Contracting: Bringing 2014 To Order

Whilst the firm pace of newbuilding activity seen in 2013 continued into early 2014, activity soon slowed and year-on-year around 40% fewer contracts were placed in full year 2014. Contracting interest weakened across the vessel sectors though there was heightened newbuilding activity in a number of interesting segments in 2014.

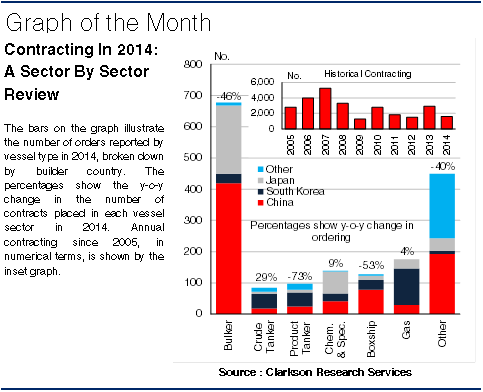

Counting Up The Contracts

Following stronger than anticipated newbuilding activity in 2013, total contracting levels declined 41% y-o-y in 2014 with a total of 1,749 ships reported  ordered. Despite a firm start to the year, with 44% of newbuilding orders placed in the first quarter of the year, the pace of ordering slowed significantly in the second half of 2014 with 521 ships ordered, down 60% on the first half of the year. Overall, ordering levels declined across the majority of vessel segments in 2014 with only a handful of sectors seeing firmer y-o-y contracting activity.

ordered. Despite a firm start to the year, with 44% of newbuilding orders placed in the first quarter of the year, the pace of ordering slowed significantly in the second half of 2014 with 521 ships ordered, down 60% on the first half of the year. Overall, ordering levels declined across the majority of vessel segments in 2014 with only a handful of sectors seeing firmer y-o-y contracting activity.

Losing The Bulk

Weaker ordering in the bulkcarrier sector contributed to around half of the y-o-y decline in total contracting with 677 bulkers reported ordered in 2014, this compares to very strong activity in 2013 when 1,253 bulkers were contracted. Despite this, bulkers still accounted for the largest share of orders in 2014 (34%). In the boxship sector, the rejection of the ‘P3’ alliance contributed to lower ordering in the 8,000+ TEU sector and 64% fewer VLCSs were reported ordered y-o-y in 2014 (57 ships). Interest for the smaller sizes supported overall containership contracting and 274 units were ordered in 2014, down 53% y-o-y. In the tanker sector, product tanker ordering fell 75% y-o-y in numerical terms following very strong newbuilding interest in 2013. Conversely, contracting in the crude and chemical tanker sectors rose 29% and 9% y-o-y respectively in 2014 with 84 crude tankers and 139 chemical tankers reported ordered. Demand for Suezmaxes buoyed crude contracting with 40 units ordered in 2014 compared to just 5 in 2013. The gas sector saw a record number of contracts placed in 2014 with 176 ships of a 16.6m cu.m. reported ordered. A record 74 LNG carriers and 5.6m cu.m. of LPG tonnage was ordered in 2014. VLGCs proved very popular and a record 54 units were ordered in 2014.

Steady Shares

The share of contracts won by each of the ‘top 3’ builder nations in 2014 were relatively consistent y-o-y and they took a reported 1,495 orders. Chinese yards lost a little ground in CGT terms, taking 39% of the 39.7m CGT ordered in 2014 down from a 42% share in 2013. However, this remains above South Korean yards’ 30% share of 2014 orders in terms of CGT. Meanwhile, Japanese yards won their largest share of contracts in CGT terms since 2006 (20%) in 2014 with a reported 389 orders of 7.8m CGT.

So, 2014 saw a considerable y-o-y decline in ordering activity, particularly in the bulkcarrier sector. The global orderbook is 7% smaller y-o-y at the start of 2015 at 5,245 ships. However, reviewing 2014 shows it wasn’t completely subdued with newbuidling orders up y-o-y in several ship sectors. No doubt contracting this year will have some highlights of its own.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional