shows the trends of TSI from Jan.8 to Jan.19. The value of TSI in Week 3, 2018 is as follows,

II. Tianjin Container Freight Index (TCI)

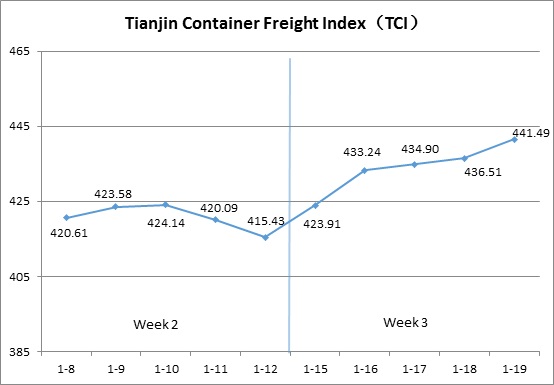

In Week 3, 2018 (Jan.15 to Jan.19), The trend of TCI is as follows,

In Week 3, the TCI kept increasing.

From Jan.15 to Jan.16 (Mon. to Tue.), the freight rates in European route, Mediterranean route, North American route, South American West Coast route, Central South American route and Persian Gulf route increased markedly. The freight rates in South American East Coast route presented a weak trend. The TCI increased rapidly by 4.29% on two consecutive release days. From Jan.17 to Jan. 19 (Wed. to Fri.), the freight rates in European route, Mediterranean route and North American route kept the increase trend. The freight rates in South American route decreased. The freight rates in Persian Gulf route kept stable. The TCI increased by 1.90% on three release days.

The TCI closed at 441.49 points with an increase of 26.06 points (6.27%) from Jan.12 (the last release day of Week 2).

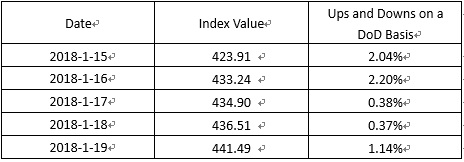

The TCI index value saw several up and down on a day-on-day basis are as follows:

European/Mediterranean route With Spring Festival coming, factories stepped up the pace to prepare goods. The demand to increased cargo volume increased. Last, some ship owners carried out the freight-rate-rising plan. After that, more and more ship owners followed their steps and the freight rates presented a strong trend the whole week. The freight rates in European route, Mediterranean East route and Mediterranean West route increased 3.68%, 5.51% and 10.88% respectively on a week on week basis.

North American route With the coming of Spring Festival shipment peak, many owners of cargo raced against time so that they can complete the shipment of export cargo before factories shutdown. The supply of shipping space of some ship owners was in a tension. The freight rates kept increased. The freight indices of North American West Coast route and North American East Coast route increased 5.93% and 13.76% respectively this week.

South American route In South American West Coast route and Central South American route, the shipping alliances kept reducing the transport capacity and cargo volume increased. The freight rates increased markedly early this week and then some ship owners reduced the freight rates to raise loading rate. The freight rates stabilized and decreased slightly in later half of the week. The freight indices increased 6.43% and 3.45% respectively on a week on week basis. In comparison, the freight rates in South American East route presented a weak trend the whole week. The freight indices decreased 8.49% on a week on week basis.

Persian Gulf route The freight rates decreased about 60% in 2017. Since 2018, pressured by cost, the freight rates were raised continuously. This week, the ship owners kept raising the freight rates and it kept the increase trend of last week. The freight indices increased 27.61% on a week on week basis.

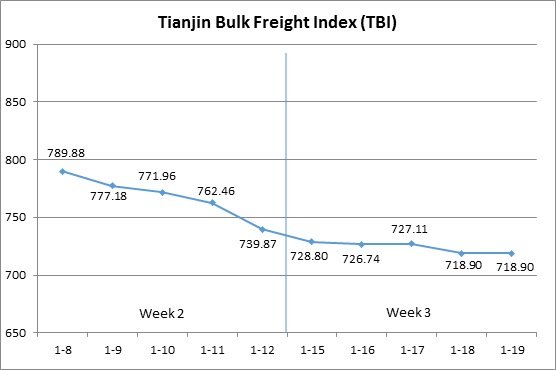

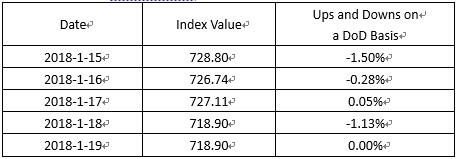

III. Tianjin Bulk Freight Index (TBI)

Week 3, 2018 (Jan.15 – Jan.19), Tianjin Bulk Freight Index (TBI) is shown as follows:

In week 3, the TBI decreased with narrow shocks.

From Jan.15 to Jan.16 (Mon. to Tue.), the freight rates of coal and mineral ore decreased slightly and the freight rate of grain shocked narrowly. TBI decreased for two continuous release days and the total decrease was 1.77%. Then, the freight rates of coal and grain decreased slightly and the freight rate of mineral ore increased slightly. TBI increased 0.05% on Jan.17 (Wed.).

From Jan.18 to Jan.19 (Thu. to Fri.), the freight rates of coal and mineral ore decreased and the freight rate of grain shocked narrowly. TBI decreased again and ended at 718.90 points with a decrease of 20.97 points (2.83%) from Jan.12 (the last release day of week 2).

TBI index value saw several ups and downs on a day-on-day basis, which is shown as follows:

TBCI decreased continuously this week. TBCI ended at 547.94 points with a decrease of 17.19 points (3.04%) from Jan.12 (the last release day of week 2). Cargo volume of coal was small this week and the freight rate did not continue to increase. For the Panamax market, the carriers were sufficient and continuous decrease of the freight rate of Capesize influenced the market. As a result, the freight rate of the DBCT to Tianjin route decreased over 3%. The Capesize market was still gloomy and the freight rate of Hay Point to Qingdao route decreased about 3%.

TBGI shocked narrowly this week. It ended at 681.54 points with a decrease of 0.87 points (0.13%) from Jan.12 (the last release day of week 2). There were some deals of grain in South America but because of the increase of the carriers in ballast, the increase of the freight rate of South America to Tianjin route was limited and the total increase was about 0.5%. By contrast, the freight rate of US Gulf to Tianjin route decreased over 0.6% and the freight rate of West America to Tianjin route decreased over 0.3%.

TBMI decreased with shocks this week. It ended at 927.21 points with a decrease of 44.86 points (4.61%) from Jan.12 (the last release day of week 2). For the iron ore market, the deal of iron ore in Australia was a bit better, but the freight rate of West Australia to North China route decreased 4% because the carriers were in oversupply. By contrast, the cargo volume in Brazil was small and the ship-owners lowered the freight rate. The freight rate of Brazil to Tianjin route decreased about 9.5%. As for nickel ore, the freight rate of Surigao to Tianjin route shocked narrowly and the freight rate of the end of this week was equal to that of the end of last week.

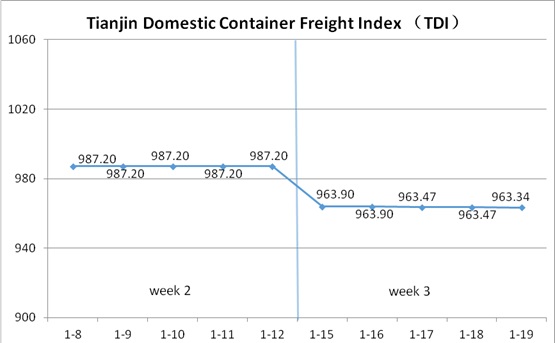

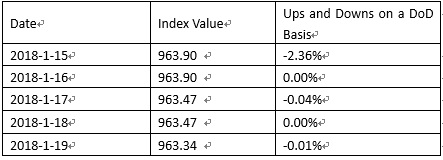

IV. Tianjin Domestic Container Freight Index (TDI)

In the third week of 2018 (Jan.15-19), the trend of the TDI is as follows:

In the third week, Tianjin Domestic Container Freight Index (TDI) stabilized after a sharp drop.

The Outward index remained stable this week. TDI changed with the Inward index. On January 15 (Monday), the freight rate from Shanghai to Tianjin increased slightly, but the freight rate from Guangzhou to Tianjin dropped sharply, with a one-day drop of 2.36% in TDI. From January 16 to January 19 (Tuesday-Friday), the freight rate from Guangzhou to Tianjin decreased slightly, while the freight rates of other routes remained stable and TDI stabilized. TDI closed at 963.34 points eventually, down 23.86 points, or 2.42%, from January 12 (the last release day of Week 2).

The value of TDI ups and downs on a day-on-day basis are as follows:

Tianjin Domestic Container Outward Freight Index (TDOI) continued its steady trend. The index closed at 1153.13 points on January 19, kept same with January 12 (the last release day of Week 2). Most ship owners of the southbound route have maintained a wait-and-see attitude since January, the freight rates of the three routes remained the same level of the end of 2017.The previous stable pattern continued this week, and the freight prices of Tianjin to Quanzhou, Tianjin to Guangzhou and Tianjin to Shanghai Routes remained flat. With the approaching of the Spring Festival holiday, the shipping company expects that the market transactions will tend to be light and freight rates will show downward trend.

Tianjin Domestic Container Inward Freight Index (TDII) remained stable after a sharp decline at the beginning of the week. The index closed at 773.36 points on January 19, down 5.81% from 47.73 points on January 12 (the last release day of Week 2). Because of the off-season in house decoration market, the demand for transportation of building materials, ceramics and other products is sluggish and the freight rate dropped too. The freight rate of Guangzhou-Tianjin fell by 8.40% from previous week. In contrast, the freight rate from Shanghai to Tianjin was steadily rising, with the freight rate index went up 0.88% on a week-to-week basis, and the freight rate of Quanzhou to Tianjin remained stable throughout the week.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional