Will the equation: “bigger canal + bigger ships = more transhipment” work for Panama’s Pacific coast?

Plans for life after the expansion of the Panama Canal in 2016 are becoming firmer. Details of the intended new vessel toll system have been released and a tender for a new five million teu capacity transhipment terminal at the Pacific end of the canal has been announced. The planned 120 hectare Corozal container terminal will have a capacity of 5.2 million teu at full build out (see Figure 1). With a quay line in excess of 2 kilometres, alongside depth will be 16.3 metres. Most likely a 20 year concession will be offered, renewable for a further 20 years.

Figure 1

Corozal Terminal Layout

Source: Courtesy of the Panama Canal Authority (ACP)

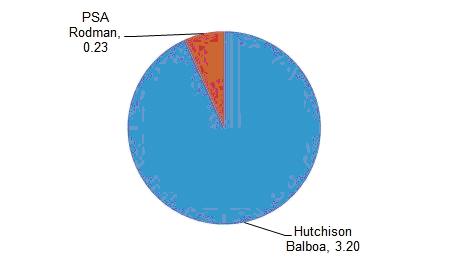

Panama’s Pacific coast transhipment activity is currently handled almost entirely by Hutchison’s Balboa terminal, whilst PSA’s Rodman terminal is at present a smaller, emerging facility (see Figure 2). Their combined current capacity is estimated to be nearly 5 million teu so the new Corozal terminal would double this figure.

Figure 2

Panama Pacific Coast Container Volumes, 2014 (million teu, estimated)

Source: Drewry Maritime Research (www.drewry.co.uk)

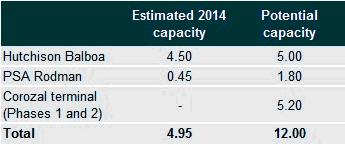

Moreover, as Table 1 shows, both Hutchison and PSA are reportedly expanding or have the potential to expand their capacity to a combined total of 6.8 million teu p.a. Hutchison announced in 2014 an investment of $110m to boost capacity to 5 million teu p.a. in time for the opening of the expanded canal in 2016. Meanwhile, also in 2014, PSA was given a 20 year concession for its terminal which reportedly enables it to be expanded from the current 450,000 teu p.a. capacity to 1.8 million teu, with $350 million investment, although no timescale has been announced.

Table 1

Actual and Potential Panama Pacific Coast Container Port Capacity (million teu p.a.)

Source: Drewry Maritime Research (www.drewry.co.uk), derived from companies and other sources

So, Panama’s Pacific coast has the potential for as much as 12 million teu p.a. of container port capacity. Will it all be needed?

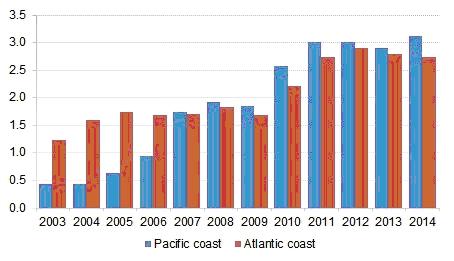

Panama is already established as the largest hub point in the Central America/Caribbean region, with an estimated 5.7 million teu of transhipment handled in the country’s ports in 2014. Overall volumes have grown by an average of 12% per annum since 2003, but Panama’s Pacific coast transhipment traffic has outstripped the Atlantic side, growing by nearly 20% per annum in the same period, reaching an estimated 3.1 million teu in 2014 (see Figure 3).

Figure 3

Development of Transhipment Activity, Panama, 2003-2014 (million teu)

Note: 2014 estimated

Source: Drewry Maritime Research (www.drewry.co.uk)

The Panama Canal Authority expects its Pacific coast container port volumes to reach 6 million teu after the expanded canal is opened in 2016, a massive 75% increase on estimated 2014 throughput levels (gateway and transhipment). The timescale for this anticipated increase in demand is not clear though.

Larger ships transiting the Panama Canal will seek to make more use of transhipment options, both for hub and spoke and relay/interlining. Growth in transhipment activity both in Panama and the wider Central America/Caribbean region seems certain therefore. Drewry expects there to be a double digit jump in Panama transhipment activity as a result of the opening of the expanded canal in 2016, and thereafter growth of around 5% p.a. On this basis, Panama Pacific coast throughput of 6 million teu would be reached by around 2024.

The expanded Hutchison and PSA terminals could in theory accommodate 6 million teu of traffic, but adding in Phase 1 of Corozal would give a more comfortable 8.2 million teu of capacity versus 6 million teu of demand. Whether the existing terminal operators will be able to bid for the Corozal concession is not yet clear though.

For the ports on the Pacific coast of Panama, the level of transhipment activity will be driven by the underlying levels of growth in Latin America in particular (along with any changes in liner shipping network patterns). For this sector of the market, other Pacific coast hub ports such as Manzanillo and Lazaro Cardenas (Mexico) and Callao (Peru) will also be vying for a share of the growing market.

There is also wild card in the pack as well – the potential Nicaragua Canal which, if built, would inevitably impact on both Panama Canal vessel transits and regional container transhipment activity. The project envisages the construction of two deep water ports, one at each end of the canal – Punta Aguila on the Atlantic side with an intended capacity of 2.6 million teu p.a. and Brito on the Pacific coast, with a capacity of 2 million teu p.a. – and these would surely have transhipment business in their sights.

The maximum size of container ship able to transit the Nicaragua Canal would likely be around 20,000 teu, significantly higher than the 13-14,000 teu New Panamax size. The project though remains speculative in the eyes of many observers (despite the recent news that construction work has already commenced), not least because of its $50 billion+ price tag.

Our View

Expansion of the Panama Canal will trigger growth in regional transhipment activity and Pacific coast ports should be beneficiaries. The timing and phasing of the new Corozal terminal project will need to be carefully judged though – and a close eye will have to be kept on Nicaragua.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional