The market is waiting for more clarity of bunker prices trend, expert says

World fuel indexes are still hovering around levels at the close of last week. High levels of refined products are weighing on the market. While there are clear signs that the market continuing down the path towards supply/demand balance, there is still disagreement over how quickly that will arrive. Besides, the fuel market is still concerned that a further slowdown and any major fallout from Britain’s recent decision to leave the EU would leave the world even more vulnerable to the risk of a global recession.

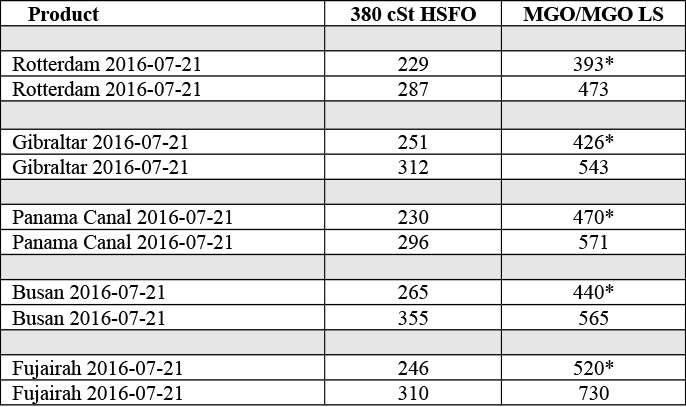

MABUX World Bunker Index (consists of a range of prices for 380 HSFO, 180 HSFO and MGO at the main world hubs) demonstrated insignificant irregular changes with no firm trend in the period of July 14 – July 21:

380 HSFO – up from 230.93 to 231,00 USD/MT (+0,07)

180 HSFO – down from 278.43 to 277.00 USD/MT (-1,43)

MGO – down from 469.57 to 466.50 USD/MT (-3,07)

A coup’s attempt in Turkey on Jul.15 rose momentum concerns of possible disruptions in oil traffic through the Turkish Straits, including the Bosphorus and Dardanelles (one of the world’s major chokepoints for seaborne crude, with about 2.9 million barrels of oil passing through daily in 2013). However, the Straits were reopened on Jul.16 after closing for several hours and at present the situation is under government’s control: oil tankers are loading and unloading normally at Turkey’s ports and supplies are arriving in ships as well as in pipelines. The possible impact of failed coup on fuel prices is completely levelled.

OPEC forecasts higher demand for its crude next year as the global surplus fades, while Saudi Arabia pumped near-record levels amid peak summer consumption. The Organization will need to produce about 33 million barrels a day next year, 142,000 a day more than June output (output in June increased by 264,100 barrels a day to 32.858 million a day). As per Cartel, global oil demand will increase by 1.2 million barrels a day next year to reach an average of 95.3 million a day, with almost all of the growth concentrated in emerging economies such as India and China.

The EIA in turn increased its U.S. crude output forecast for 2017 to 8.2 million barrels a day from 8.19 million projected in June. Production in 2016 will be 8.61 million barrels a day, up from 8.6 million in last month’s report. As per Agency’s evaluation, while the rebalancing of the oil market is progressing, brimming inventories remain a threat to the recent stability of fuel prices. Oil inventories in industrialized nations climbed to an all-time high of more than 3 billion barrels in May, while the volume of crude being stored on tankers at sea has reached the highest level since 2009.

U.S. crude inventories fell 2.34 million barrels last week to 519.5 million barrels: the longest stretch of declines in the data series which was began gathering in 1982. Supplies remain at the highest seasonal level in at least a decade. Refineries bolstered operating rates by 0.9 percentage points to 93.2 percent of capacity, the highest since November (U.S. refiners typically boost utilization in June and July as they maximize gasoline output for the summer peak driving season). U.S. consumption of the fuel averaged 9.73 million barrels a day in the four weeks ended July 15, down 0.1 percent from July 8. Falling U.S. crude production and inventories have offered support for the market.

The U.S. rig count increased for a third consecutive time for the week ending on July 15, rising to 357. That brings the total increase to 41 rigs since the end of May, a clear sign that more than a few companies feel that they can get back to work. However, the increase likely has more to do with $50 oil in June than it does with $45 oil in July.

Chinese refiners have recently begun flooding the market with gasoline and diesel, pushing down product and oil prices. Production rose to a record high of 11 million barrels per day in June, an increase of 3.2 percent from June 2015. China’s domestic market can’t consume that much refined product, so the country has increased exports as well. Meantime, China’s economy continues to slow, although its second quarter GDP growth rate of 6.7 percent beat expectations. Still, it is at its lowest level in decades. That means weaker demand for oil and petroleum products. The IEA cut its oil demand forecast for China by 50,000 barrels per day to a 275,000 barrel-per-day increase for 2016, which may transform into downward driver in a medium-term outlook.

Almost 400 North Sea oil workers will conduct a 24-hour strike on July 26, that may affect production at some of Royal Dutch Shell Plc fields in the North Sea.

A venture between Arab Petroleum Investment Corp. and National Shipping Co. of Saudi Arabia is expected to create the world’s largest fleet of oil tankers to support the kingdom’s plan to boost crude exports. A $1.5 billion investment fund is to be formed to add 15 very large crude carriers (VLCC), to the shipper’s planned fleet of 46 such vessels.

Libya’s government of national unity is working to reopen four of the OPEC country’s biggest oil ports after securing a deal to unify the fractured nation’s state energy company. Four ports (Es Sider, Zawiya, Ras Lanuf and Zueitina) accounting for about 860,000 barrels a day in crude-exporting capacity have been shut due to political turmoil and fighting. The country currently pumps about 350,000 barrels a day of crude and exports 220,000 to 250,000 barrels a day. It is expected that crude exports from Es Sider and Ras Lanuf will resume within a week. The shipments will be made under the authority of the unity government.

* MGO LS

All prices stated in USD / Mton

All time high Brent = $147.50 (July 11, 2008)

All time high Light crude (WTI) = $147.27 (July 11, 2008)

Source: Marine Bunker Exchange

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional