Frontline agrees $500m loan facility

Frontline’s subsidiaries have signed a $500m loan facility to repay fellow John Fredriksen firm Ship Finance International (SFI).

Secured against six VLCCs and six suezmax tankers with an average age of 4.6 years, the proceeds of the facility will be used to repay $113m of outstanding debt to SFI, as well as refinancing four existing bank facilities of approximately $378m in aggregate.

The refinancing is expected to reduce breakeven time-charter rates on the current operating fleet of 43 owned or leased vessels by approximately $1,400 per day.

Facilitated and partially funded by DNB Bank, the facility’s other backers comprise Nordea Bank Norge, ABN AMRO Bank, ING Bank, Skandinaviska Enskilda Banken AB (publ) (SEB), Danske Bank and Credit Suisse.

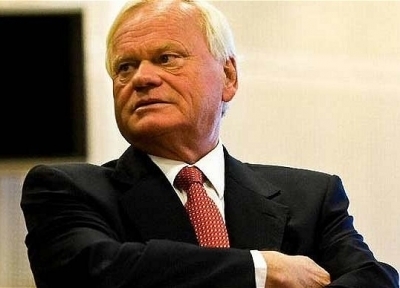

"The terms achieved in the refinancing and related amendments improve our cash flow and lower our cash breakeven rates further,” said Robert Hvide Macleod, ceo of Frontline Management. “The terms clearly demonstrate the strong support we have from our relationship banks."

The news follows the merger announcement of Frontline and sister company Frontline 2012.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional