Latin America: Finished steel production falls 6% and consumption 9% in January-October 2016

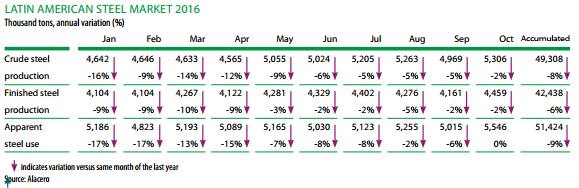

During the first 10 months of 2016, the finished steel consumption decreased 9%, while regional crude steel production and finished steel fell 8% and 6% y-o-y., respectively, vs same period of 2015, this situation is showing the economic deceleration in the world and in the region.

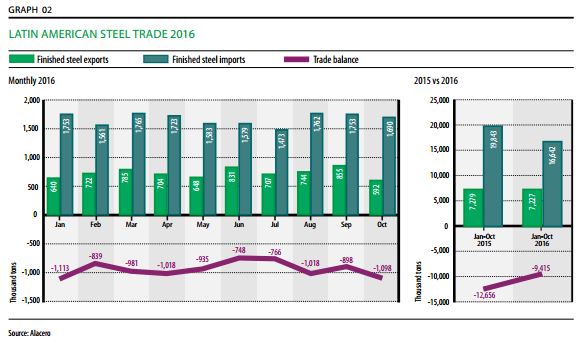

Meanwhile, regional steel imports represents 32% of Latin-American consumption and their participations is held in the local markets. The trade balance of the region remains negative, despite that during the analyzed period the deficit in tons decreased 25% versus January-October 2015.

Production

Crude Steel. Latin America and the Caribbean produced 49.3 million tons (Mt) of crude steel in Jan-Oct, 8% below the volume recorded in 2015. Brazil remains the main producer in the region with 52% of the regional production (25.6 Mt), but shows an annual contraction of 9%.

Finished steel. In the same period, Latin America produced 42.4 Mt of finished steel, 6% less than January-October 2015. Brazil was the main producer (17.7 Mt), accounting for 42% of the Latin American output. Mexico came second with 15.7 Mt (37% share of regional output).

Finished steel consumption

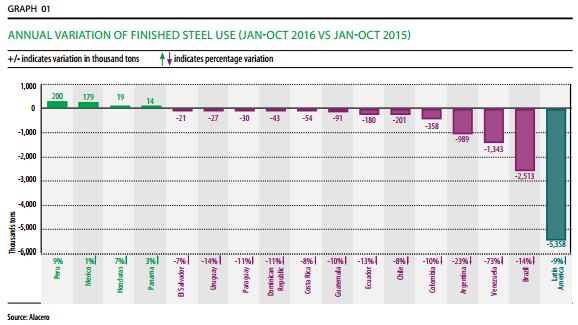

During the first ten months of the year, finished steel consumption in the region reached 51.4 Mt, down 9% vs January-October 2015. Largest increases in consumption -in absolute and percentage terms- were record in Peru (200 thousand additional tons, up 9%), Mexico (additional 179 thousand tons, an increase of 1%) and Honduras (19 thousand additional tons, up 7%).

Conversely, in Brazil finished steel consumption shrank by 2.5 Mt, down 14% vs January-October 2015. While Argentina, Chile, Colombia and Ecuador recorded declines of 23%, 8%, 10% and 13%, respectively.

From Latin-American`s total steel consumption, 52% corresponds to flat products (26.9 Mt), 47% for long products (23.9 Mt) and 1% to seamless tubes (624 thousand tons).

Trade balance

Imports. During the first ten months of 2016, Latin America imported 16.6 Mt of finished steel, down 16% vs January-October 2015 (19.8 Mt). Of this total, 63% corresponds to flat products (10.5Mt), 34% for long products (5.7 Mt) and 2% to seamless tubes (393 thousand tons).

Currently, imports represent 32% of the regional finished steel consumption, which brings about disincentives to the local industry, trade frictions, and threatens jobs.

Exports. Latin American exports of finished steel reached 7.2 Mt, decreasing 1% over January-October 2015 (7.3 Mt). Of this total, 50% are flat products (3.6 Mt), 41% for long products (3.0 Mt) and 10% to seamless tubes (692 thousand tons).

Trade deficit. In January-October 2016, the region recorded a trade deficit of 9.4 Mt of finished steel. This imbalance is 25% lower than the one observed in January-October 2015 (12.6 Mt).

In the same months, Brazil was the only country to maintain a trade surplus of finished steel, 2.9 Mt. The largest deficit was recorded in Mexico (-3.8 Mt), followed by Colombia (-1.9 Mt), Peru (-1.3 Mt) and chile (-1.3 Mt).

The evolution of trade flows and the balance are show in Figure 02.

Production November 2016 – Advance Information

Advance information for November 2016, indicates that crude steel production reached 4.9 Mt, 7% less than October 2016 and 1% less than November 2015. The volume accumulated in the first eleven months of the year recorded 54.2 Mt, 8% less than January-November 2015.

Meanwhile , the production of finished steel closed at 4.3 Mt in November, 5% less than October 2016 and 2% less than November 2015, and between January-November 2016 reached 46.7 Mt, down 5% vs January-November 2015.

Source: Alacero (Latin American Steel Association)

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional