Frontline sisters report strong Q3 profits ahead of merger

John Fredriksen's flagship tanker company Frontline has booked a $17.4m profit, its strongest Q3 result since 2008, while imminent merger partner Frontline 2012 realised $61.9m.

The result pushes Frontline’s nine-month profits to $65.9m, shored up dramatically by a surge in congestion at ports as a result of high demand for oil. Spot rate averages between Q1 and Q3 were $48,500 for VLCCs and $31,700 for Suezmaxes, compared with $23,800 and $19,300 respectively in the same period in 2014.

During the quarter Ship Finance International (SFI), another Fredriksen related entity from which Frontline charters-in vessels, terminated long term charters for three suezmaxes, including 1995-built Front Glory, 1995-built Front Splendour, and 1998-built Mindanao, reducing SFI’s contribution to 12 VLCCs and two suezmaxes and generating $3.3m in compensation payments.

The company is also purchasing two 157,500 dwt suezmax tanker newbuilding contracts from struggling sister company Golden Ocean, at $55m per vessel.

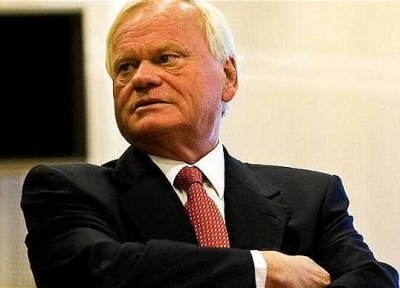

Frontline is now looking forward to an even stronger fourth quarter. “For our vessels employed in the spot market, we have covered 80% of our VLCC operating days in Q4 at TCE rates of approximately $68,500 and 88% of our suezmax operating days at TCE rates of approximately $42,500,” said ceo of Frontline Management Robert Hvide Macleod. “Rates for vessels on time charters are naturally at lower levels than those that can be achieved on a spot basis in this strong market."

Meanwhile Frontline 2012, soon to become a subsidiary of Frontline once the proposed merger is completed, booked its “strongest third quarter ever” with a net income of $61.9m, beating its first two quarters combined at $61.68m.

One-off gains of $14.6m and $11.9m were recorded during the quarter after Frontline 2012 cancelled three newbuilding contracts at STX Dalian, having already cancelled three in Q2. Three VLGC newbuildings delivered to Avance Gas in the third quarter generated $29.7m.

The company now has 14 LR2s, six VLCCs and six suezmax newbuildings on order, amounting to $1.38bn in commitments for the period 2015-2017.

“The product tanker market was strong throughout Q3,” said Macleod. “TCEs earned through a combination of spot and time charters in the third quarter by the company's LR2 tankers and MR tankers were $27,000 and $25,700, respectively. Demand for refined petroleum products remains robust. Africa and Australia imports are helping to drive the market and trading volumes are high worldwide on the back of strong refinery margins.”

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional