Analysis: No money in met coal trading as industry consolidates, spot volume falls

In 2015, the top five metallurgical coal Chinese trading houses by sales volume imported close to 19 million mt into China.

But three of these firms — China National Building Material Company, Pacific Minerals and General Nice — have since largely pulled back from trade activities this year, leaving just two Beijing-based traders to account for an annualized 17.5 million mt of met coal imports this year, based on trade figures over January-June.

The total number of active met coal traders had also fallen to 39 by June this year from 48 in the whole of 2015, S&P Global Platts data showed.

Lower volumes and margins due to fewer arbitrage opportunities, a diminished spot market and high volatility in prices have forced the exit of several trading houses and restricted operations of many others over the last two years, industry insiders told Platts.

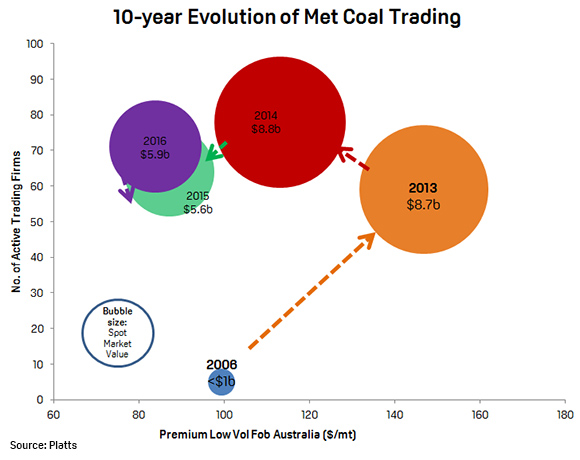

Volumes traded in the spot market slipped to an annualized 71 million mt this year, down 9% from a peak of 78 million mt in 2014, according to Platts analysis of trade data over January-June 2016.

The total value of spot shipments traded has also dropped, by about a third to an annualized $5.95 billion calculated based on spot volumes and average spot prices in the first half of 2016, from $8.82 billion in 2014.

“There is no money in physical trading anymore,” a source from an international commodity trading house said. The met coal trading business is still relatively new, having just begun in the last decade, sources said. But trade activities quickly took off in recent years, thanks to the industry’s pivot to short-term pricing which expanded the spot market, leading more trading houses to jump on the bandwagon, with a record number of 61 traders active in 2014, according to Platts data.

Since then, difficult trading conditions over the past two years have sparked an exodus of prominent Chinese trading firms, while trading desks at a few major international firms have trimmed their headcount this year, sources said.

This implies the industry could come full circle — as it consolidates and reverts back to the days when traders were a small part of the market, as in 2006 when fewer than five trading outfits existed.

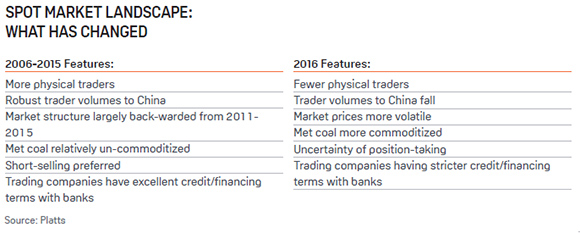

The decline in met coal volumes concluded by trading houses was driven by a confluence of factors, such as greater transparency and further commoditization of China’s met coal market, as well as more long-term deals signed directly between mining firms and steel mills.

Harsher financial conditions and limited options to hedge against price volatility were also cited as obstacles to trading, sources said.

TOP SPOT BUYER CHINA RETREATS

The fall in spot volume over the last three years is largely due to a decline in imports by the world’s top consumer of spot met coal, China.

The country is Asia’s clearing market for met coal, absorbing excess spot seaborne supply with its end-users snapping up every variety of coal, from top-of-the-line premium hard coking coal to lower quality semi-soft.

Trading firms navigating the dusky terrains of the Chinese market — the world’s largest spot market — were rewarded by the critical roles they play. Cultural and bureaucratic complexities in China had created buyer-seller information asymmetries that trading houses were able to bridge, an international trader said.

However, the decline in China’s met coal imports from a record of 75 million mt in 2013, coupled with much greater market transparency, undermined the role of such intermediaries.

Meanwhile, other growth markets are not able to fully offset the fall in China’s import demand.

Spot purchases by region’s second-biggest buyer India have only increased marginally, while European and South American buyers have largely steered clear of spot offerings from Australia since March because of the surge in prices.

“You can’t just only focus on India and Europe these days because you need [a foothold in] China to help you clear volumes when things don’t work out,” an Australian mining source said.

TOPSY-TURVY PRICES, LIMITED HEDGING

While rapid price declines since 2012 have routinely punished traders with long positions, short sellers have also been caught flat-footed by unexpected changes in market direction, which occurred particularly often this year.

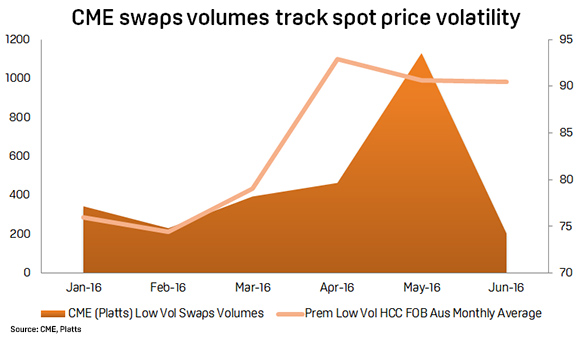

Premium HCC spot prices surged 37% from February 18 to hit a 13-month high of $100/mt FOB Australia on April 26, Platts data showed. Prices then plummeted 16% to $84/mt FOB Australia on May 27, before waging a modest rebound to be assessed at $94.75/mt FOB Australia on July 14.

The wild fluctuation in prices was seen to have hurt traders, particularly those locked into index-linked positions.

Since 2012, the market has mostly been in backwardation — where prompt prices are higher than forward prices. The backwardated market structure has motivated several traders to adopt a short-selling strategy of selling cargoes at fixed prices and buying them back on a floating price basis.

Short sellers have largely benefited from such a long-term strategy, but the price rally over March-May this year had caught many by surprise.

The loss incurred by a short seller is estimated at $14.19/mt, should the trader pre-sell an April laycan cargo at a fixed price on February 29, and purchase at parity to the month’s index average price, Platts calculations showed.

This would entail a loss of $1.06 million for a 75,000 mt Panamax-size position for a trader without a paper hedge in place.

Volatile spot prices also spawn longer trading chains as cargoes change hands multiple times. Total spot volume this year on an annualized basis had risen 11% from 64 million mt in 2015.

Faced with dramatic swings in prices, traders need a liquid paper market to hedge in order to reduce the risk of physical trading, sources said. However, a trade source said the biggest problem now is that “the paper market has not been fully developed.”

While total derivative volumes cleared by the Chicago Mercantile Exchange hit a monthly record high of 1.13 million mt in May, sources said that the derivatives market is still nascent. The contract is settled against Platts premium low vol FOB Australia assessments.

A few trading firms told Platts they have been able to curb index-linked losses during periods of drastic price upswings in March and May. But most think the swaps market needs consistent volumes for viable hedging strategies to materialize.

Traded volumes on CME slipped to just 201,000 mt in June. Sources attributed this to reduced volatility in physical spot prices, as prime hard coal traded within a tight band of $4.35/mt during the month and trader volumes were squeezed by limited spot availability because of quarterly benchmark negotiations and mining operational issues.

“The paper market is a logical extension [of the physical market] which has become so transparent,” an active coking coal physical and paper trader said.

“If you can’t hedge, you can’t trade [physical].”

MORE MINER-MILL TERM CONTRACTS

A greater push by mining firms to seal term contracts for Australian coal grades with end-users has also reduced trading opportunities.

At least three large mining firms have made a concerted push for long-term agreements with major Chinese steelmakers, sources told Platts.

At the same time, trading firms are allocated lower offtake volumes by their suppliers, which implies miners have essentially shifted their volumes from traders to end-users.

The move by mining companies could either stem from a bid to cut out the middleman or reduce risk exposure to trading companies with less-than-satisfactory credit ratings, sources said.

As a result, trading firms have less tonnage in their portfolios since both their key demand and supply pools have evaporated.

“Spot volumes have come down a lot — there are less opportunities now for physical trading,” a large trader said. Another market source noted that the “spot market has shrunk” in 2016 compared with 2015, due to more volumes being tied into long-term contracts.

Furthermore, such a trend did not appear to be peculiar to the Chinese market.

Term contract volumes between miners and traders have shrunk year on year in markets outside of China, multiple sources confirmed.

One company, for example, saw its contract volume fall by more than a third this year from 2015. “The market is getting smaller and there is no need for so many traders anymore,” one trader quipped.

MARKET COMMODITIZATION, TOUGHER ACCESS TO CREDIT

The slow, but gradual commoditization and standardization of met coal has also reduced the relevance of traders in bridging the knowledge and technical gap, sources said.

End-users are now comfortable with understanding multiple coal brands and have demonstrated greater willingness to experiment with new brands or blends, diminishing the role of the trader as a reliable guide or point man.

“Met coal is now commoditized and transparent, so there’s less demand for the middleman,” a European steelmaker said. “You go to traders only if you want to get cargoes on the cheap.”

Still, market participants believe the tough market conditions have forced inefficient trading setups to exit, leaving behind dynamic coal-focused companies with versatile trading methods.

“Traders will not disappear, [but] traders’ profile will change,” said a source from a trading firm with desks in and outside of China.

“It’ll be more small or single commodity focused traders or country-specific focused participants rather than large global multi-commodity trading houses,” he added.

Those trading firms left standing will be consummate operators of logistics management, risk mitigation and own stakes in certain physical assets, according to a recent Platts survey.

Such traders also have customer bases in China and the international market, enabling them to pursue arbitrage opportunities, sources said.

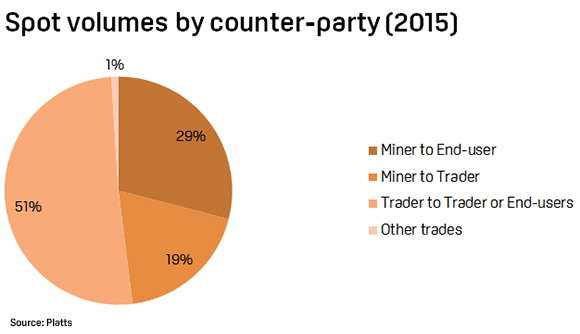

Trading firms still contribute to a great deal of spot liquidity. Trader sales accounted for 51% of total spot volumes traded and trader procurement from mining companies totaled 19% of all trade volumes in 2015.

“Opportunities keep changing and patterns keep changing … it is still a new industry, which will see a lot of turnaround,” an international trader concluded.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional