Call The Doctor! Shipping’s Medical Drama Unfolds…

The recycling market has started 2016 with a bang, with a huge volume of tonnage heading to demolition facilities. Many of the key shipping markets continue to be in a state of very ill health, and owners seem to be rushing to the emergency room. But with such a youthful global fleet on the water, how might this next episode of shipping’s medical drama play out?

Off To The Infirmary

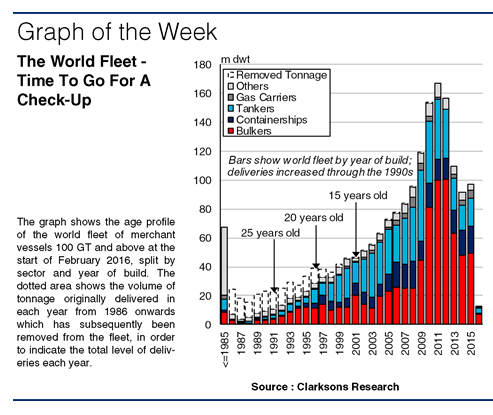

So far this year, around 8m dwt of tonnage has been reported recycled – a dramatic start, and one which suggests that 2016 could be another very strong year for demolition, after a total of 39mdwt was recycled in 2015. A quick check-up on the age profile of the world fleet shows that despite the obvious youthful bias, there is still some elderly tonnage in operation; 6% of global dwt capacity (or 112m dwt) is aged 25 years or over. However, only around one third of this amount is accounted for by the three major volume sectors, an unfortunate circumstance given the degree to which two key patients, the bulkcarrier and containership sectors, are currently suffering.

Seeking Medicine

The delivery boom over the last decade has meant that the fleet in these two sectors is very young – the average bulkcarrier is less than 9 years old. Following elevated levels of scrapping since the start of the downturn, there is now only 23m dwt of bulker tonnage left aged 25 years or more (3% of the fleet), while only 2% of boxship fleet capacity is over 25 years old – a seemingly limited relief valve.

However, the distressed market conditions are leading to younger ships being scrapped. In 2012, the bulkcarriers scrapped were aged 28 years on average, but this fell to 25 years in 2015, and 23 years in January 2016 (reaching just 20 years in the Capesize sector). For the last few years, containerships have been scrapped at an average age of 23 years, but so far in 2016 this figure has fallen to just 19 years.

Prescribing Steel Therapy

The apparent willingness to demolish more youthful ships could have the potential to eventually underpin a more positive supply-demand balance. More ships were delivered (see graph) in 1992-96 (vessels now aged 20-24 years) than in 1987-91 (ships now 25-29 years old), and only a third of tonnage delivered in 1992-96 has since been removed. Deliveries rose further past 1997, so the share of fleet capacity aged 15 years or more rises to 18% in both the bulker and containership sectors – a greater volume offering a wider range of scrapping candidates. Owners seem to have been making use of this treatment option. Since the start of 2015, 37% of bulker tonnage and 42% of boxship capacity scrapped has been less than 20 years old.

What’s The Prognosis?

So, there’s plenty of capacity which can be recycled if owners can swallow the pill of selling less elderly units. With a strong dosage of demolition, bulk fleet growth could fall below 2% this year, and supply-side fundamentals in the boxship charter market sector should remain supportive. Firm demolition is far from a cure to the challenges faced, but it could be a way to limit some of the worst symptoms.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional