Tianjin Shipping Index (Dec.24-Dec.29)

I. Tianjin Shipping Index (TSI)

In Week 52, 2018 (Dec.24-Dec.29), due to the New Year holidays and international customary arrangements, Tianjin Shipping Index (TSI) and Tianjin Bulk Freight Index (TBI) were temporarily suspended and resumed normal release on January 2, 2019. Tianjin Container Freight Index (TCI) increased dramatically at the beginning of the week and then fluctuated. Tianjin Domestic Container Freight Index (TDI) decreased slowly.

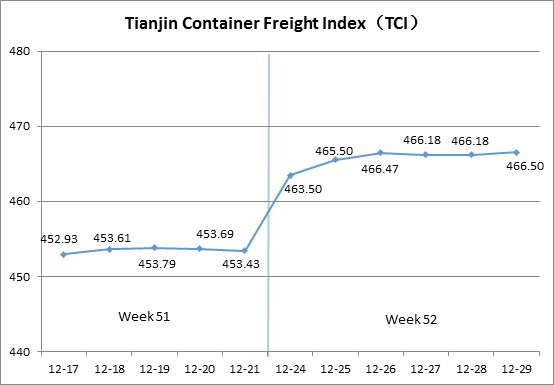

II. Tianjin Container Freight Index (TCI)

In Week 52, 2018 (Dec.24 to Dec.29), the Tianjin Container Freight Index (TCI) was released six times because of the New Year Holidays. The trend of TCI is as follows:

In week 52, the TCI increased dramatically at the beginning of the week and then fluctuated.

From Dec.24 to Dec.26 (Mon. to Wed.), the freight rates in European route, Mediterranean route and Persian Gulf route continued to increase. The freight rate in American route decreased slightly. The freight rate in South American route decreased at first and then increased. The TCI increased 2.88% on three release days. From Dec.27 to Dec.29 (Thu. to Sat.), the freight rates in European route and Mediterranean route increased steadily. The freight rate in American route continued to decrease. The freight rates in South American West Coast route and Persian Gulf route kept steady. The freight rates in South American East Coast route and Central South American Coast route increased. The TCI increased 0.01% on three release days.

The TCI closed at 466.50 points with an increase of 13.07 points (2.88%) from Dec.21 (the last release day of Week 51).

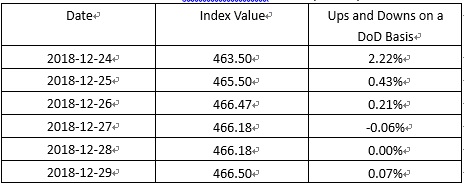

The TCI index value and several ups and downs on a day-on-day basis are as follows:

European/Mediterranean route Near the New Year, traders’ shipments continued to rise. At the same time, some shipping alliances optimized the layout of the new annual liner route. The market supply and demand were more reasonable and balanced. In this context, the market reached a consensus on price increases, and the freight rate climbed steadily. The freight indices in European route, Mediterranean East route and Mediterranean West route increased 4.10%, 5.09% and 6.83% on a week-on-week basis.

American route On the one hand, the previous trade friction overdrafted the market shipping volume in advance; on the other hand, the shipping company failed to reduce the capacity according to market changes in a timely manner. This week the market freight rate continued the weak pattern of last week. The freight indices in American West Coast route and American East Coast route decreased 1.55% and 1.43% on a week-on-week basis.

South American route The freight rate increased overall. As for South American West Coast route and Central South American Coast route, since the mid-December, the market continued to push up the freight rate. Some ship owners began to levy a low sulfur surcharge LSS this week. The freight rate fluctuated and strengthened, but the gains were significantly weaker than last week. The freight indices increased 0.27% and 4.10% on a week-on-week basis. In the early stage of the South American East Coast route, due to the low shipping volume, the freight rate continued to fall. This week the market tried to boost the freight rate to ensure certain operating income. The freight index increased 6.90% on a week-on-week basis.

Persian-Gulf route The market shipping volume continued to improve, and the effectiveness of the ship owners’ capacity reduction measures appeared. The freight rate continued to rise in the past month and continued to rise. The freight index increased 6.73% on a week-on-week basis.

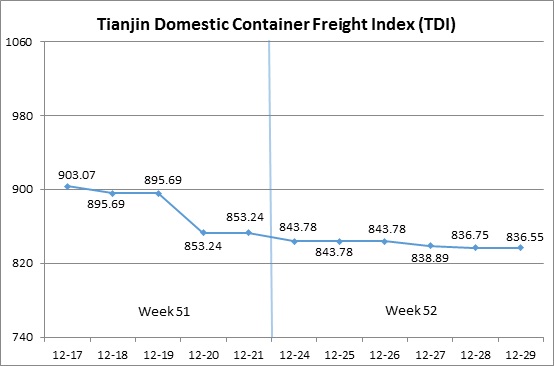

III. Tianjin Domestic Container Freight Index (TDI)

In Week 52, 2018 (Dec.24 to Dec.29), the Tianjin Domestic Container Freight Index (TDI) was released six times because of the New Year Holidays. The trend of TDI is as follows:

The TDI in Week 52 dropped slowly.

On Dec.24(Mon.), as to the Outward Index, the freight rate of Tianjin-Guangzhou route went downward, while the Inward Index sustained the level of last weekend, which drove the TDI decrease by 1.11% compared to last day, and kept stable in following two release days. From Dec.27 to Dec.28 (Thu.-Fri.), the Outward Index and Inward Index both fell, and the TDI dropped 0.83% within two consecutive release days. On Dec.29 (Sat.), the Outward Index recovered again, and the freight rate of Shanghai-Tianjin route under Inward Index decreased modestly, TDI finally closed at 836.55 points, 16.69 points (1.96%) lower than that on Dec.21 (the last release day of Week 51).

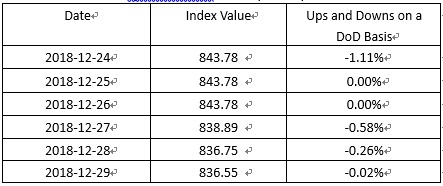

The TDI index value and several ups and downs on a day-on-day basis are as follows:

Tianjin Domestic Container Outward Freight Index (TDOI) dropped apparently, and eventually ended at 863.05 points on Dec.29, 24.41 points (2.75%) lower than that on Dec.21 (the last release day of Week 51). Shipping capacity still exceeded demand because of no significant improvement in market shipments, and the freight rates of Tianjin-Quanzhou route, Tianjin-Guangzhou route had a drop in this week, thus the indices respectively decreased by 2.66% and 3.14% compared with last week. In addition, the freight rate of Tianjin-Shanghai route kept stable, and the index kept no change compared with last week.

Tianjin Domestic Container Inward Freight Index (TDII) continued to decrease, and finally closed at 810.04 points on Dec.29, 8.97 points (1.10%) lower than that on Dec.21 (the last release day of Week 51). The freight rate sustained decline due to the low demand in cargo shipping market. The freight rate of this week dropped sharply. The freight rate of Quanzhou-Tianjin route fell apparently and the freight index decreased by 5.67% compared to last week. The freight rate of Shanghai-Tianjin route fell slightly and freight index decreased by 0.42% compared to last week. As to Guangzhou-Tianjin route, the freight rate kept steady and index kept no change compared with last week.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional