Beijing not Brexit the focus for European steel markets

Platts Steel Markets Europe conference was held less than a week after the United Kingdom voted to leave the European Union, but that historical decision paled in comparison to concerns around the ongoing influence of China on European steel markets.

Overcapacity, imports, the efficacy or otherwise of trade measures, and whether or not China should acquire Market Economy Status, were the perennial topics revisited this year at the event held in Barcelona.

“China is the bull in the porcelain shop – when it moves it can do a lot of damage,” said Laurent Plasman, head of operational marketing at ArcelorMittal, summing up the feelings of most in the room.

Notwithstanding the anti-dumping duties placed on some Chinese steel imports by the European Commission this year, many steel industry participants believed the organization was not tough enough.

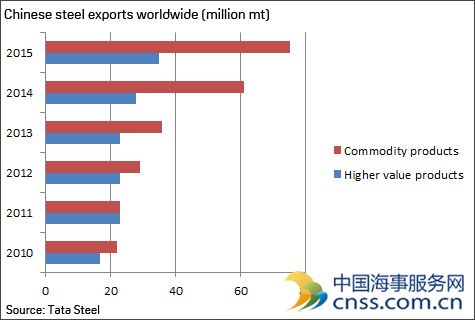

“EU producers are competing on an uneven playing field; I believe we can convince the EC to act,” Tata Steel Europe’s chief commercial officer Henrik Adam said, noting that steel trade flows had risen 53% in just 10 years mainly due to Chinese exports.

Günter Luxemburger, chief sales officer of German heavy plate producer Dillinger, said imports of quarto plate from China had been increasing this year. “It’s a really sad story. The market is modestly recovering but local producers are losing market share,” he lamented.

The EC’s representative at the conference, Mattia Pellegrini, acknowledged industry complaints that Europe was too slow and too lenient with its trade measures – taking an average of 15 months to announce definitive anti-dumping duties compared with around eight months in the US.

He said the EC was trying to accelerate and modernize the process but believed trade measures would “only achieve so much”, and the “elephant in the room” that needed to be addressed was Chinese steel overcapacity. China’s plan to cut 100 million-150 million mt/year of steel capacity within five years was “clearly below what is needed” and lacked an annual target.

Pellegrini said the EC discussed the overcapacity issue – estimated at around 350 million mt, more than double the EU’s annual steel output – in meetings with Chinese officials in March. (However, he noted the EC almost crossed paths in Beijing with an EU auto delegation seeking to ensure supply of low priced steel from China!) While China recognized it was a problem, solving it would be difficult and there was also tacit concern in Beijing that large-scale closures of so-called ‘zombie’ mills could potentially result in millions of lost jobs. Pellegrini said AD measures could continue even if China is awarded MES status.

Another hot topic at the Barcelona conference centered on fears that China could be accorded Market Economic Status – in principle, making it easier for China to export into Europe – by the WTO later this year. Energy-intensive groups, including steelmakers, led by association Eurofer, have lobbied hard against the EC recommending this change. This collective believes a change of China’s trade status could result in 3 million job losses within the EU – an assertion the EC disputes, though it does admit it would result in closures.

However, with the US firmly against any change to China’s status, many believe the upgrade to MES is unlikely.

“We are fighting hard to avoid it but how likely it is to occur is difficult to say,” said ArcelorMittal’s Plasman, “and when you look at what other trade blocks are doing, such as the US, we are confident there is a sense of realism at the political level and that it won’t be granted.”

Source: Platts

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional