Container M&A activity on the rise

Following a turbulent few years that included a close shave with bankruptcy, a revolving cast of CEO’s and an anti-trust investigation, US Jones Act carrier Horizon Lines has called it a day and is selling up.

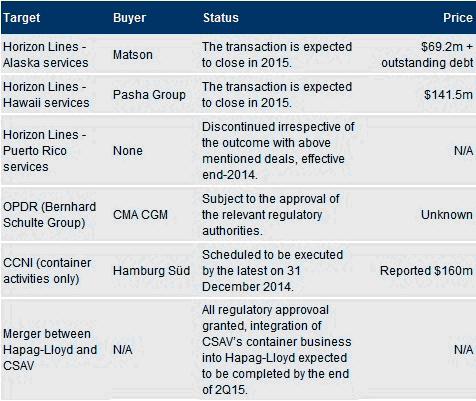

Subject to regulatory and shareholder approval, the company is selling its Hawaii operations for $141.5 million to the Pasha Group, which will augment its existing roll-on/roll-off operations between the US mainland and Hawaii. Also going is Horizon’s Puerto Rico services, which are being sold to Matson for $69.2m.

Table 1

Summary of Recent Container M&A Deals

Source: Drewry Maritime Research (www.drewry.co.uk)

Pasha will acquire four Jones Act containerships, while Matson will gain three diesel -powered containerships and a fourth steam-powered box ship for dry-dock relief, plus terminal operations in Anchorage, Kodiak and Dutch Harbor. Horizon’s Alaska service consists of two weekly sailings from Tacoma to Anchorage and Kodiak, and a weekly sailing to Dutch Harbor.

George Pasha, IV, President and CEO of the Pasha Group

“Since Pasha entered the Hawaii transportation circuit nearly 10 years ago, we have elevated the quality of customer service. With this acquisition, we will supplement that service and provide an improved, more competitive offering on the Hawaii trade lane.”

Matt Cox, President and Chief Executive Officer of Matson

“The acquisition of Horizon’s Alaska operations is a rare opportunity to substantially grow our Jones Act business. Horizon’s Alaska business represents a natural geographic extension of our platform as a leader serving our customers in the Pacific. We expect this transaction to deliver immediate shareholder value through earnings and cash flow accretion via significant cost and operating synergies.”

Figure 1

Horizon Lines’ Quarterly Operating Profit, 1Q08-3Q14 (US$ million)

Source: Drewry Maritime Research (www.drewry.co.uk)

A financial restructuring in 2011 enabled Horizon Lines to avert bankruptcy, but left it with a large debt burden most of which is due to repaid in 2016. The proceeds from the sale to Pasha will be used to reduce Horizon Line’s debt obligations prior to closing of the Matson transaction, at which time Matson will acquire all of the outstanding shares of Horizon Lines and repay the remaining debt outstanding at closing. The two transactions are valued at approximately $598 million on an enterprise value basis, putting the debt to be repaid by Matson at approximately $387m.

Separately, Horizon has decided to terminate its US-Puerto Rico operations by the end of this year, irrespective of whether or not the transactions with Pasha and Matson are completed.

The company said that it has suffered continued losses in the Puerto Rico trade and despite scaling back operations it couldn’t see any prospect of future profitability, especially as its two aging vessels built in the early 1970 that are currently plying the trade are increasingly uncompetitive.

“Unfortunately, a combination of factors, including uncertain prospects for the Puerto Rican economy, losses over recent years and more expected going forward, aging ships that we cannot afford to continue to maintain or replace, and upcoming large capacity additions by two other carriers has led to this difficult but prudent and necessary decision,” said Steve Rubin, President and Chief Executive Officer of Horizon Lines.

It is unclear at present whether Matson will continue with the Horizon Lines brand following the takeover, but while it is only a small player in the container shipping sector the company can trace its lineage to the genesis of the industry with links to Malcom McLean’s Sea-Land Service, Inc. With such rich container shipping heritage it seems likely that the name will continue in some form.

Across the Atlantic, French carrier CMA CGM announced that it is purchasing German company OPDR (Oldenburg-Portugiesische Dampfschiffs-Rhederei GmbH & Co. KG) from the Bernhard Schulte Group for an undisclosed sum.

OPDR employs 200 staff, owns seven vessels and a container fleet of about 10,000 units of all types. It operates routes between North Europe, the Iberian Peninsula, Portugal, the Canary Islands and Madeira as well as Northern and Western Africa. Annual volumes for this year expected to come in at 240,000 teu (up from 200,000 teu in 2013), a similar sum to MacAndrews (estimated 290,000 teu in 2014), a subsidiary of CMA CGM’s that runs services between North Europe, Iberia and Morocco.

Farid T. Salem, CMA CGM Group Executive Officer

“This new acquisition reinforces the Group’s presence on the growing intra-European Short Sea transportation market. This is a continuation of our strategy to broaden our regional network, a strategy which began with the acquisition of MacAndrews in 2002. As with MacAndrews, we plan on maintaining and developing the OPDR company, as well as creating new synergies with both MacAndrews and the CMA CGM Group.”

While these deals, and the more advanced transactions such as the merger between CSAV and Hapag-Lloyd and Hamburg Süd’s purchase of CCNI’s container activities, are not going to drastically reshape the container shipping market, they do suggest that carriers are more confident and looking to expand. Due to the high expense and complexity involved, M&A is not expected to occur between any of the big shipping lines, who instead are protecting themselves through more wide reaching vessel sharing agreements.

Our View

Container M&A is gaining momentum but will be limited to smaller, regional deals for the time being.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional