China’s Consumer Boom Risks Slowing as Income Gains Moderate

Chinese consumers, whose spending helped underpin the first-half expansion this year, may not be able to deliver a repeat performance in the second as income growth slows.

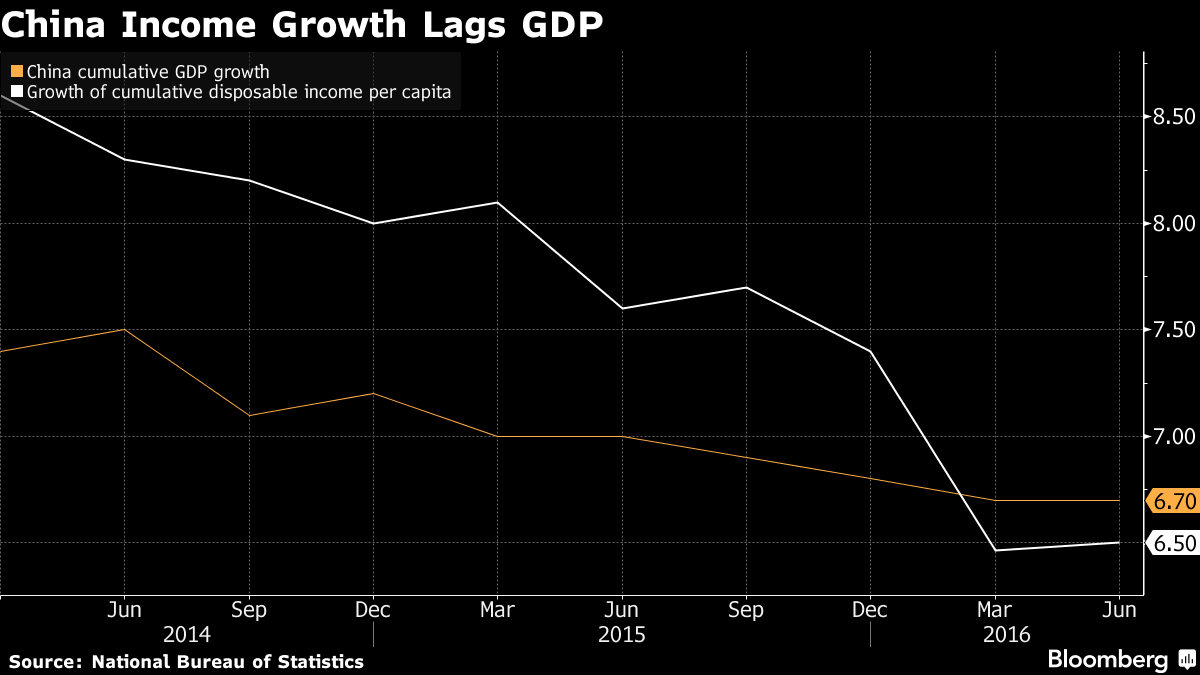

Household income growth slumped to 6.5 percent in the first six months from 7.6 percent a year earlier, data released Friday showed. Headwinds on consumer spending may increase as officials signal they will step in to curb pay gains to keep manufacturing competitive with rival nations that have cheaper production costs.

As shoppers become an increasingly crucial growth driver, any erosion of their strength would weaken the ability for the consumer-led expansion to offset weakness in exports and investment. That threatens the government goal of raising gross domestic product by 6.5 percent a year through 2020 and slow the rebalancing away from factory-led growth.

“While China’s consumer spending remains resilient, its growth is likely to soften,” Li Wei, the China and Asia economist for Commonwealth Bank of Australia in Sydney, wrote in an e-mail. “Consumer spending is likely to fall further as the impact of policy easing fades.”

Friday’s GDP report showed growth held up at 6.7 percent in the second quarter from a year earlier, exceeding economist estimates and also outpacing household income growth. Other data showed June retail sales beat forecasts with a 10.6 percent year-on-year gain while the broadest measure of new credit beat all 29 analyst projections.

Seventy-three percent of economic growth in the first six months was from consumption. But that wasn’t as desirable as it sounds because consumers offset weakness elsewhere: Investment rose at the slowest pace since 2000 and exporters face tepid global demand.

“The increasing share of consumption in the economy is a mathematical result of slumping investment,” said Zhao Yang, chief China economist at Nomura Holdings Inc. in Hong Kong. “In the long term, consumption will slow down as economy decelerates.”

‘Long Run’

Income growth has slowed in recent years, which may not be so bad for policy makers. China should slow down wage growth appropriately to maintain its competitiveness, Xin Changxing, Vice Minister of Human Resources and Social Security, said earlier this month. Finance Minister Lou Jiwei said this year salary increases have risen faster than labor productivity in recent years, which he said is “not sustainable in the long run.”

Beyond the top-level strength of the headline retail sales figure, some private indicators are showing consumers may be less confident about opening their wallets.

Sales at the nation’s top 100 retailers fell 3.2 percent in the first half versus a year earlier, the government-backed National Commercial Information Center said Monday. Restaurant spending also cooled in the first five months, according to bank card swipe data from China UnionPay Co., the country’s largest payment and clearing network.

“A tougher comparison, wetter weather, and reduced effects of policy easing” contributed to slower second-quarter consumption, Goldman Sachs Group Inc. analysts including Joshua Lu said in a report. The People’s Bank of China has kept its main interest rate at a record low since October and this year reduced the amount of cash big banks must hold.

High, Low

Other indicators from private providers show high-end markets are diverging from the low end. A gauge of sales growth for low-end consumer goods such as soft drinks and shampoo fell to a five-year low of 3.5 percent last year, according to Kantar Worldpanel and Bain & Co. While high-end products are doing better, cheap staples such as instant noodles and beer suffered declines.

“China’s economy is evolving to adapt to slower GDP growth,” Jason Yu, a manager at Kantar, wrote in a report last month. “As we track the shopping behavior of Chinese consumers, we see the distinct effects that these and other major economic shifts are having on their consumption.”

Luxury Goods

The number of online shoppers classified as high-end is rising by 25 percent a year and will reach 61 million by 2020, according to a report from Alibaba Group Holding Ltd. and McKinsey & Co. These customers favor expensive brands such as $1,900 Rimowa suitcases and $1,000 Clé de Peau Beauté facial creams, according to the report.

Amid the slowdown, the government is working to shift away from old smokestack industries with excess capacity. That may help spur rising unemployment, according to Frederik Kunze, chief China economist at Norddeutsche Landesbank in Hanover, Germany. He added that slower household income growth may be a drag on consumption growth.

“Consumption could be affected by uncertainty,” Kunze said. “We still believe household consumption of products and services is a long-term growth driver in China. The middle class is still growing and will continue to do so with significantly lower GDP growth.”

Source: Bloomberg

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional