316 HK: Posts Solid Operating 1H12 Results In A Difficult Market; Reiterate Outp

CLARKSON key takeaways in 30 seconds: 1) 1H12 operating results were positive and ahead of our expectations (see below); 2) Both Transpacific and intra-Asia liftings progressively accelerated in 1H with higher 2Q volume growth (+8% 2Q12 vs. +3% 1Q12 in Transpacific; and +8% 2Q12 vs. 5% 1Q12 in intra-Asia), while Asia-Europe liftings decelerated during the period (-0.4% 2Q vs. +3% 1Q). We would expect this pattern for most of our other four liner companies in our coverage universe (Maersk, China Shipping Container Lines, Neptune Orient Lines, and Wan Hai Lines) as they report interim results in Aug; 3) Peak season volumes (tracking in-line with 2Q) and load factors (95%+) appear supportive of current freight rate levels for mainlane routes, Asia-Europe and Transpacific. Although there are more peak-season surcharges on the table for Transpacific ($500/FEU, effective August 1st), we expect OOIL’s 3Q12 operating results to be fairly strong; 4) However, our near-term optimism is tempered by scheduled newbuild capacity coming on line. Over the next 12-18 months about 2.4 million TEUs (or ~15% of total fleet) are projected to hit trade lanes (mostly mainlane routes), which raises freight rate risk; 5) OOIL pays out $0.05/share dividend (25% payout ratio). We project another $0.05-0.10/share potential payout based on 2H12 results. Although the 1% current yield is modest, OOIL is one of the few shipping companies able to return of cash to shareholders in a challenging environment.

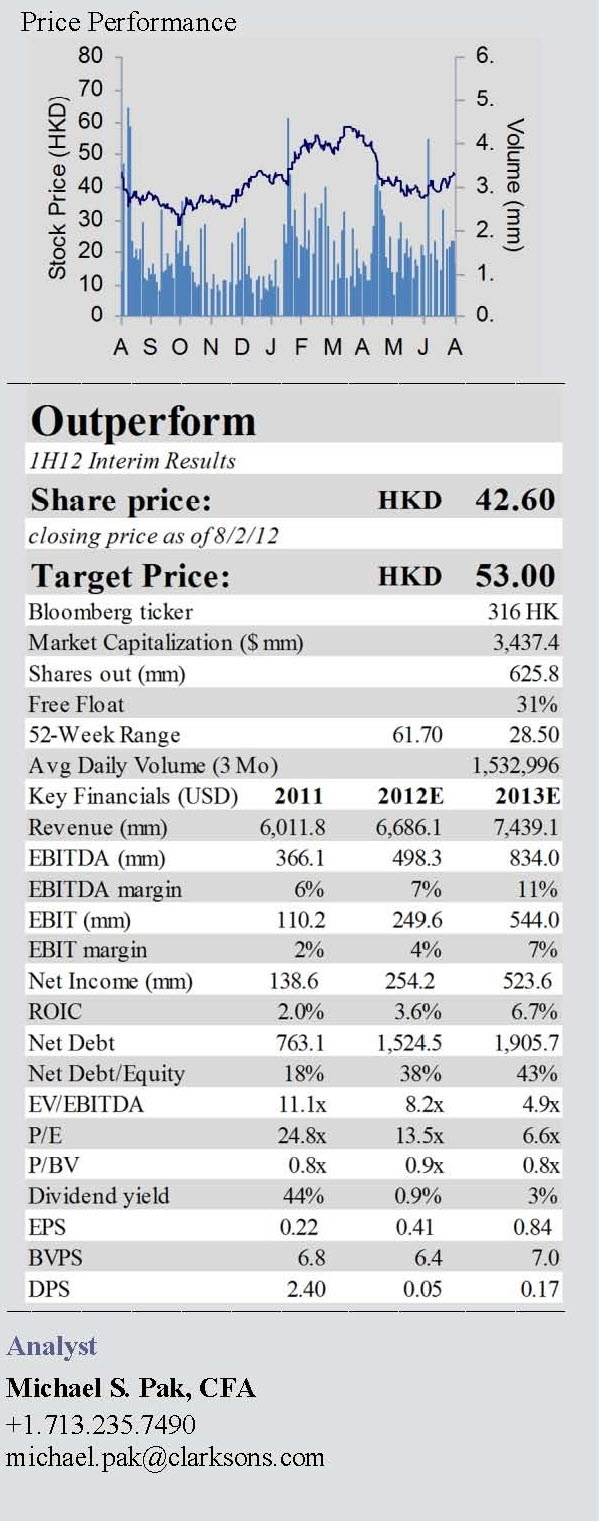

CLARKSON Reiterate Outperform rating, raising target price to HKD 53: OOIL remains one of our favorite ways to play the container shipping sector. The company’s 1H results underscores our view that OOIL should continue to generate above-peer group profit margins, yet is valued at 15% discount on price-to-book and 35% discount on forward EV/EBITDA. Our 12-month target price is raised to HKD 53 (was HKD 51), based on our three-prong valuation.

CLARKSON Model changes: Our EPS estimates are as follows: 2H12E: $0.29/share (unchanged); 2012E: $0.41/share (was $0.38/share); and 2013E $0.84 (unchanged). Our 2012 estimate revision reflects the $0.03 earnings beat in 1H12 and slightly lower freight rate projections, offset by higher margin assumptions. Our 2013 and 2014 forecasts reflect lower freight rate and Asia-Europe volume projections, offset by higher margin assumptions.

CLARKSON 1H12 operating EPS of $0.12 vs. our $0.09 estimate: OOIL’s adjusted EPS (ex-Hui Xian Holdings dividends and upward real estate revaluation) were $0.12, which came in above our expectations. The company’s reported 1H12 EPS were $0.19. Results were above our forecasts driven by modestly higher operating profit (+$0.02/share) and positive below-the-line variances (taxes, minority interest, affiliate earnings and share count).

From: CLARKSON Capital Markets

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional