Port investors playing safe

Amidst tough business environment, investors in equity markets continue to prefer the companies with a healthy balance sheet and focus on emerging markets, according to Drewry Maritime Equity Research (DMER). Further, businesses facing regulatory headwinds and business uncertainties have not been favoured despite being available at attractive valuations.

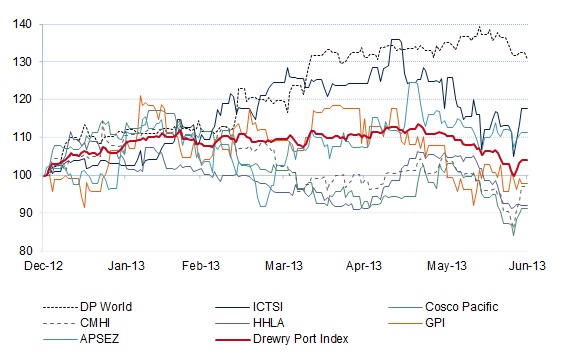

In the first half of 2013, the share price performance of port operators under DMER’s coverage was a mixed bag but provided clear indications to where investors are betting their money on. DMER have identified the current investing theme as one where there is combination of focus on emerging markets coupled with well managed balance sheets (DP World, ICTSI). These factors were the clear drivers of stock performance in 1H13. What investors continued to shun was heightened regulatory risk and business uncertainties (Santos Brasil, HHLA AG).

Note: Share prices and Port index indexed to beginning of the year

Source: Bloomberg, Drewry Maritime Equity Research

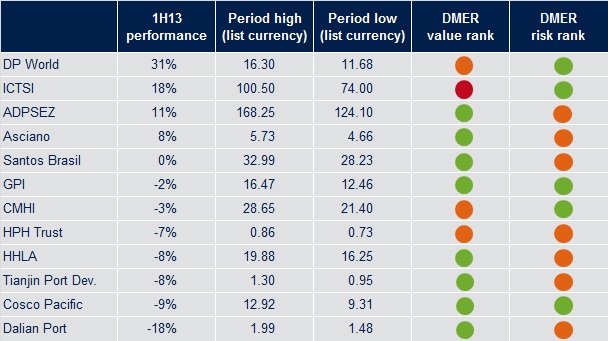

The top performers, namely DP World (+31%) and ICTSI (+18%), are companies with global presence and focus on emerging economies. The two companies in some way have differed in terms of their actions this year, but with a common goal of increasing presence in emerging economies. ICTSI has continued two acquire/develop new assets while DP World has been lately monetising its non-core assets, so that it can focus on its key regions/ assets and expand in emerging markets.

DP World’s stock price this year was backed by strong operating results, and an attractive valuation. The company has managed its balance-sheet well and timely monetised port assets such as in Hong Kong considering the moderating port volumes at the port.

ICTSI stock had a secular bullish performance till middle of May this year fuelled by its expansion plans. The company announced concession win at Honduras and disclosed plans to build a 2 million teu container facility at Tagum, Gulf of Davao in the beginning of the year. The company continues to manage its balance sheet well through a mix of equity and bond issuance. In May 2013, it raised $200 million through an equity issuance following the $400 million notes issue in January 2013.

Adani Ports & SEZ (APSEZ) also climbed 11% in 1H13 as the company’s efforts to deleverage were rewarded. It divested the entire stake in the Abbot Point which resulted in net gearing to reduce from 330% in FY12 to 163% at the end of FY13. This will further reduce in FY14e in DMER’s view as the company successfully raised INR 10 billion ($166.5 million) from the sale of 2.5% equity stake at INR 150 per share in June 2013. APSEZ also received the security clearance in May 2013 from the Indian government to bid for new projects after three years which was first denied in November 2010.

In China, economic concerns were at the forefront despite valuations being in a fair territory for most players. Concerns over the tight liquidity conditions and sluggishness in the manufacturing activity resulted in the weak financial markets and underperformance of Chinese listed ports. Hang Seng index was down 8% from the levels seen at the beginning of the year. In the same vein, COSCO Pacific, CMHI, HPH Trust and Tianjin Port Development were down 9%, 3%, 7% and 8% in 1H13 respectively.

Investors are avoiding companies facing regulatory risk and uncertain business environment. Santos Brasil was unable to attract investor’s interest despite attractive valuations due to uncertainty regarding the extension of its concession at Tecon Santos, and increasing competition as Embraport and BTP are set to start operations in 2H13. The company’s stock has not moved materially since the start of this year as it is currently trading at similar levels.

Similarly, HHLA’s stock performance has been muted because of the lack of clarity regarding the dredging of River Elbe. Global Port Investments’ GDR also remained range-bound owing to the uncertainty in its business. Not to mention that problems in Eurozone coupled with uncertainty regarding performance of oil handling segment is a drag on the stock. We highlight that Eurozone is key export market for Russia; demand weakness will impact Russia’s earnings and hence will lead to weakening imports into the country.

Source: Bloomberg, Drewry Maritime Equity Research

Our View

At DMER, we expect this investment thesis to stay valid over the course of the remainder of the year as the companies with more visible revenues, lower regulatory risks, and a stronger financial position are likely to trade at a valuation premium over the next 12 months.

Drewry Maritime Equity Research brings to you an investment service that further leverages Drewry’s expertise within the maritime sector, extending our portfolio to deliver equity research reports on listed companies.

Authorised by the UK Financial Conduct Authority (FCA) to provide investment advice, Drewry are in a position to provide a product that offers independent and therefore unbiased analysis on investments within the quoted maritime space.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional