Paradigm Change? HMM Teeters on Brink of Viability Due to Global Shipping Firms’ M&A Movement

The stock price of Orient Overseas International Ltd., the parent company of Hong Kong-based ocean carrier Orient Overseas Container Line, have jumped more than 20 percent at the Hong Kong stock market over the beginning of the year. The figure was also up about 50 percent from July last year. Shipping companies shows the worst profitability ever due to the prolonged global economic downturn, which determines container traffic, and basic low shipping costs at the moment. Then, why has the share price of OOIL rapidly increased?

According to maritime analyst Alphaliner on January 16, the rumor that OOIL will sell out OOCL has spread, and China’ COSCO and Taiwan’s Evergreen have been mentioned as possible buyers. Alphaliner said, “As the merger and acquisition activity has swept the global container shipping industry, OOCL can be the next victim.”

Neither COSCO nor Evergreen has officially expressed any interest in taking over OOCL. However, there is also a growing possibility considering the fact that a number of M&As between large shipping carriers have recently completed and the two possible buyers are Chinese shipping liners, just like OOCL.

The speculations that OOCL, which is ranked as the fourth largest container carrier in Asia in terms of tonnage, following COSCO, Evergreen and Yang Ming Marine Transport, and the ninth largest worldwide can be merged and acquired is full of suggestions. First of all, it means that another medium and large shipping company can disappear in history amid the huge M&A movement among global shipping giants.

Last year, a total of four companies that were in the top 10 list in the global shipping industry alone carried out M&A deals. Denmark’s Maersk Line, the largest container shipping line in the world, agreed to buy Germany’s Hamburg Sud, the world’s seventh biggest container operator, while Hapag-Lloyd, the world’s sixth largest carrier, announced to take over United Arab Shipping Company (UASC), the world’s tenth largest. In Asia, China’s COSCO has jumped up to be the world’s fourth biggest shipping company after acquiring CSCL and Japan’s three largest shipping firms agreed to merge their container operations in a joint venture.

With such M&A movements between large global shipping liners within the top ten, the global shipping businesses are now clearly divided into mega-sized shipping companies which owns more than 1 million TEU and others. An official from the shipping industry said, “The global container shipping market is changing to the market that can be controlled by shipping giants ranked first to seventh.” Compared to them, the bottoms of Hyundai Merchant Marine stand at 450,000 TEU, showing a huge gap with global shipping giants.

As the shipping market has been reorganized around large shipping liners, there are speculations that shipping alliances, which are designed to share and exchange vessels between shipping companies, will disappear in the end. The ultimate reasons for companies to form the alliance are to secure shippers of the route that they cannot provide services and to expand the bottoms of the existing route. However, the mega M&As change the structure that a single large shipping giant operates almost all routes.

Source: Business Korea

HEADLINES

- Do shipping markets want Biden or Trump for the win?

- All 18 crew safe after fire on Japanese-owned tanker off Singapore

- Singapore launching $44m co-investment initiative for maritime tech start-ups

- Cosco debuts Global Shipping Industry Chain Cooperation Initiative

- US warns of more shipping sanctions

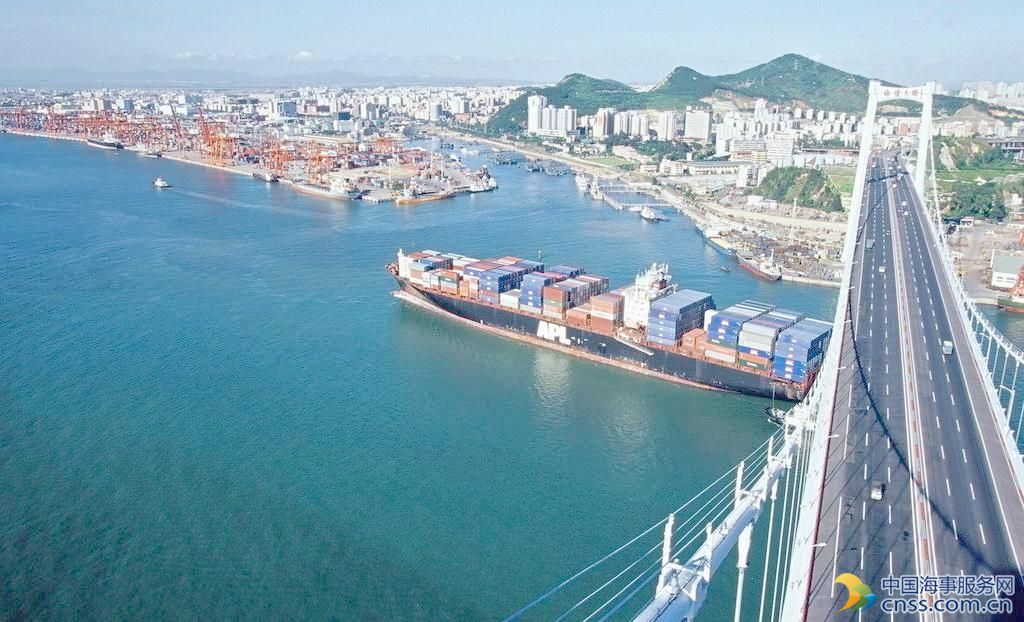

- China continues seaport consolidation as Dalian offer goes unconditional