South China Sea Ruling Increases Uncertainty for Shipping, Trade

A ruling by an international tribunal against China’s claims over most of the South China Sea has created fresh uncertainty for shipping and international trade, industry associations and analysts say.

Shipping companies have long worried that escalating tensions in the South China Sea could impact global commerce. But Tuesday’s ruling could embolden smaller Asian countries to be more assertive regarding their rights in these waters, increasing run-ins with China and leading to possible disruptions of freedom of navigation.

China has rejected the verdict, accusing the tribunal that delivered it of bias.

Eric Shimp, a policy adviser at U.S. law firm Alston & Bird and a former U.S. trade representative to the Association of Southeast Asian Nations, said that the potential for conflict increases if governments interpret the ruling as a legal basis to expand fishing operations or oil and gas exploration in waters where China has asserted control.

“If there is a government-backed increase in commerce without a concurrent conversation with the Chinese, that is something that ramps up the potential for conflict,” he said.

Any disruption to shipping-borne trade in the South China Sea could have a wide-ranging impact on global commerce, including energy supplies, analysts say.

“It is vital that merchant ships are allowed to go about their lawful business on the world’s oceans without diversion or delay,” said Esben Poulsson, president of the Singapore Shipping Association, one of the biggest shipping associations in the Asia-Pacific, representing close to 500 companies. The group will continue to monitor the situation closely, he said.

China has offered harsh rhetoric rejecting the ruling but also said it is committed to negotiations with the Philippines, which brought a case to the Permanent Court of Arbitration in The Hague to counter a steady military buildup by China in waters that Manila also claims. Vietnam, Malaysia, Taiwan and Brunei also have territorial claims in the South China Sea.

Tens of thousands of ships transit the passage daily, connecting markets and goods in East Asia with the Middle East and Europe. Total annual trade through the South China Sea amounts to $5.3 trillion, with U.S. trade accounting for $1.2 trillion.

A third of the world’s liquefied natural gas passes through the Straits of Malacca and into the South China Sea, much of it bound for Japan and South Korea.

Tensions in the South China Sea have grown in recent years as China has built artificial islands on reefs and atolls it occupies, triggering alarm from smaller neighbors and prompting the U.S. to send warships through the area to assert freedom of navigation. Beijing has accused Washington of using the smaller claimants to thwart Chinese claims of sovereignty.

Circumnavigating the sea to avoid conflict would drive up shipping costs and the industry has expressed concern that insurance companies could respond to the uncertainty by raising rates.

“Given the current challenging state of the shipping/maritime industry globally, any increase in insurance will exacerbate an already difficult time for shipping companies,” said Teresa Lloyd, chief executive officer at Maritime Industry Australia Ltd., which represents Australia’s shipping, ports and maritime service sectors.

A disruption to the many ships carrying Australian export cargo through the sea could have an even greater impact on the country’s resource sector, she said.

In the wake of the ruling, several firms that cover the maritime insurance sector said they didn’t have immediate plans to raise rates.

“We have taken notice of the decision reached by an international tribunal, but we see no direct impact for us at the moment,” said Michael Hauer, head of marine in Asia for Munich Re, a reinsurer for the logistic and shipping industry.

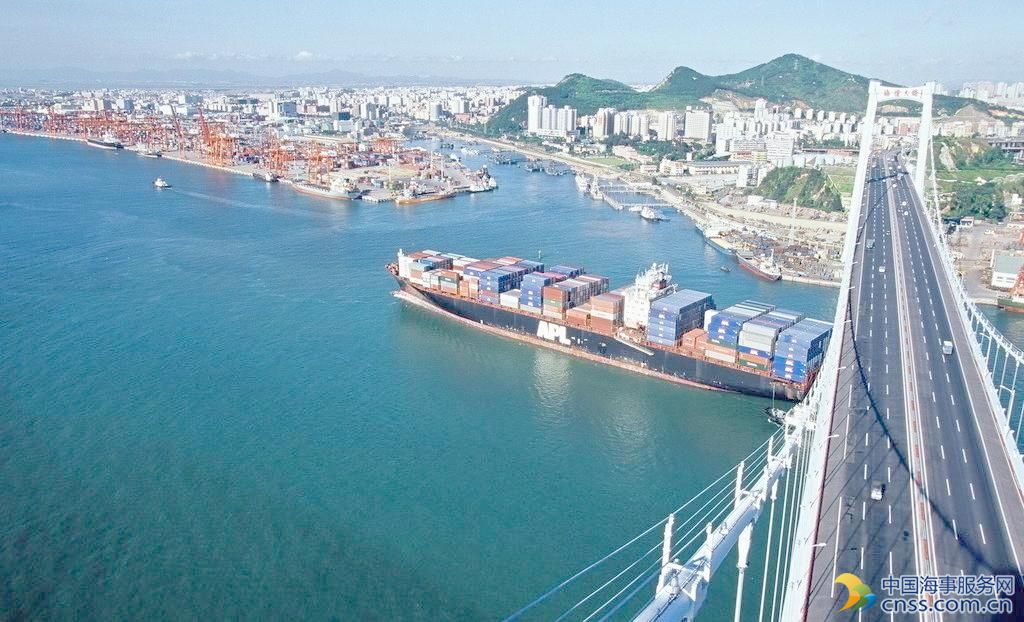

ENLARGE

China has used its extensive fishing fleet to push south into waters controlled by Indonesia, Malaysia and the Philippines. Jakarta stepped up security in March after a run-in with the Chinese coast guard over a Chinese fishing vessel and announced plans to build up its economic and military presence around the Natuna Islands, pressing against the edge of a “nine-dash line” China uses to demarcate its claims in the South China Sea.

The international tribunal ruled that China’s claims of historic rights over some 90% of the resource-rich waters aren’t recognized under international law. It also said its occupation of several islets in the Spratly Island chain doesn’t entitle Beijing to claim an exclusive economic zone around them.

A long-term escalation in tensions “is actually a lose-lose outcome for Asia overall,” said Rob Subbaraman, a chief economist for Asia, barring Japan, at brokerage Nomura. “Because the region is so integrated…it would be negative for all countries that are linked to this very tight web of trade and investment.”

Companies have learned to live with uncertainty in the South China Sea.

The Philippines brought the case in 2013 and so far shipping and insurance firms haven’t built the uncertainty into their rates, said Amarjit Singh, a senior analyst for the Asia-Pacific at IHS Markit in London.

“It’s difficult to see how the situation could descend such that the Chinese feel the need to do something that could impede shipping or trade flows,” he said.

Source: Wall Street Journal

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional