Greek shipping fleet keeps growing despite market challenges

Greek shipping continues to demonstrate its durability in the face of the challenges prevailing in the market in most sectors and dry bulk in particular, as well as the poor associated cashflows and the selective financing policy by banks.

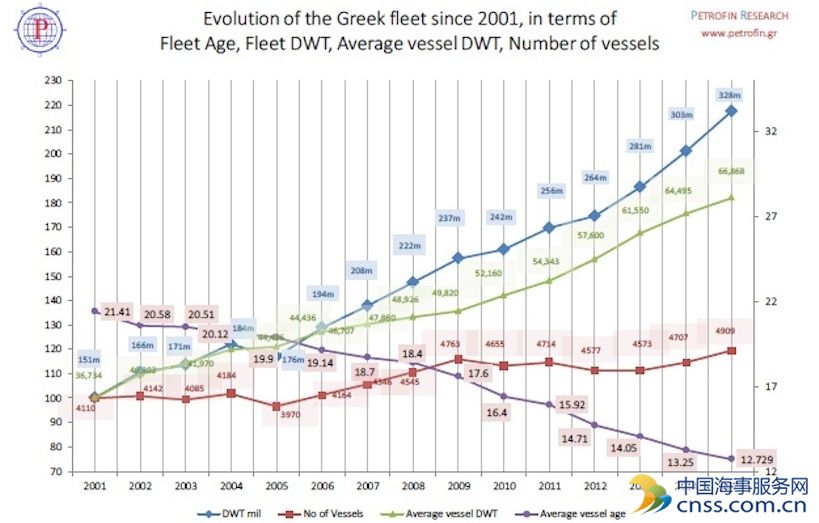

In the 12 months to September 2015 the fleet grew 4.3% in ship numbers to 4,909 vessels and 7.75% in dwt terms to 325.25m, according to Athens-based Petrofin Research’s latest review of the Greek-controlled fleet.

This expansion also reflects the on-going renewal of the world’s largest fleet as the average age of the fleet continues to come down and is now 12.73 years from 13.26 in 2014 and 14.05 in 2013 and 14.7 in 2012. When using a 20,000 dwt cut-off, the average age of the Greek fleet has fallen to 8.71 from 9.14 years in 2014 and 9.83 in 2013.

In his remarks about the expansion of the fleet, Ted Petropoulos, Petrofin’s md said: “Greek owners are committed to building up their eco fleets, as the vessels of the future and in the expectation that they will reap rewards in time, when conventional tonnage shall either be scrapped or shunned by charterers”

He also says public companies in particular, “need to grow, as part of their public profile strategy and in order to sell their story to the market and shareholders”. He adds other Greek owners are consummating jvs with private equity funds and are following previous newbuilding ordering decisions. “Admittedly, there have been many delivery extensions and some order conversions into tankers but, on the whole, Greek owners remain committed to following through with their orders and outliving the difficult markets,” says Petropoulos.

He goes on: “Overall, Greek owners have continued to commit huge sums, not only to preserve their fleets, but to grow them and modernise them. But, behind their brave faces there is worry as to the slowdown of global growth, in particular that of China, and how quickly shipping would return to vessel incomes that would provide a positive return to their committed capital.”

Petropoulos concludes: “In light of the continuing Greek political and economic crisis and the huge uncertainty surrounding the future of Greek shipping being operated out of Greece, due to the expected increase in taxation, the growth in vessels’ capacity and improvement in age comes as a surprise.

“Greek owners are renowned for their ability to pick the right time to invest and disinvest. Time will show if they got it right once again in these unprecedentedly challenging times.”

For the record, Petrofin Research reveals the bulker fleet of vessels over 20,000 dwt has gained an impressive 163 units, pulled its age down to 8.6 years average and lifted its tonnage by 19.5m dwt but has lost a handful of operating companies over the12 months.

The tanker fleet over 20,000 dwt remains static, showing a small increase in tonnage of 220,751dwt and a very small increase in unit numbers but a drop in the overall age reflecting the renewal effort.

The container ship fleet in the same 20,000 dwt size bracket is a bit younger year-on-year, despite the fact this is a sector that shows a slow rate of renewal. It has gained 2.9m dwt and is one of the very few sectors, which show an increase in the companies running this ship type, up by four.

The LPG sector of vessels over 20,000 dwt, remains static, but the VLGC LNG fleet has expanded significantly with the addition of 24 vessels to last year’s 50 strong fleet.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional