China crude stocks up for fourth straight month

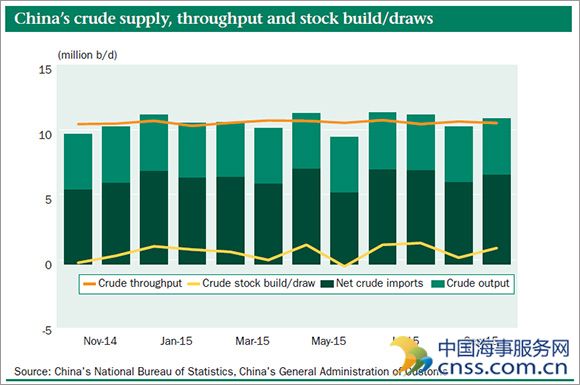

China registered a crude stock build for the fourth straight month in September at 784,000 b/d on an increase in net imports and a decline in refinery throughput, Platts calculations based on recently released official data showed.

The crude stock build compared to the 47,000 b/d rise in August.

China does not release official data on stocks. Platts calculates China's net crude stock draw or build by subtracting refinery throughput from the country's crude oil supply. The latter takes into account net crude oil imports and domestic crude production.

The build in September resulted in an average of 755,000 b/d of stock build, or total 92 million barrels, over this stockbuilding wave that started in June -- higher than the 572,700 b/d, or total 68.72 million barrels, in the previous four-month wave seen over November 2014 to February 2015.

Moreover, this wave is likely to extend to November.

Chinaoil, the importing arm of state-owned oil giant PetroChina, alone purchased 72 crude cargoes of 500,000 barrels each during the Platts Market on Close assessment process in August.

The delivery month for these will fall across October and November, which will likely push up imports in November.

On the other hand, Chinese independent teapot refineries, which have been given import quotas in recent months, are in a hurry to import crude, sources have said.

All this suggests that the country is speeding up stockbuilding.

China is planning to have a strategic petroleum reserve to cover 90 days of its net crude imports in 2015.

"To meet these targets, an estimated 600 million barrels of crude will be needed by the end of this year," said James Lu senior analyst from Platts China Oil Analytics.

A total of around 8 million cu m (50.3 million barrels) of SPR storage facilities are scheduled to be put into operation by the end of this year, while more independent companies are building oil storage, which will allow more crude inflows to oil tanks in China.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional