US interest rates to drive port refinancing over next 12 months

The prospect of higher US interest rates is set to drive increased port assets acquisition and refinancing over the next 12 months, according to Drewry Maritime Advisors, the port consultancy division of Drewry.

US Federal funds target rate is projected to increase from its all-time low of 0.25% with the tapering of the Federal Reserve’s bond purchases. The prospect of higher borrowing costs will drive more acquisition activity as investors seek to secure financing at low rates before costs start to rise. Similarly, port operating companies will look to refinance outstanding loans prior to any rates rise.

“We have already noticed this trend within our own portfolio of consulting projects,” said Tim Power, director of Drewry Maritime Advisors. “Over 70% of our current consultancy workload relates to due diligence of port asset acquisition and refinancing assignments. Three years ago this activity represented less than 30%, indicating the growth in the scale of such transactions. We expect this trend to accelerate over the next 12 months as investors seek to lock into low rates.”

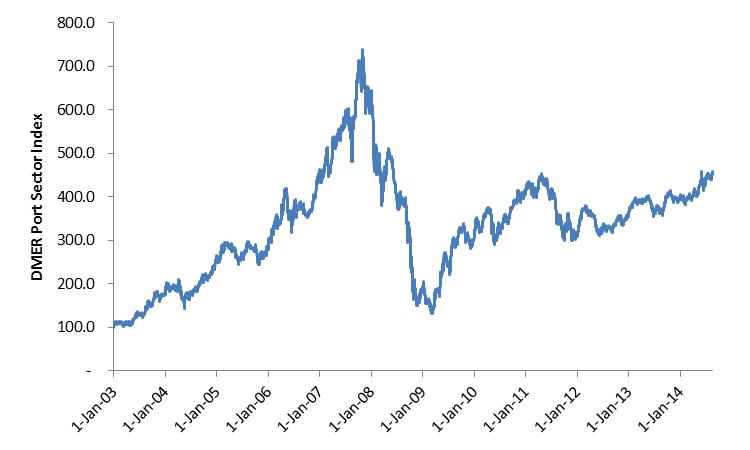

Drewry Maritime Advisor’s Port Sector Index, a measure of the market weighted value of listed companies within the ports sector, has risen 13.7% since the start of the year to a value of 458.9 in August (see chart below). The index is still 37.8% off its pre-financial crisis high of 738.3, but has been rising steadily since 2012.

Drewry Maritime Advisor’s Port Sector Index (2003-2014)

Source: Drewry Maritime Advisors (www.drewry.co.uk/consultancy)

Port operators are pre-empting any upcoming rise in interest rates by engaging lenders to refinance or seek out new capital while rates remain low. Meanwhile, potential investors are taking advantage of the opportunity to evaluate port assets which may not otherwise have been available.

“Refinancing assignments have remained stable but are expected to increase once interest rates rise. The projected increase could dampen port valuations in the future as financing costs increase,” warned Power.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional