Navios Maritime Partners L.P. Reports Financial Results for the Second Quarter and Six Months Ended June 30, 2016

Navios Maritime Partners L.P. (“Navios Partners” or the “Company”) (NMM), an international owner and operator of container and dry bulk vessels, today reported its financial results for the second quarter and six months ended June 30, 2016.

Angeliki Frangou, Chairman and Chief Executive Officer of Navios Partners stated, “For the second quarter of 2016, we recorded $44.9 million of revenue and earned $11.8 million of EBITDA.

Angeliki Frangou continued, “Navios Partners is a unique platform in the dry sector. Since the beginning of 2016, we have fortified our balance sheet, having reduced our debt by $44.6 million. As a result, our net debt to book capitalization is 42.5% and interest coverage is 4.3x. In addition, we have no significant debt maturities until 2018 and expect to generate $45.0 million in free cash flow for the remainder of 2016. We also benefit from annual operating savings that we enjoy through the economies of scale achieved by our sponsor, Navios Maritime Holdings Inc.”

Charter Restructuring with HMM

Pursuant to the charter restructuring documentation executed on July 15, 2016, it has been agreed that the hire rate of five Container vessels chartered out to Hyundai Merchant Marine Co., Ltd. (“HMM”) will be reduced by 20%, as follows:

With effect from (and including) July 18, 2016 until (and including) December 31, 2019, hire rate shall be reduced to $24,400 per day pro rata.

With effect from (and including) January 1, 2020, hire rate shall be restored to the rate of $30,500 per day pro rata until redelivery.

In exchange under the charter restructuring agreement, the Company received:

$7.7 million principal amount of senior, unsecured notes, amortizing subject to available cash flows, accruing interest at 3% per annum payable on maturity in July 2024; and

3.7 million freely tradable shares of HMM.

In August 2016, Navios Partners sold the 3.7 million shares of HMM generating net cash proceeds of approximately $21.3 million.

Sale of MSC Cristina

In June 2016, Navios Partners agreed to sell to an unrelated third party the MSC Cristina, a 2011 South Korean-built Container vessel of 13,100 TEU, for a total net sale price of $125.0 million, with delivery expected by the first quarter of 2017, subject to signing of definitive documentation.

Long-Term Cash Flow

Navios Partners has entered into medium to long-term time charter-out agreements for its vessels with a remaining average term of 2.4 years. Navios Partners has currently contracted out 94.9% of its available days for 2016, 55.5% for 2017 and 44.9% for 2018, including index-linked charters, respectively, expecting to generate revenues of approximately $191.2 million, $122.3 million and $103.9 million, respectively. The average expected daily charter-out rate for the fleet is $18,744, $25,526 and $27,200 for 2016, 2017 and 2018, respectively.

Navios Partners has insurance on certain long-term charter-out contracts of drybulk vessels for credit default occurring until the end of 2016, through an agreement with Navios Maritime Holdings Inc., up to a maximum cash payment of $20.0 million.

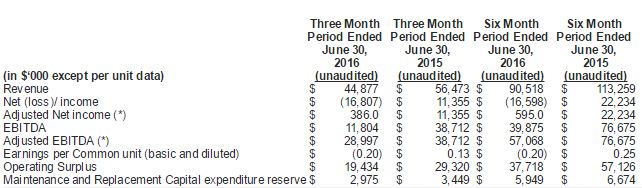

EARNINGS HIGHLIGHTS

For the following results and the selected financial data presented herein, Navios Partners has compiled consolidated statements of income for the three and six months ended June 30, 2016 and 2015. The quarterly 2016 and 2015 information was derived from the unaudited condensed consolidated financial statements for the respective periods. Adjusted EBITDA, Earnings per Common unit, Adjusted Net Income and Operating Surplus are non-GAAP financial measures and should not be used in isolation or substitution for Navios Partners’ results.

(*) Adjusted EBITDA and Adjusted Net Income for the three and six months ended June 30, 2016 have been adjusted to exclude a $17.2 million impairment loss on one of our vessels.

Three month periods ended June 30, 2016 and 2015

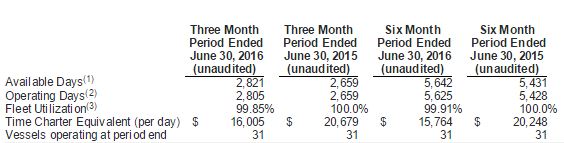

Time charter and voyage revenues for the three month period ended June 30, 2016 decreased by $11.6 million or 20.5% to $44.9 million, as compared to $56.5 million for the same period in 2015. The decrease was mainly attributable to the decrease in TCE to $16,005 per day for the three month period ended June 30, 2016, from $20,679 per day for the three month period ended June 30, 2015. The decrease in time charter and voyage revenues was primarily due to the decline in the freight market during 2016, as compared to the same period in 2015, and was partially mitigated by an increase in revenue due to the delivery of the MSC Cristina in the second quarter of 2015. As a result of the vessel acquisition in April 2015, available days of the fleet increased to 2,821 days for the three month period ended June 30, 2016, as compared to 2,659 days for the three month period ended June 30, 2015.

EBITDA for the three months ended June 30, 2016 was negatively affected by the accounting effect of a $17.2 million impairment loss on one of our vessels. Excluding this item, Adjusted EBITDA decreased by $9.7 million to $29.0 million for the three month period ended June 30, 2016, as compared to $38.7 million for the same period in 2015. The decrease in Adjusted EBITDA was primarily due to a: (i) $11.6 million decrease in revenue; (ii) $0.6 million increase in management fees mainly due to the increased number of vessels; (iii) $0.7 million increase in general and administrative expenses; and (iv) $0.5 million increase in time and voyage charter expenses. The above decrease was partially mitigated by a $3.6 million increase in other income/ expense, net.

The reserve for estimated maintenance and replacement capital expenditures for the three month period ended June 30, 2016 and 2015 was $3.0 million and $3.4 million, respectively (please see Reconciliation of Non-GAAP Financial Measures in Exhibit 3).

Navios Partners generated Operating Surplus for the three month period ended June 30, 2016 of $19.4 million, compared to $29.3 million for the three month period ended June 30, 2015. Operating Surplus is a non-GAAP financial measure used by certain investors to assist in evaluating a partnership’s ability to make quarterly cash distributions (please see Reconciliation of Non-GAAP Financial Measures in Exhibit 3).

Net income for the three months ended June 30, 2016 was negatively affected by the accounting effect of a $17.2 million impairment loss on one of our vessels. Excluding this item, Adjusted net income for the three months ended June 30, 2016 amounted to $0.4 million compared to $11.4 million for the three months ended June 30, 2015. The decrease in Adjusted net income of $11.0 million was due to a: (i) $9.7 million decrease in adjusted EBITDA; (ii) $0.8 million increase in direct vessel expenses, comprising of the amortization of dry dock and special survey costs; and (iii) $0.8 million increase in interest expenses and finance cost, net. The above decrease was partially mitigated by a $0.2 million decrease in depreciation and amortization expense.

Six month periods ended June 30, 2016 and 2015

Time charter and voyage revenues for the six month period ended June 30, 2016 decreased by $22.7 million or 20.1% to $90.5 million, as compared to $113.3 million for the same period in 2015 The decrease was mainly attributable to the decrease in TCE to $15,764 per day for the six month period ended June 30, 2016, from $20,248 per day for the six month period ended June 30, 2015. The decrease in time charter and voyage revenues was primarily due to the decline in the freight market during 2016, as compared to the same period in 2015, and was partially mitigated by an increase in revenue due to the delivery of the MSC Cristina in the second quarter of 2015. As a result of the vessel acquisition in April 2015, available days of the fleet increased to 5,642 days for the six month period ended June 30, 2016, as compared to 5,431 days for the six month period ended June 30, 2015.

EBITDA for the six months ended June 30, 2016 was negatively affected by the accounting effect of a $17.2 million impairment loss on one of our vessels. Excluding this item, Adjusted EBITDA decreased by $19.6 million to $57.1 million for the six month period ended June 30, 2016, as compared to $76.7 million for the same period in 2015. The decrease in Adjusted EBITDA was primarily due to a: (i) $22.7 million decrease in revenue; (ii) $1.9 million increase in management fees due to the increased number of vessels and the increased daily management fee; (iii) $1.3 million increase in general and administrative expenses; and (iv) $0.7 million increase in other expenses. The above decrease was partially mitigated by a: (i) $1.1 million decrease in time charter and voyage expenses; and (ii) $5.8 million increase in other income.

The reserve for estimated maintenance and replacement capital expenditures for the six month periods ended June 30, 2016 and 2015 was $5.9 million and $6.7 million, respectively (please see Reconciliation of Non-GAAP Financial Measures in Exhibit 3).

Navios Partners generated operating surplus for the six month period ended June 30, 2016 of $37.7 million, compared to $57.1 million for the six month period ended June 30, 2015. Operating Surplus is a non-GAAP financial measure used by certain investors to assist in evaluating a partnership’s ability to make quarterly cash distributions (please see Reconciliation of Non-GAAP Financial Measures in Exhibit 3).

Net income for the six months ended June 30, 2016 was negatively affected by the accounting effect of a $17.2 million impairment loss on one of our vessels. Excluding this item, Adjusted net income for the six month period ended June 30, 2016 amounted to $0.6 million compared to $22.2 million for the six month period ended June 30, 2015. The decrease in Adjusted net income of $21.6 million was due to a: (i) $19.6 million decrease in adjusted EBITDA; (ii) $1.7 million increase in direct vessel expenses, comprising of the amortization of dry dock and special survey costs; and (iii) $0.5 million increase in depreciation and amortization expense. The above decrease was partially mitigated by a: (i) $0.1 million decrease in interest expense and finance cost, net and (ii) $0.1 million increase in interest income.

Fleet Employment Profiles

The following table reflects certain key indicators of Navios Partners’ core fleet performance for the three and six month periods ended June 30, 2016 and 2015.

(1 ) Available days for the fleet represent total calendar days the vessels were in Navios Partners’ possession for the relevant period after subtracting off-hire days associated with scheduled repairs, dry dockings or special surveys. The shipping industry uses available days to measure the number of days in a relevant period during which a vessel is capable of generating revenues.

(2 ) Operating days is the number of available days in the relevant period less the aggregate number of days that the vessels are off-hire due to any reason, including unforeseen circumstances. The shipping industry uses operating days to measure the aggregate number of days in a relevant period during which vessels actually generate revenues.

(3 ) Fleet utilization is the percentage of time that Navios Partners’ vessels were available for revenue generating available days, and is determined by dividing the number of operating days during a relevant period by the number of available days during that period. The shipping industry uses fleet utilization to measure efficiency in finding employment for vessels and minimizing the amount of days that its vessels are off-hire for reasons other than scheduled repairs, drydockings or special surveys.

(4 ) TCE rates: TCE rates are defined as voyage and time charter revenues less voyage expenses during a period divided by the number of available days during the period. The TCE rate is a standard shipping industry performance measure used primarily to present the actual daily earnings generated by vessels on various types of charter contracts for the number of available days of the fleet.

Conference Call details:

Navios Partners’ management will host a conference call today, Thursday, August 11, 2016 to discuss the results for the second quarter and six months ended June 30, 2016.

Call Date/Time: Thursday, August 11, 2016 at 8:30 am ET

Call Title: Navios Partners Q2 2016 Financial Results Conference Call

US Dial In: +1.866.394.0817

International Dial In: +1.706.679.9759

Conference ID: 2661 5706

The conference call replay will be available two hours after the live call and remain available for one week at the following numbers:

US Replay Dial In: +1.800.585.8367

International Replay Dial In: +1.404.537.3406

Conference ID: 2661 5706

Slides and audio webcast:

There will also be a live webcast of the conference call, through the Navios Partners website (www.navios-mlp.com) under “Investors”. Participants to the live webcast should register on the website approximately 10 minutes prior to the start of the webcast.

A supplemental slide presentation will be available on the Navios Partners’ website under the “Investors” section by 8:00 am ET on the day of the call.

Source: Navios Maritime Partners L.P.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional