West African Iron Ore: Up And Coming In China

In the first nine months of 2014, China’s appetite for iron ore imports has continued to impress, with seaborne imports during the period totalling 685mt, reflecting a y-o-y increase of 18%. While most of the growth has been driven by Australia, it is worth noting that countries in West Africa have also played a role, with imports from the region totalling 25.1mt in the year to date, up 44% y-o-y.

Surging Volumes

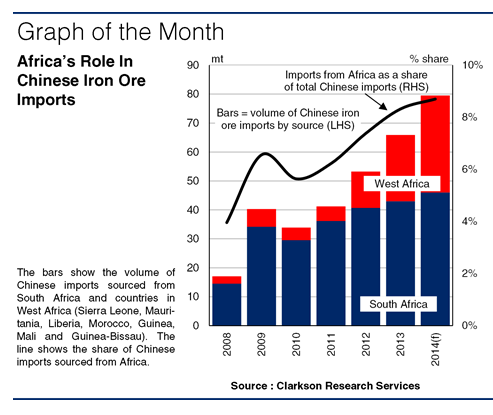

When comparing Chinese imports from Africa (specifically West and South Africa) to those from traditional suppliers such as Australia and Brazil, the volumes are relatively small. However, growth

has been substantial, with imports from the region rising more than four-fold over the last six years. In 2008, Chinese iron ore imports from Africa totalled 17.2mt, of which South Africa accounted for 14.5mt. Since 2008, the share of China’s ore imports sourced from West and South Africa has risen from 3.9% to 8.6% in the year to date, and imports are projected to total 79.5mt in full year 2014, largely due to a ramp up of West African ore output.

Growth in iron ore imports from West Africa has been especially robust since 2011, with volumes increasing from 5.1mt in the year to 22.9mt in 2013. Strong growth has continued and it is expected that imports from West Africa will total 34.5mt in full year 2014. Sierra Leone is the largest West African supplier and is now China’s fifth largest source of ore.

Chinese Investment

In recent years, China has tried to limit its reliance on iron ore imports from major sources to reduce the impact of supply disruptions. This investment into West African ore reserves has partly driven the expansion of production in countries such as Sierra Leone, Mauritania and Liberia.

In addition to investing in particular mines, China has also been investing in surrounding project infrastructure. This has helped to shorten project development. For instance, the time taken for the first cargo of ore to be shipped from Sierra Leone’s Tonkolili project after receiving a mining lease and environmental licences was just 14 months due to China’s investment into railway infrastructure.

A Bright Future?

In late 2011, phase 1 of the Tonkolili project was completed. Output has reached 20mtpa and it has been indicated that when phase 3 is completed in 2017, output may reach 80mtpa. Investment into the project by Shandong Steel Group has meant that the company has been able to import discounted ore. Elsewhere, the Chinese-owned Bong Range Mine, Liberia, is expected to raise output from 1mtpa in 2013 to 10mtpa in 2018. In addition, if the development of the part Chinese-owned Simandou iron ore deposit in Guinea is completed in 2019, output will eventually reach 93mtpa, with China likely to be the primary export destination.

It is clear that the development of African iron ore exports to China has been significant. In the future, this will depend on investment in infrastructure, as well as obvious political and pricing issues. Nevertheless, given Chinese investment in the region, West Africa in particular looks set to play a increasing role in Chinese ore imports.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional