LNG Trade – Dynamic Growth In The Energy Competition

Energy is shipping’s biggest single market, accounting for 43% of the cargo moved in 2013 – 4.3 billion tonnes. Oil is still the big dog, with 2.8 billion tonnes of cargo and the coal trade has now reached 1.2 billion tonnes. Which leaves gas as the junior partner in the energy triangle with 307 million tonnes of trade in 2013, of which 244 million tonnes was LNG and an estimated 63 million tonnes was LPG.

The Crown Prince Of Energy

LNG may still be the junior partner in tonnage, but it is widely seen as a future “seed corn” trade for the maritime business. This positive perception rests on two foundations. Firstly there are enormous reserves of “stranded” natural gas located so far from the world’s major consumer zones that sea transport is the only way to bring the product to market. Secondly natural gas is a clean fuel, in an era which is becoming increasingly preoccupied with reducing emissions of carbon and other pollutants into the atmosphere.

Fight For The Title

But it’s not all plain sailing and LNG is up against some tough competition – coal and oil – and in the three way fight for market share which lies ahead it has a few strategic disadvantages. Oil, the ultimate portable energy source, has the land and air transport fuel market nailed down. In this market the need to maintain LNG at a temperature of -162°C makes competition extremely difficult, and creates limitations to the wider use of LNG as a transport fuel.

The other major market is power generation and here LNG is on firmer ground. Once the storage and re-gasification facilities have been installed, LNG is the ideal clean fuel. The problem is that in this market coal is a long established and devastating competitor. Coal is generally much cheaper than gas and more widely available. In contrast gas supplies are more limited, requiring major investment, and are often located in “difficult” geopolitical areas.

Speedy Growth

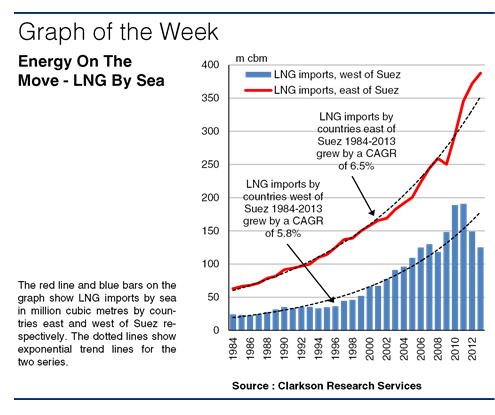

Despite these disadvantages, the LNG trade has turned in a spritely growth performance. Since 1984 imports by countries east of Suez have grown by a CAGR of 5.8%, and by 6.5% west of Suez (despite a slowdown in 2012-13). Compared with the growth of the oil trade when it developed more than a century ago, this is super-fast. 44 years since the first LNG shipment by sea to Asia, global trade in 2013 reached 532m cbm, or 244m tonnes, with a fleet of 31m dwt. For comparison, after 44 years seaborne oil trade only reached 55m tonnes and the tanker fleet was just 9.5m dwt (in 1928). This is a reminder that although LNG has not been an easy ride, things take time and LNG’s growth path is pretty dynamic (though not without its problems – in the 1980s one third of the fleet was laid up).

Trending But Tricky

If current growth trends continue, LNG trade could reach one billion tonnes in the 2030s. It is easy to believe that there will be demand in an energy hungry world for this clean fuel, despite its limitations. But in the meantime LNG is a niche player, trading luxury fuel to price sensitive markets. Which makes it tricky, even for the big boys. Have a nice day.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional