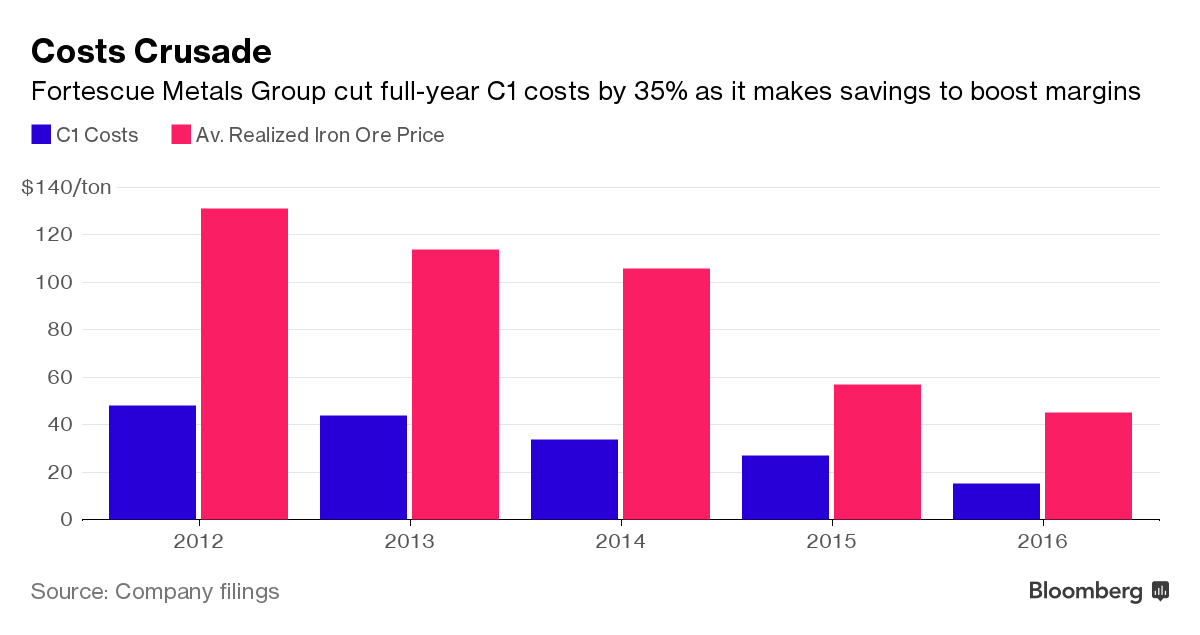

Fortescue Quarterly Iron Ore Production Costs Fall 35%

Fortescue Metals Group Ltd., the iron ore producer that’s cut debt by almost $3 billionsince last July, said fourth-quarter cash costs fell 35 percent as it continued to slash operating expenses and bolster margins amid increased demand from China.

Costs fell to $14.31 a wet metric ton in the three months ended June 30, the Perth-based producer said Wednesday in a statement. That compared with $22.16 a ton in the same period a year earlier and was in line with a $14.15 a ton median forecast among four analysts surveyed by Bloomberg.

Benchmark iron ore prices have surged 33 percent this year, rallying from three straight annual declines as China posted a steel output record last month. Higher-than-expected prices in the first half and efforts by producers to cut costs and debt means most suppliers are generating margins of between $25 a ton and $35 a ton and will be better prepared to handle any new downturn, according to Investec Ltd.

The world’s fourth-largest iron ore exporter had been seeking to end the year with a C1 cost rate of about of $13 a ton, though has faced pressure from a strengthening Australian dollar and rising fuel costs. It’s aiming to get C1 costs down to between $12 and $13 a ton in fiscal 2017.

“They had flagged a couple of headwinds on costs. No-one is going to lose any sleep over it and the progress they’ve made is excellent,” David Coates, a Sydney-based analyst with Bell Potter Securities Ltd. The producer’s target to lower costs further in the coming year is credible, he said.

Discussions on potential joint ventures with Brazil’s Vale SA, the biggest iron ore producer, are continuing and Fortescue said it remains hopeful an agreement will be concluded before the end of the year. The company also is exploring interest in a number of potential lithium projects located within its tenement holdings in Western Australia.

“Costs have been lowered for the tenth consecutive quarter and our continued focus on productivity and efficiency measures will drive C1 costs even lower” in fiscal 2017, Chief Executive Officer Nev Power said in the statement. Iron ore and steel prices have been supported by improved demand from China’s property and infrastructure sectors along with strong steel exports, the company said.

Fortescue rose as much as 6 percent and was 5.6 percent higher at A$4.35 at 11:03 a.m. in Sydney. The producer has advanced 133 percent this year, outpacing competitors including BHP Billiton Ltd. and Rio Tinto Group. Iron ore with 62 percent content delivered to Qingdao rose 2.1 percent to $58.08 a dry ton on Tuesday, according to Metal Bulletin Ltd.

Full-year costs of $15.43 a ton were above the company’s guidance of $15 a ton, it said. The C1 measure includes charges for mining, processing and rail and port transport. The producer will target shipments of 165 million to 170 million tons.

Mining Investment

Fortescue shipped 169.4 million tons in the year to June 30, it said in a July 13 filing. The rate was 2.7 percent higher than full-year guidance of about 165 million tons amid better weather in early 2016 that caused fewer-than-expected disruptions. Rio said last week full-year shipments in 2016 will rise about 4 percent, the slowest pace since 2012. BHP forecasts production will remain flat or advance by as much as 4 percent in the year to next July.

Planning is under way for a potential $1.5 billion development of satellite ore bodies and rail infrastructure to replace the Firetail mine at the Solomon Hub operation within the next five years, Fortescue said.

The company will raise exploration spending to $40 million from $31 million in the coming year and is continuing campaigns to examine copper-gold prospective tenements in South Australia and New South Wales, along with sites in Ecuador.

Net debt fell to $5.2 billion as of June 30, the producer said. Fortescue may target a further $2 billion of cuts to its debt pile over the next year, Chief Financial Officer Stephen Pearce said in a June interview.

Source: Bloomberg

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional