Top Iron Ore Forecaster RBC Says Prices Will Pull Back This Year

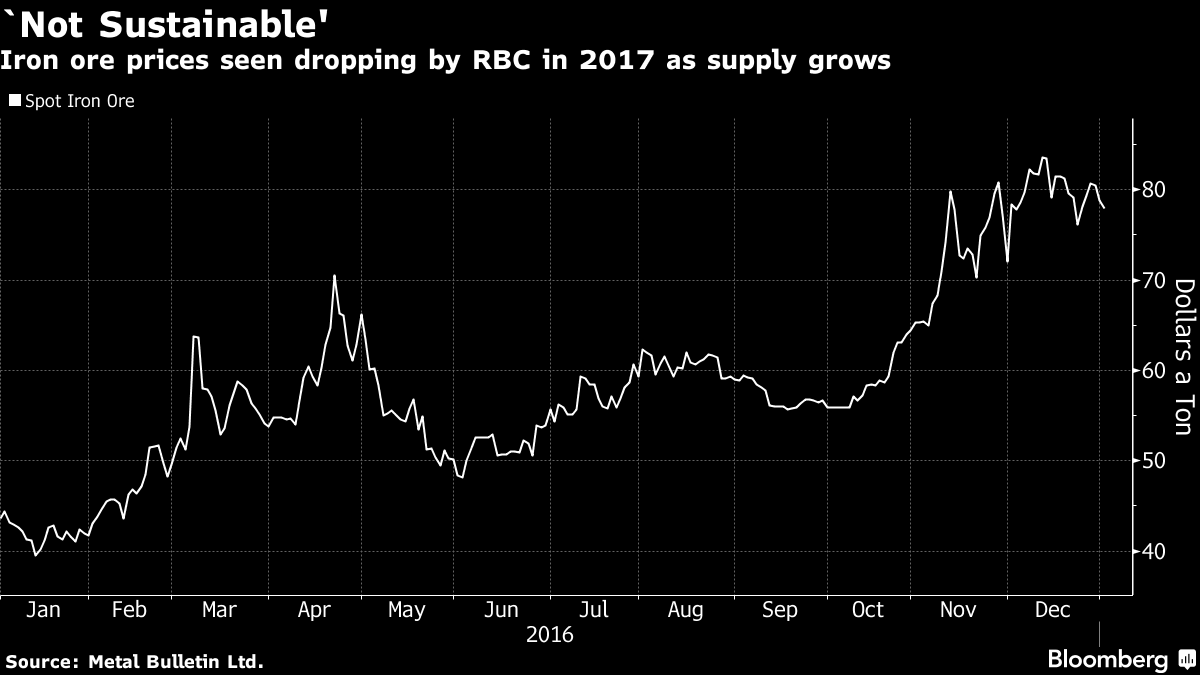

Iron ore prices are primed for a retreat this year after surging in 2016, according to RBC Capital Markets, the most accurate forecaster for the commodity in the final quarter of last year.

“We believe iron ore prices are not sustainable at current levels and expect a pullback in 2017,” RBC analysts wrote in a report received on Wednesday. The firm placed first in predicting prices, according to data compiled by Bloomberg.

Iron ore soared 81 percent in 2016 in a rally that caught out many investors after stimulus in China helped sustain steel output, buoying demand even as mine supplies rose. RBC is more positive on the outlook for base metals, which also surged last year, as economies show signs of a pickup.

Price Strength

Base metals’ “price strength could continue into the first quarter of 2017 driven by improving leading economic indicators and strong seasonality, though we expect further share price upside to be limited with valuations stretched after the recent rally,” it said.

Iron ore with 62 percent content in Qingdao, which hit a two-year high of $83.58 on Dec. 12, fell 0.9 percent to $77.25 a dry metric ton on Wednesday, according to Metal Bulletin Ltd. The benchmark rallied 41 percent in the final three months of last year, supporting miners’ shares.

Signs of abundant iron ore supply are mounting. Holdings at ports in China rose 2.7 percent to 113.95 million tons in the final week of last year to the highest on record, according to Shanghai Steelhome Information Technology Co. Figures from Brazil showed the country’s exports at an all-time high in 2016.

Plenty of banks have forecast weakness in iron ore after 2016’s surprise surge. Morgan Stanley listed the steel-making commodity among its bottom three metals picks, and Barclays Plc has said it expects prices to be back below $50 by the third quarter as China’s property market cools.

Source: Bloomberg

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

- China continues seaport consolidation as Dalian offer goes unconditional