It’s A Cycle, Captain, But Not As We Know It

Imagine the intrepid crew of ‘Starship Enterprise’ staring out at a weird apparition approaching the ship. Spock makes his apocryphal observation “it’s life Jim, but not as we know it”. Then imagine the equally intrepid navigator of the ‘Bulkship Enterprise’ staring at the 2014 statistics as she sails into 2015, and observing “it’s a cycle, Captain, but not as we know it”. So what is it?

Alien Life Form

For the Captain, the problem of identification comes to bear because bulk shipping’s vital statistics in 2014 exhibit symptoms which don’t fit with the  industry’s perception of how a shipping cycle ought to behave. For one thing, cycles are supposed to last 7 years. Well it’s now 6 years and 5 months since the great downturn started in August 2008 and the market is still relatively flat.

industry’s perception of how a shipping cycle ought to behave. For one thing, cycles are supposed to last 7 years. Well it’s now 6 years and 5 months since the great downturn started in August 2008 and the market is still relatively flat.

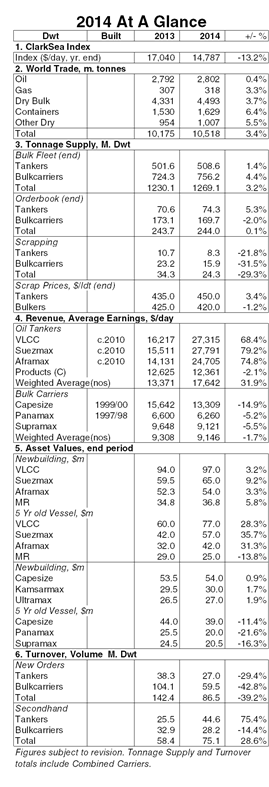

At the end of 2008 the ClarkSea Index stood at $13,654/day and it ended 2014 at $14,787/day. In the meantime, the annual average value of the index has wandered between $9,000/day and $16,000/day and currently seems to be going nowhere fast.

Fundamentally Floored

Another feature of this alien “cycle” is that it seems impervious to warning fire. Bulk trade (wet and dry) has grown by 21% since 2008, but bulk tonnage supply surged by 54% between end 2008 and end 2014. And it’s not just the big orderbook from the boom. Investors have been very active. Bulk orders of 142.4m dwt in 2013 and 86.5m dwt in 2014 are not so different to pre-crisis levels.

Meanwhile, secondhand prices, which it could be argued should be heading for distressed levels, have been surprisingly resilient. A 5-year-old VLCC costing $77m at end 2014, and a 5-year-old Capesize costing $39m, are both indicators of relatively firm prices. Yet despite high prices and the credit clampdown, the 75.1m dwt of secondhand bulk sales in 2014 was close to the highest on record.

Alien Market Mutation

Another puzzle for the navigators is the resurgence of tanker sentiment. Tanker demand has been hammered by the triple death ray of fracking, high oil prices (up until the astonishing downturn over the last few months) and the environmental agenda. So oil trade edged up only 0.4% in 2014, while the tanker fleet grew by 1.4%. Yet average weighted tanker earnings surged by 32% compared to the 2013 average levels, with crude carrier earnings booming and products earnings fairly flat. Meanwhile bulkers, much favoured for their umbilical link to Chinese and Asian demand, saw dry bulk cargo trade grow 3.7% and the fleet by 4.4%. Average weighted bulkcarrier earnings fell by 2% (and more in the larger sizes), which was not enough to deter investors from ordering 60m dwt of new capacity.

Beam Me Up, Scotty

Against this surreal background, it’s easy to see why some investors might be feeling a little disorientated. Tankers may be in vogue, but the fundamentals across the market remain tricky. Chinese growth appears to be slowing, Europe is struggling and the shipyards seem to be immune to everything the market throws at them. At the same time, the surplus tied up by vessels slow steaming appears to be undiminished.

It all adds up to something which doesn’t fit neatly into the usual cyclical pattern. No wonder some confused investors wish they could beam up to the deck of ‘Starship Enterprise’ and view this alien landscape from a safe distance. Have a nice day.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional