Tanker Supply – A Gift and a Curse

While tanker demand dictates trade volumes and tanker routes, the volatility of fleet growth on the supply side may have a pronounced impact on freight rates, according to the latest report from McQuilling Services.

Ton-mile data for crude/dirty petroleum product tankers (DPP) and clean petroleum product tankers (CPP) shows relatively steady annual demand growth of 1-3% on average, allowing for the ebbs and flows of supply fundamentals to influence the direction of the market.

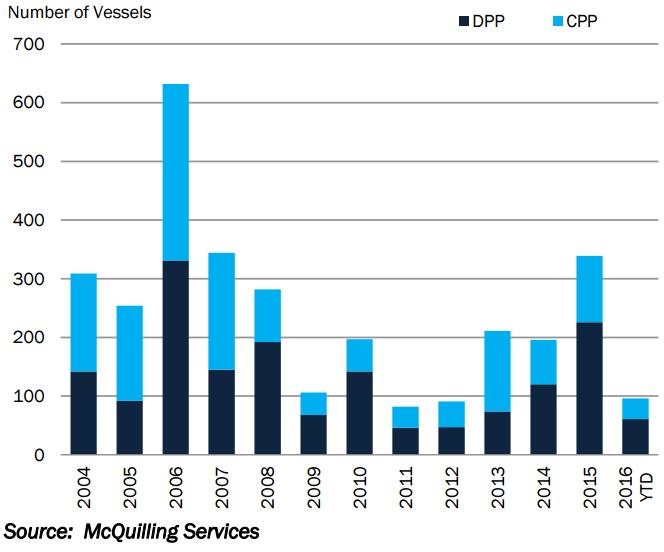

As the market continues to absorb deliveries from robust ordering activity in previous years, freight rates remain under pressure. The low earnings environment for significant parts of this year, combined with financial constraints and banking issues at shipyards, have contributed to a weak contracting year, comparable to 2011 and 2012.

Through October 25, McQuilling Services recorded 96 newbuilding orders, including 61 crude carriers and 35 product tankers, which represents a significant drop from 196 orders in 2014 and 339 orders in 2015.

Another trend to make note of this year is the significant amount of order cancellations as many of the major shipyards have suffered severe financial losses. In particular is South Korea’s STX Offshore and Shipbuilding (STX) who posted a net loss of over USD 105 million in the first quarter of 2016 and has become insolvent, forcing lenders to effectively “own” the yard using debt-for-equity swaps.

Through August, shipbuilding orders at STX were down 72% year-on-year, to USD 1.2 billion in contracts, while some tanker owners, including Frontline and Navig8 Chemical Tankers, canceled orders for VLCCs and MRs recently.

“Looking forward to 2017, we are expecting DPP net fleet growth of 5.6% on an average inventory basis. The growth stems from a surge in ordering of 120 vessels in 2014 and 226 in 2015, resulting in a projected 160 additions to the dirty trading fleet in 2017,” McQuilling Services said, adding that, even with the expectation of 51 crude carrier exits next year, rates are likely to be pressured from the oversupply.

Beyond 2017, a marked shift in the supply fundamentals could be expected. With 2016 contacting activity of just 96 vessels and the expectation of below average ordering activity in 2017 amid a softer earnings environment, a tightening of supply growth in the years from 2018 to 2020 is projected for both CPP and DPP.

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional