China’s Imports – Never More Important To Shipping?

Over the last 15 years China has led maritime forecasters a right old dance. In 2002, rumours that Chinese iron ore imports were about to take off were hard to believe. In those days China’s total imports were below 400mtpa and the ore trade had been sluggish for a decade. But even the most bullish forecasters were way below target and in 2014 seaborne iron ore imports jumped 15% by 119mt to 914mt.

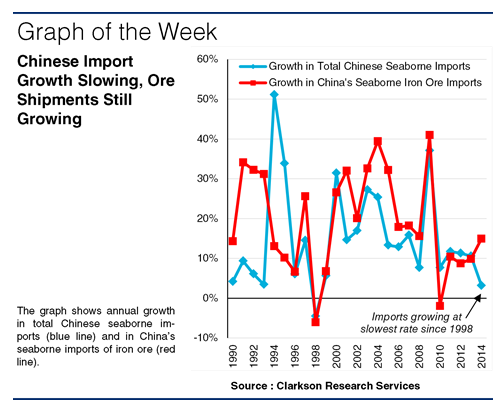

Ironing Out The Bumps

This was more than total Chinese seaborne imports which only grew by 65mt in 2014. Coal and metal imports both fell sharply, and the resulting 3% rise was the lowest since the Asia crisis in 1998. So dry bulk should say a very big thank you to Chinese iron ore importers for keeping some water under the hull.

Economic Discomfort

The problem now facing analysts is that the 2014 growth of iron ore imports does not appear to hang together with the rest of the steel economy. Construction slowed and shipbuilding output fell 14%. Overall steel demand decreased 3%, which makes the reported 1% growth in steel output look high. The real driver of import growth was a surge in low-cost ore production by major Australian miners, forcing out higher-cost mines in China and elsewhere. But estimates of the impact on domestic Chinese iron ore production vary, and official statistics suggest total output growth of 4%. Even after accounting for the falling grade of domestic ore, the figures don’t quite fit together.

Inscrutable Statistics

What’s going on? It’s a crucial question. Under-reporting of steel production could be a factor, and historical data has been revised up before. The 50% drop in iron ore prices last year may have led to stock building across the supply chain, or impacted domestic output to a greater extent than reported. Either way, it is clear that steel exports have surged, while strong Australian ore output depressed prices and kept Chinese imports firm.

Market Consequences

The worry for the dry bulk market is if Chinese demand falls enough to dampen imports. There are legitimate concerns that the construction and infrastructure programs which drove the steel industry over the last decade are facing serious problems. One issue is that the financial foundation of this growth is looking shaky. The debt to GDP ratio has risen sharply since 2010, much of it “back door debt” arranged by the provinces. As one leading economist put it at a conference in Long Beach California this week, “no country has ever escalated debt on this scale without something happening”. He thought the options are a crisis or a decade of slow growth.

Troublesome Times?

So there you have it. Thanks to Chinese steel, in the 2000s the bulker market enjoyed the biggest boom in history. Whatever the position over the debt mountain, readjusting the capital side of the economy will take time. A positive response is that we’ve been worrying about Chinese trade for the last 5 years – somehow the accident never happened, and there’s more low-cost mine expansion underway. Will our star performer continue to ride its luck? Time will tell. Have a nice day.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional