Greek shipowners drive European fleet growth

Since the start of 2014 European shipowners have been in expansion mode, primarily driven by the Greeks.

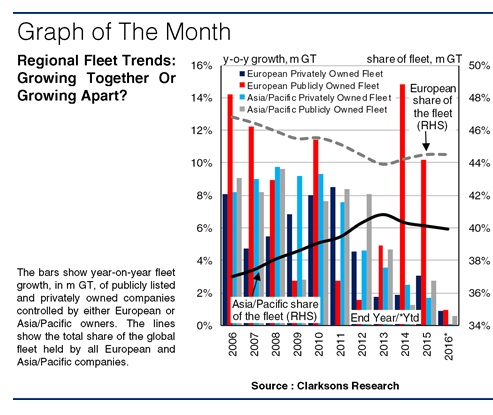

Indeed, the sustained growth of the world fleet over the last decade saw owners based in the Asia - Pacific region taking market share from the Europeans until the flood of Greek newbuildings began delivering with the result that over the past 30 months of so all the lost market share has been regained.

Looking at market share, Clarksons Research notes that since the start of 2014, the European owned fleet has grown 49.4m gt, or 51.6% of global fleet growth. This has seen European owners retain a steady market share, accounting for 43.9% of global tonnage at the end of 2013 and 44.5% of the fleet at the start of May 2016. During the same period Asia - Pacific owners have experienced a 0.9% decline in fleet share.

However, European fleet growth has not been uniform across the region.

The Greek owned fleet has increased 31.9m gt since the start of 2014, the result of strong deliveries, 24m gt since the start of 2014, and significant s&p activity. In contrast the German fleet, Europe’s second largest, declined 4.2m gt during the same period.

Since the start of 2014, Greek fleet growth has been equivalent to 64.6% of total European growth, and 33.3% of global fleet expansion.

Historically European ownership has been dominated by private companies, which account for 71.4% of current tonnage. However, says Clarksons during the last few years public companies have seen a stronger rate of fleet growth, with the public listed European fleet growing 14.2m gt in 2015, double the privately owned fleet.

Although the strongest rate of growth amongst Greek owners has remained in the private sector, hardly surprising considering the strong traditional owner base, the public owned Greek fleet has still grown 28.5% in the last two and a half years.

There has also been particularly strong growth amongst public companies in the rest of Europe. Just now 17 Greek listed groups have ship on order, while listed Norwegian owners experienced fleet growth of 6.8m gt in 2015, whilst public listed Italian, Danish and Belgium based owners have also seen significant fleet growth since 2014. Overall, the European public owned fleet has grown 30.9m gt since the start of 2014, compared to 28.4m gt of growth in the privately owned fleet.

Despite recent trends, the orderbook highlights how future fleet development could return to former patterns. Asia - Pacific based owners hold the largest proportion of the orderbook, 45.7%, with 23.2m gt more on order than their European counterparts. This could reshape recent fleet developments, with Asia - Pacific owners getting back to the fore. Similarly, the European orderbook is dominated by private companies, holding 66.6% of the 65.4m gt on order. Consequently, public companies may see lower levels of annual fleet growth.

So, concludes Clarksons: “Reasons for recent changes in regional fleet development are complex. Whilst European owners have regained fleet share, and public owners have grown relatively rapidly, the orderbook indicates fleet growth patterns will continue to evolve over the coming years.”

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional