Nickel Ore Trade: Chinese Imports Driving Growth

Seaborne nickel ore trade has grown significantly in the last decade from 4.4mt in 2003 to 72.8mt in 2012, and now makes up 6% of minor bulk trade. Nickel ore trade growth has contributed to over a quarter of minor bulk trade growth since 2006, and has mostly been driven by a surge in stainless steel production in China due to a rapid increase in demand. In 2012, Chinese nickel ore imports made up 89% of global nickel ore trade.

Graph of the Week

Importing Nickel Ore

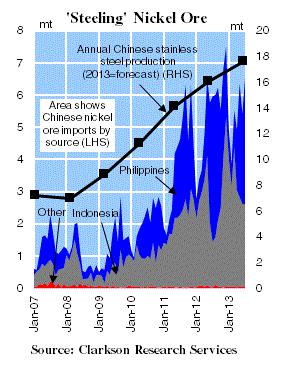

The Graph of the Month shows monthly Chinese nickel ore imports by source and annual Chinese stainless steel production. Between 2007 and 2012, Chinese stainless steel production increased by 8.9mt to 16.1mt. The production of stainless steel traditionally requires refined nickel however in 2005 China started to  produce nickel pig iron (NPI) from nickel ore, which has been used as a cheaper alternative to stainless steel scrap and nickel metal in the production of stainless steel. The high availability of nickel ore in South-East Asia has facilitated this growth of Chinese nickel ore imports.

produce nickel pig iron (NPI) from nickel ore, which has been used as a cheaper alternative to stainless steel scrap and nickel metal in the production of stainless steel. The high availability of nickel ore in South-East Asia has facilitated this growth of Chinese nickel ore imports.

Sourcing Nickel Ore

The Philippines and Indonesia are the major exporters of nickel ore to China and the relative share of each exporter has varied since 2007. A temporary ban on Indonesian mineral exports for most of 2012 led to a fall in Indonesian exports and market share last year, with shipments in July 2012 totalling just 1.4mt. However, during this period the Philippines was rapidly able to make up for this decrease, enabling Chinese imports to grow 35% in the full year. This strong increase in imports facilitated both an increase in Chinese NPI production during the year, and a significant build up of nickel ore stocks.

Stocking Up

So far in 2013, Chinese nickel ore demand has remained strong, supported by an 18% y-o-y increase in Chinese stainless steel production in Q1 2013 to 4.4mt. In full year 2013, Chinese nickel ore imports are projected to reach 78.1mt, up 7% y-o-y. China has increased imports from both Indonesia and the Philippines in the year to date. However, given that the Indonesian government currently intends to ban exports of unprocessed minerals again in 2014, it is expected that China will source a growing proportion of nickel ore from the Philippines if this regulation is introduced. Therefore, the ban is not expected to significantly reduce Chinas nickel ore imports as the Philippines is likely to be able to meet the demand, although Chinas high nickel ore stocks may present a downside risk.

Reported environmental issues with nickel pig iron production has led to the closure of some plants and the potential Indonesian ban suggests there may be some risks to nickel ore trade growth on the horizon. However, nickel ore imports still look set to provide trade growth in the short-term. Given the significant contribution of nickel ore to minor bulk trade growth, it remains an important commodity to watch.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional