All or Nothing in China Bond Recoveries as Bankruptcy Murky

When it comes to defaulted bonds in China, there has been either full repayment or delays and diversions.

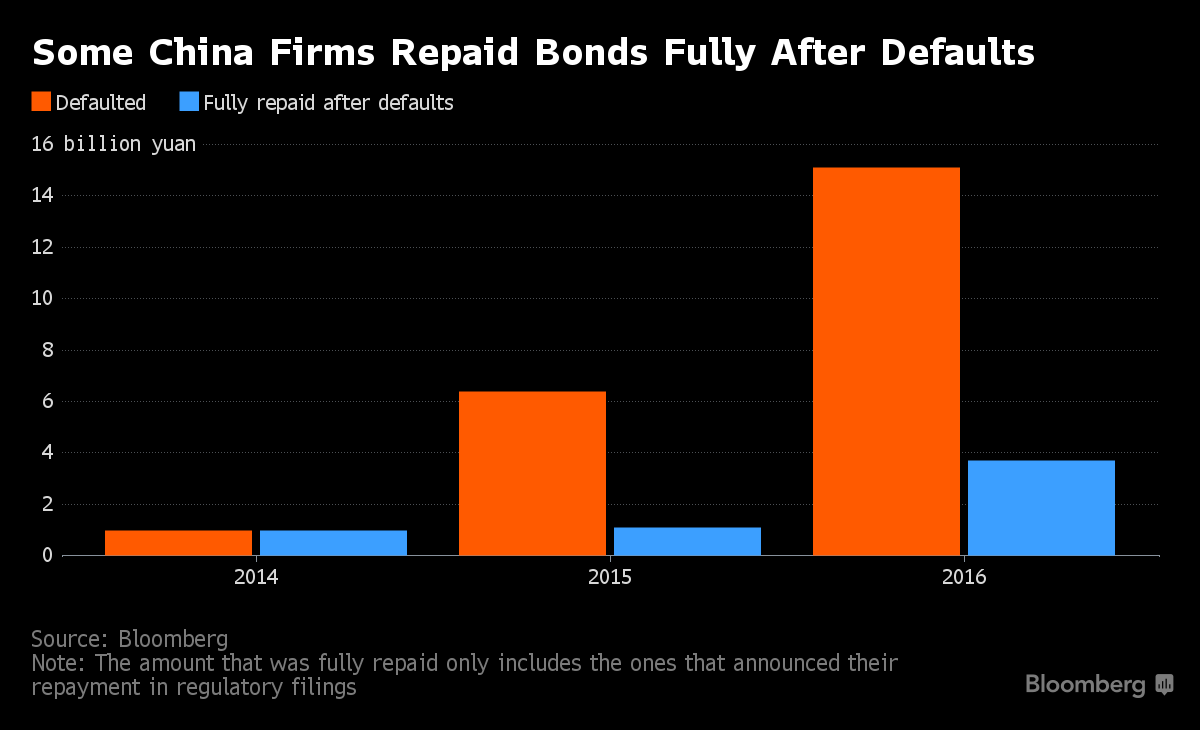

Of the 26 local public notes with failures since Shanghai Chaori Solar Energy Science & Technology Co. became the first company to renege on an onshore note payment in 2014, nine have been fully repaid and only one was partially made good, according to data compiled by Bloomberg. Most of the rest haven’t released information on repayment plans and Moody’s Investors Service bemoans the lack of a transparent restructuring process.

“When an onshore bond defaults, we noticed the issuer either repays fully or delays the repayment without further notice,” said Ivan Chung, head of Greater China credit research at Moody’s in Hong Kong. “There needs to be a negotiation process and a resulting haircut that creditors agree on. China also needs to develop secondary liquidity for defaulted bonds, which would reflect the value investors assign to those bonds.”

Defaults Spread

As authorities allow more companies to collapse, domestic bond failures soared this year, bringing the total principal of defaulted notes to 22.5 billion yuan ($3.4 billion) since 2014. Given the short history of such failures, debtholders have no road map for recovering their investments. Moody’s says the country needs to establish bankruptcy protection law like Chapter 11 in the U.S. to offer breathing space for struggling firms to negotiate with creditors and get back on their feet again.

The country’s Supreme People’s Court urged the establishment of more special divisions to handle liquidation or bankruptcy cases in intermediate courts, Xinhua reported on Thursday.

Moody’s Chung said many private sector companies have a greater incentive to repay defaulted securities than state-backed firms because their executives typically give personal guarantees, including pledging their own assets as collateral for corporate debt. Out of the nine defaulted notes fully repaid, seven were issued by private sector companies.

Note investors in Chaori Solar, a private-sector firm, were paid in full within 10 months of non-payment. Sausage maker Nanjing Yurun Foods Co. made good on both of its defaulted bonds this year. Zhuhai Zhongfu Enterprise Co., a bottle maker in China for Coca-Cola Co., borrowed money from Bank of Anshan Co. to help repay debentures that defaulted in 2015.

Chinese companies face a record 3 trillion yuan of local bonds due in the second half, according to Bloomberg-compiled data. The number of firms listed in Shanghai and Shenzhen that generated a net annual loss with negative revenue growth and not enough cash to cover short-term debt has grown to 184, based on the latest filings compiled by Bloomberg, from 107 a year ago.

The restructuring process for Chinese offshore notes has more in common with defaults among other emerging market issuers, with lengthy discussions and partial repayments. Property developer Kaisa Group Holdings Ltd., the nation’s first developer to default on offshore debentures, took more than a year negotiating with creditors to reach an agreement on a haircut. Renhe Commercial Holdings Co. offered 77 to 88 cents on the dollar in a 2014 reorganization.

It is premature to say what the recovery rate on local bonds will be and whether it will be higher or lower than the 40.9 percent average for defaulted notes worldwide in 2015, based on calculations by Moody’s Investors Service. Ben Sy, the head of fixed income, currencies and commodities at the private banking arm of JPMorgan Chase & Co. in Hong Kong, said it’s too early to estimate such a figure for China.

“The default history is so short in China, so we don’t know what the recovery rate would be,” he said. “In theory, without the government’s support, the rate should be even lower. This is because leverage for many Chinese companies is typically higher than other emerging market countries.”

Source: Bloomberg

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional