Africa looks to China for Port Infrastructure Investment Capital

For decades the West has called Africa “The final frontier of development / the Dark Continent” Thanks to Chinese investments, the lights in Africaare turning on. Africa is the only place left in the world where massive, un-tapped growth can be developed.

As the freight volume to Africa increases with the developing economies of Africa’s respective countries, the limits of their antiquated port structure are beginning to be tested.

News of American port congestion will be just a thing of the past as ports up and down the coast of Africa struggle to cope with newer post-panamax vessels unloading more and more containers, and finding ports unable to accommodate the new volume.

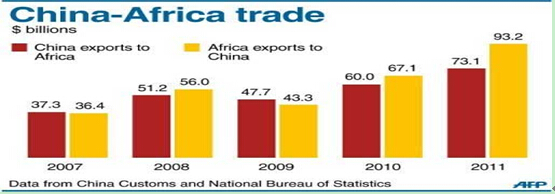

African ports are a critical part of China’s 39+ Billion $ investment. The new “Maritime Silk-Road” to Africa, according the official predictions published by the Chinese government, trade with Africa will soar to $90+ Billion by 2020, so it’s no surprise there is an interest on the Chinese side for improvement of the African Port Infrastructure.

Chinarecently announced a new deal backed by the Chinese government worth over $1.7 Billion. This will allow CMHI group (China Merchant Holdings International) to directly invest in Tanzania, and the terms of the deal even call for the construction of an entire new city in Tanzania, and a new $460 million maritime which is anticipated being finished and open for business by 2017.

Despite massive investments from the Chinese, African ports are still facing a grim situation. From 2012-2014 exports to Africa grew by 8.9 percent, this makes the sub-Saharan region of Africa amongst the fastest growing area’s in the world.

The IMF (International Monetary Fund) has predicted that over the next fiver years, Africa will out-pace all other continents in terms of economic growth & direct foreign investment – they have called for dramatic investments and drastic action to be taken in order to modernize African ports.

Ocean Freight companies are investing as much as possible into African ports, for fear of ports operating at max capacity, and unable accommodate new vessels and future growth. The growth and investment into African ports has been nothing short of amazing, said Jonathan Yock of Safmarine Inc. Due to Africa becoming more welcoming of outside investment, and realizing the need for outside investment in our infrastructure, we have been able to line up more sources than ever before to throw money at this infrastructure problem. Currently we are in the process of building a entire new logistics network along the West Coast of Africa.

Starting next year, not only will more ships than ever before be heading to Africa, but some of the largest vessels ever constructed will be appearing at African ports. CMA plans on sailing ships as large as 5500 TEU, and the Mediterranean shipping coming is planning of sailing 10 vessels next year to African waters, each with a capacity of up to 6,000 TEU. Growth in Africa shows no sign of slowing down as investment money pours in from foreign sources around the globe. We are going to see ships larger than 10,000 TEU sailing African waters by 2020 at the latest. We may even see these mega vessels by 2018 as Korean & Chinese shipyards continue to pump out larger and larger vessels every year at an unprecedented speed.

Africa is currently working on several drudging projects, and if they are all completed by the deadline of 2018, some of these ports are going to be able to accommodate the Triple E 18,000-TEU Mega Vessels from Maersk.

Improving port infrastructure has a ripple effect on the logistics network, & the local economy - once the freight volume reaches a certain level on a regular basis that is beyond the capacity of the Roads / Trucking Firms / Railroads; they are all forced to upgrade their networks in order to accommodate the growth in trade volume.

Questions / Comments? Contact: Mark@cmaritime.com.cn

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional