A.P. Moller Maersk – Looking through the noise, double upgrade to “Attractive”

Real market’ vs ‘Expectations market’

The ‘real market’ is the world in which factories are built, products are designed and produced, real products and services are bought and sold, revenues are earned, expenses are paid, and real dollars of profit show up on the bottom line.

The ‘expectations market’ is the world in which shares in companies are traded between investors, in other words, the stock market. In this market, investors assess the real market activities of a company today and, on the basis of that assessment, form expectations as to how the company is likely to perform in the future. The consensus view of all investors and potential investors as to expectations of future performance shapes the stock price of the company.

Roger L. Martin in ‘Fixing the Game’

Investors were subjected to a roller coaster ride in APMM stock over the last 12 months. We believe market has now discounted the noise of restructuring but is giving undue importance to noise of rising trade protectionism whereas ignoring fundamental improvements in the container shipping sector.

Real challenges, but early signs of market bottoming out merits an upgrade

Since the announcement that the company will undergo a strategic review, APMM’s stock price surged 25% with investors and analysts trying to quantify the value unlocking. The bankruptcy of Hanjin gave another leg-up on expectations of improved earnings but the stock came crashing down as those expectations failed to materialise in the 3Q16 report. Another down leg emerged after the US presidential elections.

Even as we remained skeptical and did not see merit in stock price gains just on the basis of an impending restructuring exercise, we also do not think the fallout from the US presidential election will be that severe and find fundamental drivers for a slightly better performance in 2017.

Maersk Line today stands at the crossroads with the industry staring at lower trade growth and bloated capacity. Increasing externalities are weighing on demand with prospects for income growth and consumption having deteriorated significantly since the financial crisis. Changing demographics as well as labour productivity and structural changes are impacting long-term demand growth.

Subdued demand for global trade is also indicated by several other factors such as structural decline of capital goods and investment spending, rising protectionism, currency wars, near shoring, miniaturisation, saturation of container penetration, and muted recovery in consumer spending. Global demand is transitioning to a lower band and the GDP trade model is definitely under threat.

An important question that remains unanswered is whether shipping / world trade will dominate in the new Industrial Revolution 4.0 as it did in the era of globalisation. We see clear evidence of shipping volumes being disrupted by the digital economy and technology. We see benefits of ‘Economies of Scale’ disappear, enabling ‘low volume manufacturing’ leading to more ‘near shoring’ and ‘bespoke production’.

We cannot fully factor in the detrimental effects of the highly restrictive trade policies of the US President Elect. The key poll promise was a massive 45% tariff on the goods China sends to the United States. That would be highly negative to Chinese exports to the US. We believe the probability of that happening in entirety is low but if it were to happen, it would sound a death knell for global trade in general and container shipping in specific.

For demand growth, we expect cargo volumes to recover to an extent, but a new phase of low growth beckons. We believe world trade is not falling off a cliff but most indicators do suggest that trade growth will remain weak for the foreseeable future.

Industry’s response to rationalise capacity has been led by renewed M&A activity and operational consolidation through bigger alliances.Container orderboook still remains elevated at over 3 mn teus, 60+ ships & 75% for at least 10,000 teu vessels for 2017 delivery.

On the positive side, we expect the industry pricing on the cusp of a turnaround after years of neglect, the bottom of the freight market has been reached and the corner is being turned. Rising focus on the financial health of the carriers will likely create a two tier market with a growing split between cash-rich and cash-poor ocean carriers. Risk mitigation by customers will come at higher costs and benefit Maersk Line.

Early indicators suggest that contract rates for 2017 are expected to increase from depressed levels of 2016. We highlight that it will be the first increase in transpacific contract rates since 2010.

Maersk Line and its peers have significantly cut costs across the spectrum over the last half decade. Costs are sticky, we expect the operating leverage to kick in significantly as price erosion reverses and aids profitability.

APMM’s other key businesses Maersk Oil, APMT will see earnings stabilize in FY17 whereas we expect Maersk Drilling and Maersk Tankers to see continued earnings deterioration. Maersk Line will be the real driver of earnings.

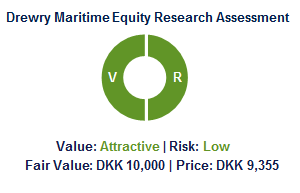

We upgrade APMM to “Attractive” from “Unattractive” earlier and reverse our bearish stance purely on improving sector fundamentals as we look through the noise of rising trade protectionism. We expect Maersk Line to return to profitability in FY17. We put our TP at DKK 10,000 which is still conservative with further upside in store as we look for further evidence in our investment thesis to play out.

Source: Drewry Maritime Equity Research

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional