Tianjin Shipping Index(Jan.29-Feb.2)

I. Tianjin Shipping Index (TSI)

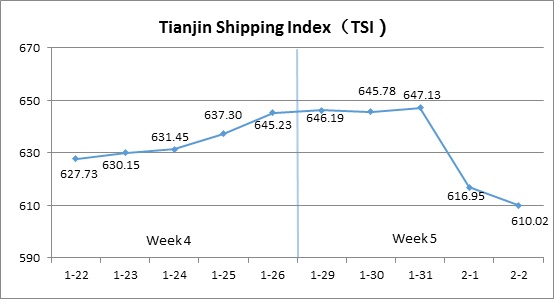

In Week 5 (Jan.29-Feb.2), Tianjin Container Freight Index (TCI) fluctuated slightly. Tianjin Bulk Freight Index (TBI) decreased after hitting a high point. Tianjin Domestic Container Freight Index (TDI) decreased markedly. Tianjin Shipping Index (TSI) fluctuated slightly and then decreased markedly. The TSI closed at 610.02 points with a decrease of 5.46% from Jan.26 (the last release day of Week 4). The TSI trend is as follows,

The chart above shows the trends of TSI from Jan.22 to Feb.2. The value of TSI in Week 5, 2018 is as follows,

II. Tianjin Container Freight Index (TCI)

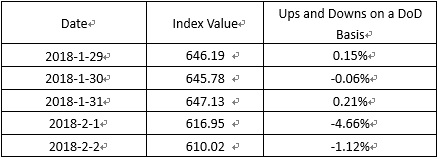

In Week 5, 2018 (Jan.29 to Feb.2), the trend of TCI is as follows,

In Week 5, the TCI fluctuated and stabilized.

From Jan.29 to Jan.30 (Mon. to Tue.), the freight rates in European route and Mediterranean route increased and then decreased. The freight rates in North American route, South American route and Persian Gulf route increased overall. The TCI increased and then decreased by 0.02% on two consecutive release days. From Jan.31 to Feb.2 (Wed. to Fri.), the freight rates in European route and Mediterranean route decreased with fluctuation. The freight rates in North American route and South American route decreased after hitting a high point. The freight rates in Persian Gulf route kept stable. The TCI fluctuated slightly by 0.36% on three consecutive release days.

The TCI closed at 459.88 points with an increase of 1.75 points (0.38%) from Jan.26 (the last release day of Week 4).

The TCI index value saw several up and down on a day-on-day basis are as follows:

European/Mediterranean route Early this week, the freight rates kept the increase trend of late last week. With workers of factories started their holidays, cargo volume presented a decrease trend in mid and later half of the week compared with that of last week. Transport overcapacity was obvious and the freight rates decreased with fluctuation. The freight rates in European route, Mediterranean East route and Mediterranean West route decreased 2.35%, 0.06% and 4.21% on a week on week basis.

North American route It is before Spring Festival, concentrated shipment remained a high level. Some ship owners strived to complete load of transport before truck drivers start their holidays. Therefore, the freight rates increased rapidly early this week. At the end of the week, some ship owners decreased the freight rates to increase loading rate, then the freight rates decreased slightly. The freight rates in North American West Coast route and North American East Coast route increased 6.24% and 4.63%

South American route Early this week, shipment demand on the market increased. The ship owners kept on carrying out freight-rate-rising plan. The freight rates kept the increase trend of last week. In later half of the week, the freight rates decreased slightly. In the end, the freight rates in South American West Coast route and Central South American route increased markedly. The freight indices increased 6.25% and 5.88% respectively on a week on week basis. In comparison, the freight rates in South American East Coast route increased slightly. The freight indices increased 1.92% on a week on week basis.

India-Pakistan route Since 2018, pressured by cost, the freight rates were raised. Early this week, the freight rates kept increasing. In later half of the week, the freight rates kept stable and the freight indices increased 4.18% on a week on week basis.

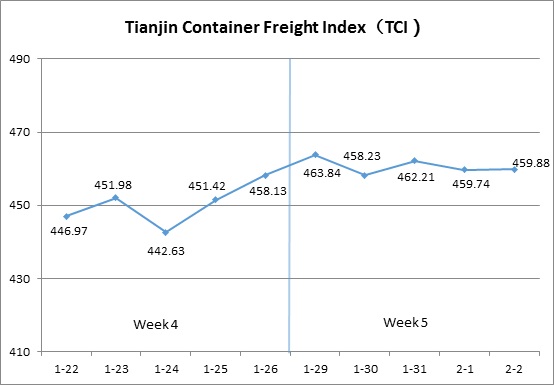

III. Tianjin Bulk Freight Index (TBI)

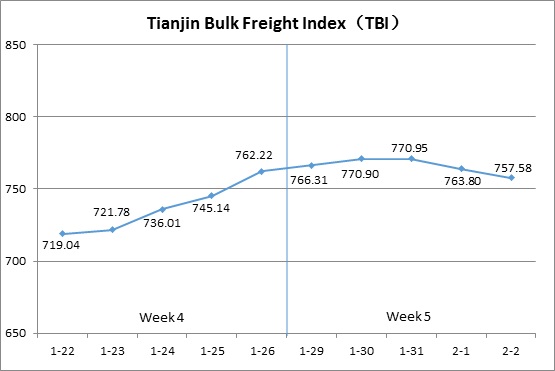

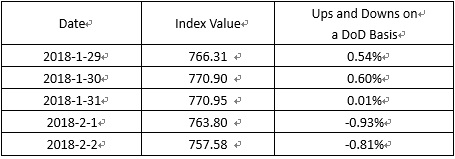

Week 5, 2018 (Jan.29 – Feb.2), Tianjin Bulk Freight Index (TBI) is shown as follows:

In week 5, the TBI continued to increase in the first half of the week but decreased later.

From Jan.29 to Jan.31 (Mon. to Wed.), the freight rate of coal increased slightly and the freight rates of grain and mineral ore increased with shocks. TBI increased slightly for three successive release days and the total increase was 1.14%. Then, the freight rates of coal, grain and mineral ore all decreased, which led the TBI to decrease from Feb.1 to Feb.2 (Thu. to Fri.) and the total decrease was 1.73%.

TBI ended at 757.58 points with a decrease of 4.64 points (0.61%) from Jan.26 (the last release day of week 4).

TBI index value saw several ups and downs on a day-on-day basis, which is shown as follows:

TBCI first increased and then decreased this week. TBCI ended at 585.45 points with a decrease of 7.40 points (1.25%) from Jan.26 (the last release day of week 4). For the Panamax market, there were some cargo of coal in Australia but the carriers were in oversupply. The freight rate of the DBCT to Tianjin route increased first but then decreased continuously and the total decrease was over 1.5%. The freight rate of the Capesize also first increased and then decreased and the freight rate of Hay Point to Qingdao route decreased about 0.8%.

TBGI decreased with narrow shocks. It ended at 686.10 points with a decrease of 3.78 points (0.55%) from Jan.26 (the last release day of week 4). The shipment of grain in South America slowed down this week but the increase of the carriers in ballast made the freight rate decrease obviously. The freight rate of South America to Tianjin route decreased over 1%. By contrast, the freight rate of US Gulf to Tianjin route decreased 0.03% and the freight rate of West America to Tianjin route decreased 0.57%.

TBMI continued to increase in the first and middle part of the week but decreased fast later. It ended at 1001.18 points with a decrease of 2.76 points (0.27%) from Jan.26 (the last release day of week 4). For the iron ore market, the Capesize market in the Pacific region continued to be active earlier this week and the freight rate of West Australia to North China increased further, but the freight rate decreased later in the week. The market in the Atlantic was gloomy this week and the freight rate of Brazil to Tianjin route decreased over 1.5%. As for nickel ore, cargo volume of nickel ore was small in Philippines and the freight rate of Surigao to Tianjin route decreased over 0.3%.

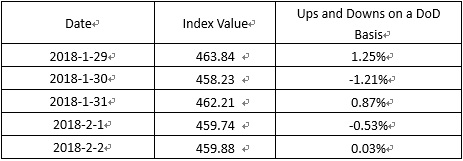

IV. Tianjin Domestic Container Freight Index (TDI)

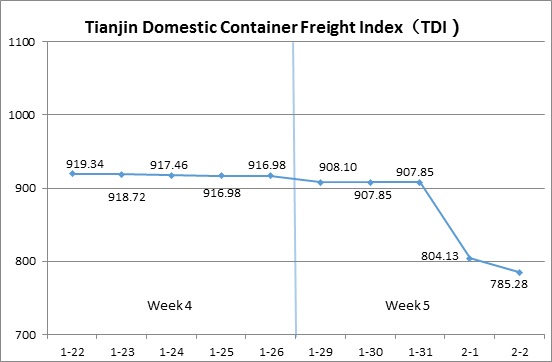

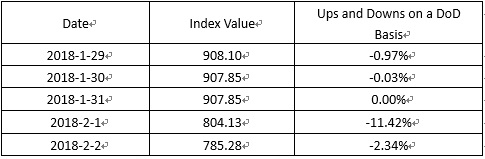

In the fifth week of 2018 (Jan.29-Feb.2), the trend of the TDI is as follows:

In the fifth week, Tianjin Domestic Container Freight Index (TDI) weakened slightly early this week, then fell sharply.

On January 29 (Monday), both the Inward and Outward indices showed a downward trend, and TDI going down. From Jan.30 to Jan.31 (Tuesday-Wednesday), the Outward Index remained stable while the Inward Index declined slightly while the TDI declined slightly. From Feb.1 to Feb.2 (Thursday-Friday), the Inward and Outward indices both dropped sharply, dragging TDI decline rapidly, with a total decrease of 13.50% on two release dates. As a result, TDI ended at 785.28 points, down 131.70 points, or 14.36%, from Jan. 26 (the last release day of Week 4).

The value of TDI ups and downs on a day-on-day basis are as follows:

Tianjin Domestic Container Outward Freight Index (TDOI) dropped sharply. The index closed at 968.65 points on Feb.2, down by 113.14 points, or 10.46% from Jan.14 (the last release day of week 4). As Spring Festival approaching, coupled with the impact of ice and snow weather, logistics fleet capacity became constraints, and the supply of goods in the market was limited, the shipping companies enhanced the intensity of cargo canvassing, cut the price substantially in order to reserve the cargo for the holiday. This week, the freight rates of Tianjin to Quanzhou, Tianjin to Guangzhou, Tianjin to Shanghai decreased by 18.70%, 7.15% and 21.02% respectively on a week-on-week basis.

Tianjin Domestic Container Inward Freight Index(TDII)dropped significantly. The index closed at 601.91 points on Feb. 2, down by 150.9 points or 19.98% from Jan. 26 (the last release day of Week 4). Holiday is closing, shipping capacity of north route reduced. The market demand was light, shipping companies reduced the price in order to ensure the ship loading rate. Among them, the two routes from Quanzhou to Tianjin and from Guangzhou to Tianjin dropped significantly, with the freight rate index down 24.21% and 22.56% respectively on a week-to-week basis. In contrast, freight rates from Shanghai to Tianjin remained stable this week.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional