Buying time on toxic panamax ships will only prolong suffering

Rickmers Maritime Trust (RMT) has become the latest casualty in a growing list of containership owners with toxic vessel assets that are unable to generate sufficient funds to pay their outstanding debt obligations. While numerous privately-owned shipowners and KG vessel funds have already filed for bankruptcy in the last three years due to the collapse in containership charter rates and asset values, RMT is the first publicly listed owner to admit that it is technically insolvent and that its assets are currently only worth their scrap values.

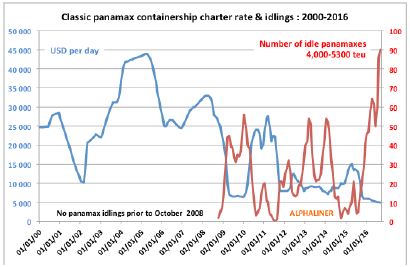

According to RMT, its fleet of 16 panamax containerships of 3,400-5,000 teu, with an average age of only nine years, would be worth a maximum of only $140 M in a distressed sale, against a book value of $640 M. Secured lenders will likely only recover 50 – 65% of the debt owed, while bondholders and shareholders will suffer a total loss on their investments if the assets are liquidated. In an attempt to buy time, RMT has proposed that its bondholders exchange $100 M of notes due in May 2017 to $28 M perpetual notes with no maturity date that are convertible to 20% of the shares of the company.

If the bondholders do not accept the proposal, the Singapore-listed company says it will not be able to obtain the secured lenders’ agreement to refinance the rest of its outstanding senior debt of $281 M, of which $180 M is due in March next year. The proposal will likely be resisted by the bondholders as it favours the equity owners, who will still retain 80% of the company shares, while buying additional time in the hope that the panamax containership market will enjoy an improbable recovery.

Source: Alphaliner

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional