Dry bulk market slowly but surely reaching “critical” status

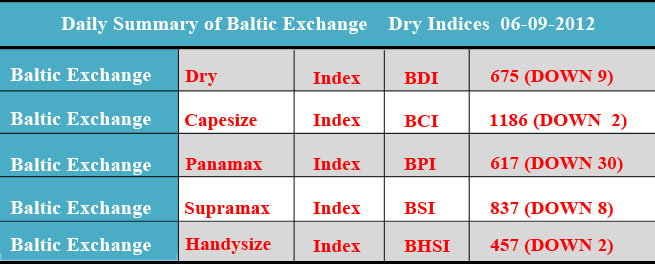

The radical consequences of the shifts in dry bulk demand and prices, especially for the most sought after commodity, concerning the industry, i.e. iron ore, has kept on this week as well. Yesterday, the industry’s benchmark, the Baltic Dry Index (BDI) continued its decline, losing an addition 9 points and ending the session down to 675 points. The biggest losses were evident in the Panamax segment which lost 30 points, reaching just 617 points (Baltic Panamax Index). By comparison, the smaller ship type of Supramax was down by 8 points in the respective Baltic Supramax Index, which stood at 837 points.

In its latest weekly report on the market, shipbroker Fearnley’s commented on the Capesize market that “a touch of A touch of optimism in the start of the week with good activity out of west Australia around the USD 7.20 level. However, ffa values were turning more negative as we approached mid-week and so did the activity. This obviously also affected short period marked, with bids just below USD 8, 000, with last done being 4-8 months USD 8,250” the shipbroker said.

On the Panamax front it added that “after last week’s continued bearish sentiment we were hoping for some glimmers of positiveness this week. This is not the case and the market in both hemispheres is continuing to drop like a rock. We see owners underbidding and waiting up to 6 days in order to even secure employment for their vessels. Some owners drop anchor waiting for cargos to come. For September loading there are very few cargos in the Atlantic and only a few forward cargos of grains are being quoted in the market. With the draught causing cargos to be cancelled, the horizon does not look very bright. TA´s now being fixed in region USD 2/3k while the fhauls are getting around USD 14k + BB. In the Pacific rounds are being fixed at around USD 4k while backhauls are giving negative return. The period market is almost none existing unless owners are able to offer very flexible periods and options” Fearnley’s noted.

In a separate report, Intermodal’s George Bassakos commented on the recent news that Vale reached an agreement to sell 10 large iron ore carriers (converted from tankers) for a total of $600 million to Polaris Shipping, of S. Korea. The world's second largest mining company, will take the vessels back on long-term charters. “With this sharp and unexpected move, Vale is freeing up capital while in the same time will continue to control flows of iron ore shipments. Vale's move comes at a time of extremely depressed market conditions, especially for the bigger ships, and seems to serve as a shield in current rough seas for Owners. China's denial to accept such mammoths in her ports being another reason for Vale to offload them” Intermodal said.

It added that “in other related news, iron ore prices returned their worst month since October 2011 in August, falling 24%, bringing the decline for the year to date to 36%, falling largely on the back of weakening demand for the steel-making ingredient from China, analysts say. Part of the problem at the moment is the high volume of stocks sitting in Chinese ports - a clear indication that steel demand growth has slowed considerably as mills turn cautious and refuse to hold inventory. As of 17 August, iron ore inventories in Chinese ports were 96.8 million tonnes (mt) (equivalent to one month's domestic use), only 4% lower than the record high of 100.9 mt reported in early February 2012. China’s manufacturing contracted at the fastest pace since March 2009, a private survey showed, indicating the slowdown in the world’s second-largest economy is deepening, Bloomberg reports. The purchasing managers’ index released today by HSBC Holdings Plc and Markit Economics had a final reading of 47.6 for August after a preliminary 47.8 provided Aug. 23. The gauge was at 49.3 in July. The dividing line between expansion and contraction is 50. Furthermore, manufacturing in the U.S. contracted for a third month in August, the longest slide since the recession ended and a sign the expansion is at risk of losing a source of strength. The Institute for Supply Management’s factory index fell to 49.6 last month, the lowest since July 2009, from 49.8 in July, the Tempe, Arizona-based group said.

If you add to all the above, the European debt crisis, which seems to be escalating lately, with no proven solution on the horizon....you get what? The 'perfect Shipping storm' on theatres around the world” the report concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional