Key tanker stock drivers: China’s crude oil import volume

China’s crude oil import: The most important factor

An indicator that has a first-degree (direct) influence on tanker rates is China’s crude oil import volume. When import volume rises, more tankers will be in use, which pushes up shipping rates. Conversely, lower import volume means an increased number of idled ships, which leads to increased competition. Increased competition will pressure shipping rates and negatively affect the revenues, earnings, cash flow, and share prices of tanker stocks.

Crude oil imports jumped in September

Crude oil imports jumped in September

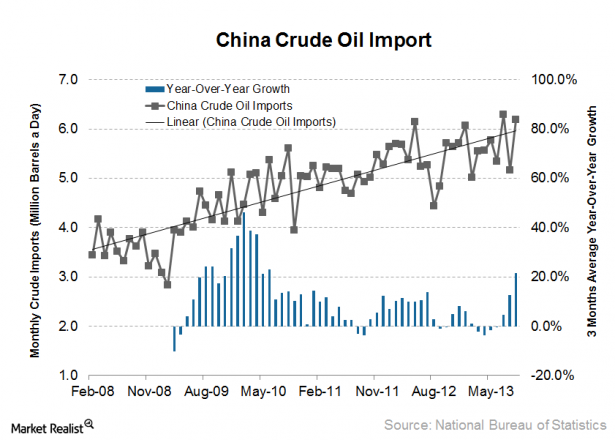

In September 2013, China had imported 6.19 million barrels of crude oil a day—a sharp increase from August’s amount of 5.17 million barrels a day, and taking back most of the decline from July’s 6.29 million barrels a day. The country’s imports are now above the long-term trend line from 2008. Year-over-year growth in imports jumped from 12.5% to 21.4%. Analysts and investors use trend lines to adjust for short-term noise as well as economic cycles. When imports are significantly below the trend line, as they were in 2009, you can expect oil imports to increase on the condition that the historical trend will continue. The disadvantage of using this tool is that if some fundamentals change, they alter future growth compared to the past.

Crude oil imports haven’t grown much since 2012

China’s crude oil import generally trends with the country’s economic activity. When China started to cool after high inflation prompted the government to raise interest rates, import growth started to fall in 2011.

But notice that crude oil imports picked up momentum in the first half of 2012, with imports holding above the long-term trend line due to stockpiling activity despite softening economic growth. As a result, the government’s action to support economic growth during the latter half of 2012, which followed through into 2013, didn’t translate into higher imports growth because most of the recent growth was pulled earlier in 2012.

How China’s crude oil import will affect tanker demand and rates

September data shows that China isn’t really slowing down. The above-normal import growth, however, was likely higher than normal due to a few days of national holiday in early October. So October imports may not be as strong as September. While crude oil imports are rising, which is positive, they’re rising rather slower than before.

Oil shipments to China will likely have to average more than 6.7 million barrels a day through the end of the year to offset projected declines in US crude oil imports estimated by the EIA (Energy Information Administration) for this year. As China’s economic growth surge upward is nowhere in sight, shipping rates will likely remain depressed in the short and possibly medium terms. This bodes negatively for Frontline Ltd. (FRO), Teekay Tankers Ltd. (TNK), Nordic American Tanker Ltd. (NAT), and Teekay Corp. (TK). To a lesser extent, the Guggenheim Shipping ETF (SEA) will be negatively affected as well. Looking into 2014, though, the picture may be a bit different

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional