Problems On The Waterfront – A Big Deal For Boxships?

In late 2014 and early 2015 port congestion has been hitting the headlines in the container shipping sector, with queues of boxships lined up outside ports on the US West Coast. The news stories focus heavily on the labour relations aspects, but for market players it’s important to examine why this pressure at the ports happens and how it can impact shipping fundamentals.

What’s In The Queue?

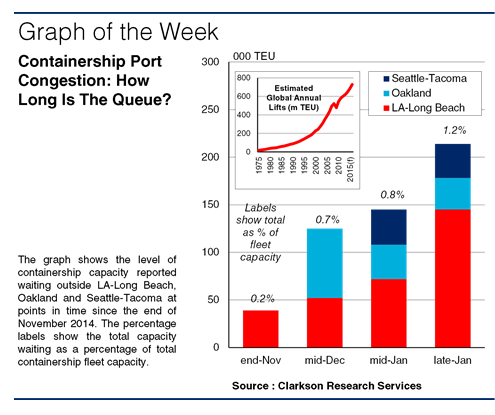

There were recently reported to be around 32 containerships of around 215,000 TEU queued up outside key ports on the US West Coast. Most of this capacity is  tied up at Los Angeles-Long Beach, but there are also ships waiting to enter port at Oakland and Seattle-Tacoma. The graph shows how this has progressed, growing from less than 40,000 TEU at the end of November.

tied up at Los Angeles-Long Beach, but there are also ships waiting to enter port at Oakland and Seattle-Tacoma. The graph shows how this has progressed, growing from less than 40,000 TEU at the end of November.

How has this come to bear? Well, the most prominent news focus has been on the labour disputes between the unions and the employers (terminal operators and carriers) at the US West Coast ports. But these issues have been allied to a range of other underlying factors.

An A To B Business

Container shipping is part of an ‘A to B’ logistics chain, moving goods in boxes from producer to consumer, and bottlenecks at any point in the chain can force congestion back along the system, often ending up at the ports (a key transition point). Labour disputes may have grabbed the headlines but other issues in the US have included a shortage of equipment for the onward movement of boxes from the ports, and congested yard space, with larger ships making bigger cargo exchanges at ports (much less manageable to port operators than more regular calls from smaller ships).

Port capacity has often come under pressure in container shipping. One only has to look at the historical growth in global port lifts (inset graph) to see how ports have had to battle to keep up with demand. Global container port handling has grown from an estimated 17m TEU lifts in 1975 to 649m TEU lifts in 2014, at a CAGR of 9.8%. This has placed port capacity under pressure to expand but that takes time and investment.

A Big Box Issue?

Does the congestion matter? Yes; 215,000 TEU is equivalent to about 1.2% of the fleet. It’s almost as much as the currently ‘idle’ boxship capacity (around 1.3% of the fleet) which has attracted so much attention. It can mean the difference between a fairly even balance between supply and demand growth or a tightening of market fundamentals. In the mid-2000s, US West Coast port workers went on strike, locking up 2-3% of fleet capacity for a substantial period, boosting vessel earnings as capacity tightened.

So, there you have it. Box shipping needs operational port capacity but when problems occur it can actually help tighten the market. Such congestion as currently seen in the US might offer some support to beleaguered owners. Having said that, extra capacity is needed in the long-run to keep the system running and drive demand for ships, so be careful what you wish for. Either way the challenge isn’t over yet. Have a nice day.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional