Tianjin Shipping Index (Mar.26-Mar.30)

I. Tianjin Shipping Index (TSI)

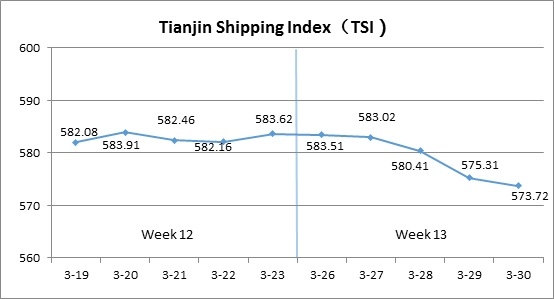

In Week 13, 2018 (Mar.26-Mar.30), Tianjin Container Freight Index (TCI) kept decreasing. Tianjin Bulk Freight Index (TBI) increased and then decreased Tianjin Domestic Container Freight Index (TDI) increased slightly. Tianjin Shipping Index (TSI) kept decreasing. The TSI closed at 563.72 points with a decrease of 1.70% from Mar.23 (the last release day of Week 12). The TSI trend is as follows:

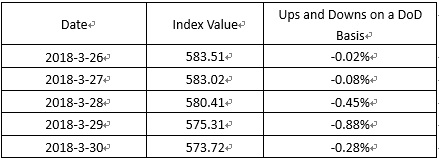

The chart above shows the trends of TSI from Mar.19 to Mar.30. The value of TSI in Week 13, 2018 is as follows:

II. Tianjin Container Freight Index (TCI)

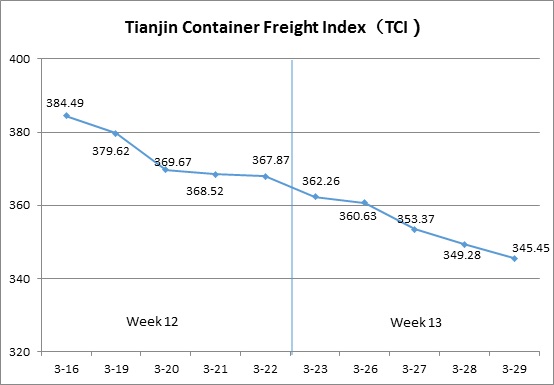

In Week 13, 2018 (Mar.26 to Mar.30), the trend of TCI is as follows:

In week 13, the TCI kept decreasing.

From Mar.26 to Mar.28 (Mon. to Wed.), the freight rates in European route, Mediterranean route, North American route and South American route decreased markedly. The freight rates in Persian-Gulf route kept increasing. The TCI decreased rapidly by 3.58% on three consecutive release days. From Mar.29 to Mar.30 (Thu. to Fri.), the decrease speed of freight rates in European route, Mediterranean route and South American route slowed down. The freight rates in North American route increased overall. The freight rates in Persian-Gulf route decreased. The TCI kept decreasing by 1.51% on two consecutive release days.

The TCI closed at 343.99 points with a decrease of 18.27 points (5.04%) from Mar.23 (the last release day of Week 12).

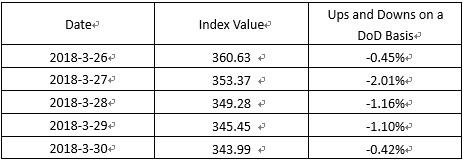

The TCI index value saw several up and down on a day-on-day basis are as follows:

European/Mediterranean route At the end of the month, some ship owners increased the frequency of ships. The transport capacity increased. Cargo volume on the market increased slowly and competition for cargo was more intense. The freight rates presented a weak trend. The freight indices in European route, Mediterranean East route and Mediterranean West route decreased 11.26%, 4.85% and 8.79% on a week on week basis.

North American route After the long Spring Festival holiday, the freight rates decreased for nearly thirty percent. Early this week, it was the mainstream that the freight rates were reduced for cargo collection. Some shipping alliances tried to raise the freight rates to guarantee market return. In latter half of the week, the freight rates increased slightly. The freight indices in North American West Coast route and North American East Coast route decreased 8.51% and 1.21% respectively this week.

South American route Cargo volume presented a weak trend. Transport overcapacity was obvious. The ship owners reduced the freight rates to attract more cargo. The freight rates decreased markedly especially in South American West Coast route. The freight indices decreased 34.00%. The freight rates in South American East Coast route and Central South American route decreased markedly by 9.26% and 18.52% this week.

Persian-Gulf route Since Feb., the freight rates decreased for almost forty percent. In first half of the week, pressured by cost, some shipping companies raised the freight rates. Then, the freight rates decreased again for the consensus on increasing the freight rates was not reached. Finally, the freight indices increased 2.23% on a week on week basis.

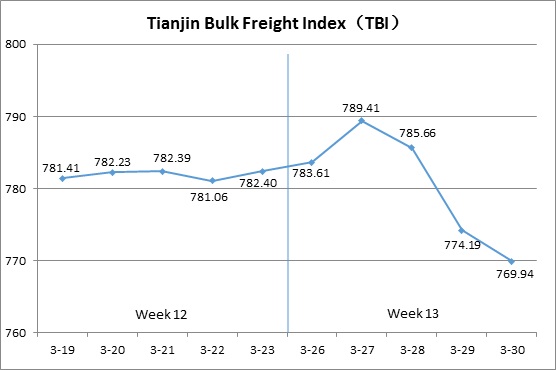

III. Tianjin Bulk Freight Index (TBI)

Week 13, 2018 (Mar.26 – Mar.30), Tianjin Bulk Freight Index (TBI) is shown as follows:

In week 13, the TBI continued to increase earlier this week but decreased fast later.

From Mar.26 to Mar.27 (Mon. to Tue.), the freight rates of coal and grain decreased slightly and the freight rate of mineral ore continued to pick up. TBI increased for two successive release days and the total increase was 0.90%. Then, the freight rates of coal and grain continued to decrease and the freight rate of mineral ore also went down. TBI decreased 2.47% from Mar.28 to Mar.30 (Wed. to Fri.).

TBI ended at 769.94 points with a decrease of 12.46 points (1.59%) from Mar.23 (the last release day of week 12).

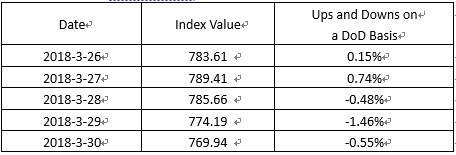

TBI index value saw several ups and downs on a day-on-day basis, which is shown as follows:

TBCI kept decreasing this week and the day-on-day decrease of each release day extended. TBCI ended at 656.75 points with a decrease of 25.71 points (3.77%) from Mar.23 (the last release day of week 12). Foreign coal price was adjusted. The deal of coal was not active and the freight rate began to decrease. For the Panamax market, the Easter holiday was drawing near and ship-owners were anxious to reduce the price to make transactions. The freight rate of the DBCT to Tianjin route decreased continuously and the total decrease was about 5%. For the Capesize market, the freight rate of Hay Point to Qingdao route decreased with shocks and the total decrease was about 2%.

TBGI decreased continuously this week. It ended at 705.28 points with a decrease of 2.36 points (0.33%) from Mar.23 (the last release day of week 12). The cargo of South American grain was stable, but the deal in the market was not active and the FFA contract price of the Panamax was low. Then, the freight rate continued to decrease. The freight rate of South America to Tianjin route decreased 0.5%. The freight rate of US Gulf to Tianjin route decreased 0.25%. The freight rate of West America to Tianjin route shocked narrowly and the rate of the end of the week was basically equal to that of last week.

TBMI continued to increase earlier this week but decreased significantly later. It ended at 947.80 points with a decrease of 9.31 points (0.97%) from Mar.23 (the last release day of week 12). For the iron ore market, inventories in domestic ports were high and the purchase intention of steel mills weakened, then the freight rate decreased. The freight rate of West Australia to North China decreased over 0.3%. Bad weather affected shipment in Brazil and the freight rate of Brazil to Tianjin route decreased about 2.5%. As for nickel ore, the deal of nickel ore was not active in the Philippines and the freight rate of Surigao to Tianjin route decreased over 1.5%.

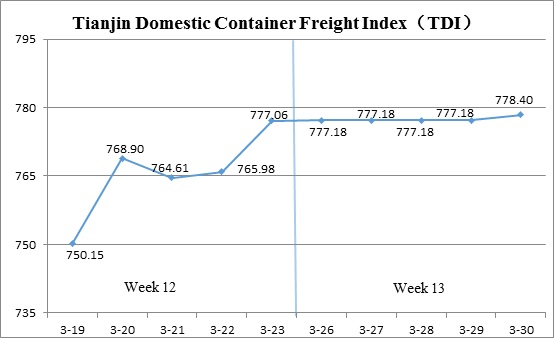

IV. Tianjin Domestic Container Freight Index (TDI)

Week 13, 2018 (Mar.26-Mar.30), the trend of Tianjin Domestic Container Freight Index (TDI) is shown in the chart below:

The TDI in Week 13 experienced a rise in stability.

On Mar.26 (Mon.), the Outward Index kept stable, but the Inward Index went up, which brought slight increase of the TDI (0.02%). From Mar.27 (Tues.) to Mar.29 (Thur.), both the Inward Index and the Outward Index did not change, so the TDI remained the same with the last day. On Mar.30 (Fri.), the freight rate of Guangzhou-Tianjin route went up, pushing the Inward Index rose again, which finally brought 0.16% increase of the TDI and made it closed at 778.40 points, with a growth of 1.34 points (0.17%), compared with that on Mar.23 (the last release day of Week 12).

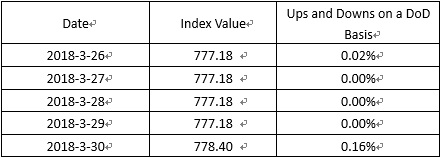

The value of TDI ups and downs on a day-on-day basis is shown as follows:

Tianjin Domestic Container Outward Freight Index (TDOI) kept stable this week. It was closed at 919.26 points on Mar.30 (Fri.), remaining the same with that on Mar.23 (the last release day of Week 12). In detail, for Tianjin-Guangzhou and Tianjin-Shanghai routes, the freight rate indices tended to enter into the wait and see period and to keep relative steady after the sharp increase last week. The freight rate index of Tianjin-Quanzhou also kept stable on a week-on-week basis after dipping last week.

Tianjin Domestic Container Inward Freight Index (TDII) went up this week, eventually being closed at 637.54 points on Mar.30, with an increase of 2.69 points (0.42%), compared with that on Mar.23 (the last release day of Week 12). This week, the decoration market started to recover and the demand of the ceramic building materials in the northern area gradually increased. Therefore, the increasing demand of the market pushed some ship owners to raise the freight slightly. It is reasonable that the freight rate indices of Quanzhou-Tianjin and Shanghai-Tianjin route respectively rose 0.57% and 0.27%. However, the freight rate index of Quanzhou-Tianjin route kept steady this week.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional