Thinking Of Going “Retro”? …Check Out The Repair Yards!

Providing newbuilding market data has always been a strong focus for Clarksons Research but in recent years there has been a growing need to better understand activity in the ship repair and refurbishment sector. In this week’s Analysis we discuss the reasons behind this interest and present some highlights from a new intelligence flow of ship repair activity now available on our World Fleet Register.

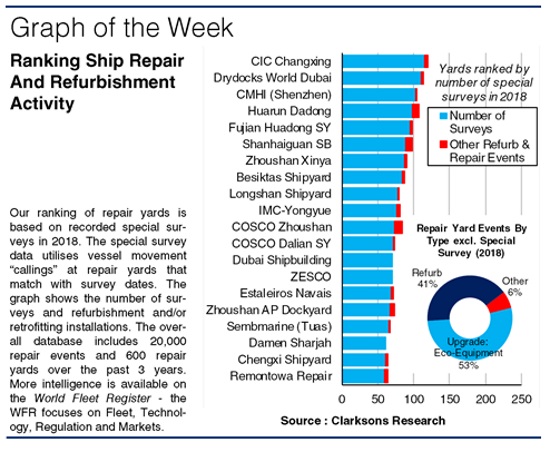

In this week’s Graph of the Week we highlight CIC Changxing as the busiest repair yard in the world (by number of special surveys in 2018) and detail trends towards upgrading and retrofitting of ships. But for a market that historically involved low CAPEX spend and thin margins, is ship repair worthy of more analysis today?

Larger Fleet, Fewer Newbuilds?

Some of the interest in repair and refurbishments stems from the much larger fleet today (65% more tonnage on the water compared to ten years ago, 25% more by number). Not only is this a bigger potential market for repair yards, but also for suppliers looking to balance the lower newbuilding volumes with an expansion of service and after sales business lines.

Going “Retro”?

Although some shipping segments (e.g. cruise, ferry, offshore) have a history of significant CAPEX spend at points in a vessel life cycle, for many segments passing special survey and related steel renewal or paint coatings was often the extent of investment. With environmental regulation driving new “eco” technology solutions, retrofitting of Ballast Water Treatment Systems (BWTS) and now Scrubbers has ramped up. Alongside the focus on fuel economics, relatively modern vessels are increasingly considered “old” designs (shipbuilding output peaked in 2010-11, prior to the “eco” ship) impacting asset value and earning potential. We suspect these investments are the start of a trend (it already seems that LNG as a fuel is gaining further traction).

Counting The Scrubbers…

The intelligence flow also helps us track repair yards involved with retro-fitting SOx scrubbers, providing insights into overall yard capacity and the time taken to complete an installation. Our overall “Scrubber Count” now stands at over 3,000 vessels and we estimate that “off hire” time involved in the retrofits will reduce available fleet supply in 2019 by 1.0% (containerships), 1.4% (crude tankers) and 0.5% (bulkcarriers). The data also details the small number of LNG fuel conversions to date (including the first containership conversion to be carried out at the Huarun Dadong yard).

Cruising For A Refurb…

The repair data also reveals some significant refurbishment markets. In the past ten years, we have recorded over 650 cruise refurbishments, with Grand Bahama topping the charts (35 cruise special surveys and refurbishments in 2018). Increasingly cruise lines carry out major investment programs, in part to standardise their various brands. Conversion activity is also detailed in the data, with increased FPSO activity now expected. So perhaps in a maritime world faced with environmental regulation and a relatively modern fleet, it’s worth keeping a closer eye on ship repair. Have a nice day!

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional