Russia’s Pledge to OPEC Means ‘Herding Cats’ to Deliver Cuts

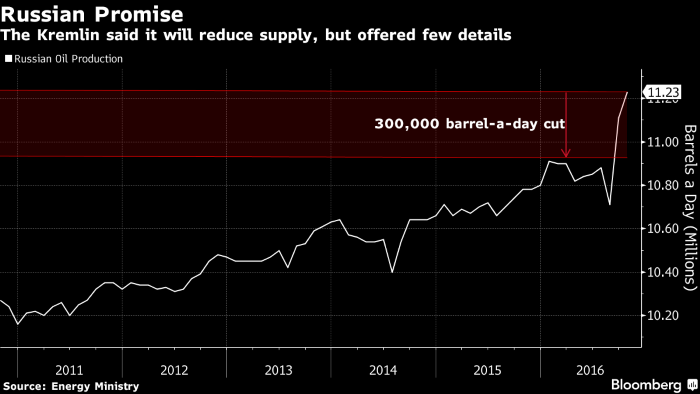

Russia has committed to cooperate with OPEC by cutting as much as 300,000 barrels a day from its oil output but offered no clear method for enforcement, creating uncertainty about how easily the reduction can be delivered.

Output cuts should be spread proportionally between Russian producers, who have said they support the move, Energy Minister Alexander Novak told reporters Thursday. Yet no oil companies have so far explained how they will implement the cuts, said Chris Weafer, a partner at Macro Advisory in Moscow. State-controlled Rosneft PJSC, the country’s largest producer, is likely to bear most of the burden, according to Renaissance Capital.

“Trying to get an agreement for a pro-rata cut amongst the Russian oil producers, even if mandated by the Kremlin, would be akin to herding cats,” Weafer said by e-mail Thursday. “All would want to wait to see what the others do first.”

The Organization of Petroleum Exporting Countries confounded skeptics on Wednesday by reaching an agreement to cut production by 1.2 million barrels a day. Russia added to the surprise by saying it too would reduce current output of 11.2 million barrels a day — a reversal for Novak who had for months expressed Russia’s preference for freezing at that level. While crude futures jumped above $50 a barrel on the news, questions remain over how the supply curbs will be implemented.

Lukoil PJSC, Russia’s second largest producer, supports OPEC’s moves to stabilize global oil markets, Pavel Zhdanov, the company’s director of capital markets and mergers and acquisitions, said on a conference call Wednesday. It’s too early to get into details, he said.

The press services of Rosneft and Lukoil declined to comment on any measures they would take to enact cuts.

Rosneft’s Burden

“Rosneft looks like the number one company that should take the biggest share of the cut,” Ildar Davletshin, an oil analyst at Renaissance Capital, said by e-mail. It controls almost 50 percent of Russian oil output and it has one of the lowest shares of so-called greenfields, or new developments, in its production portfolio, he said.

Cuts are more likely to be achieved by dialing back drilling on older fields, allowing the natural decline rates to grow, as opposed to stopping new projects, according to Davletshin.

Companies could even stop production at older unprofitable fields in West Siberia, the Volga region and the south of Russia, according to Mikhail Pshenitsyn, who has worked for more than 10 years in the country’s oil industry. It’s unlikely that Russia will quit drilling on new fields or damage its services industry, he said.

“The average production at new wells in Russia is around 50 tons a day, so Russia would need to decide against drilling around 800 new wells and leave some 100 drilling teams out of work,” Pshenitsyn said. “And where will we get them once we need them again?”

Next Meeting

An output reduction spread proportionately among large companies won’t change overall levels of investment in the industry, Olga Danilenko, director of oil and gas research at Prosperity Capital in Moscow, said by e-mail. Instead, they would probably shift funds to longer-term projects, she said.

Russia plans to meet with OPEC producers and nations from outside the group in the next 10 days, when the country will likely sign a memorandum confirming the supply reductions, Novak said in a briefing on Wednesday.

A cut may make a “material difference in the government’s efforts to balance the budget,” Citigroup Inc. analysts Ronald Smith and Alexander Bespalov wrote in a research note. State finances are more sensitive to higher prices than to lower production, they said.

Should cutting Russian output by 300,000 barrels a day help boost oil prices to $52.50 a barrel compared with $42.50 in the absence of an OPEC-led accord, government revenue would increase about 28 percent in dollar terms and 15 percent in ruble terms, Citigroup said. Brent crude rose 2.6 percent to $53.18 a barrel as of 2:03 p.m. in London, after gaining 8.8 percent on Wednesday.

Source: Bloomberg

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional